wing-wing/iStock via Getty Images

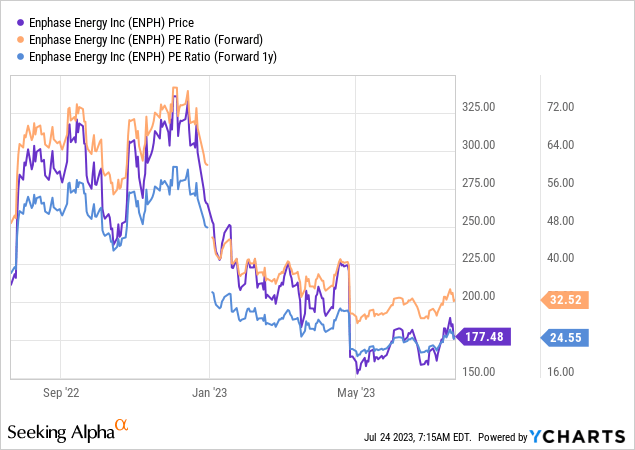

From its high of $336 in December 2022, Enphase Energy (NASDAQ:ENPH) has fallen 47%. In the same timeframe, earnings per share expectations have increased, meaning that the share price fall is completely sentiment driven. This is clearly shown in the P/E decline from 76x at the start of December to 32x today. It seems that this sentiment and reason for the fall in price is largely due to the update of the California NEM 3.0 proposal in November 2022, which changed the structure of energy credits solar owners receive for exporting energy to the grid. This proposal was eventually passed into law in April 2023.

The solar photovoltaic (PV) market in California and ENPH investors alike both seem to view this new legislation as a net negative, whereas solar inverter producers such as ENPH believe it will be a net positive. The reasons for this are discussed in the article below.

In addition, growth in Europe continues to be strong, as the continent surges towards decarbonization and energy security, both of which are likely to prove tailwinds for the company for years to come. Between these growth drivers and the current valuation, Enphase Energy stock is the most attractive it has looked in years.

Company Profile

Enphase Energy is a leading producer of solar microinverters, which transforms DC energy from sunlight into the AC energy used by houses and buildings. A typical solar panel setup will have the panels in series with a single, central inverter converting the collective energy from the panels at one point. With an Enphase microinverter system, the panels will be arranged in parallel with each panel having its own microinverter.

The benefits to such a system are lower voltages processed, increasing safety; improved reliability, as each solar panel is not hindered by the performance of the others, such is the case with traditional setups; and improved monitoring, with Enphase’s connected system allowing the user to track the performance of each inverter individually, allowing for real-time down detection.

California and NEM 3.0

Enphase fell sharply at the release of its 1Q23 earnings. The main reason was the commentary around interest rates and the April 2023 update to California’s net energy metering (NEM) regulations, which seems to have reduced the amount solar owners are paid for exporting energy to the grid.

But it isn’t as clear cut as that. As I discussed in my article on SolarEdge (SEDG), which enjoys similar dynamics to Enphase, it isn’t a straight line reduction. There will be over 500 different rates offered, depending on the time of day, month of the year, or one of many other variables. This changes the equation such that exporting energy may be very profitable if the solar owner exports energy at the most opportune time.

But this is only possible with an attached battery, such as Enphase’s IQ Battery. It is for this reason Enphase’s CEO, Badri Kothandaraman, believes California’s new energy metering legislation (NEM 3.0) will actually be a benefit to the company, stating:

The higher charging and discharging rate of a third-generation battery will be uniquely beneficial for NEM 3.0 systems in California through its ability to generate revenue by exporting into the grid at the appropriate time.

– Badri Kothandaraman, Enphase Energy CEO, 1Q23 Conference call.

Zvi Lando, CEO of SolarEdge echoed these sentiments and went further, saying they have seen this before in other countries that switched to a similar pricing mechanism, once the market realised the economics of the new regime, sales improved. See his comments from the 4Q conference call below:

This will make coupling of solar PV with a battery, a more attractive proposition for California homeowners, especially if the battery is smartly used to import and export power at the right times. We have seen such transitions happen in the past in Europe, in countries like the UK, Germany and Belgium. And while it takes the market time to adjust to the new reality, we typically experienced significant growth in PV plus battery installation rates following such tariff transition.

– Zvi Lando, SolarEdge CEO, 4Q22 conference call.

While this dynamic may be positive in the medium term, it may take some time to be realised for two reasons:

- There was above average demand in 1Q23 due to the so-called NEM 2.0 rush, as installers rushed to get as many systems installed for homeowners who wished to be grandfathered into the NEM 2.0 pricing mechanism. This has likely brought forward sales and may mean demand could be lower in latter periods in the year. And,

- Homeowners are currently of the opinion that NEM 3.0 will be a net negative, and it will take some time for them to be re-educated by the sellers and installers of solar PV systems.

Europe has huge upside

There is a very different dynamic playing out in Europe at the moment, and sales to the continent stand to be a massive driver of growth for Enphase. European homeowners, businesses, and governments are now rapidly seeking energy independence after Russia cut off LNG exports to Europe in September last year. So while US sales declined 9% from Q422 to 1Q23, revenue in Europe increased 25% sequentially. On a year-on-year basis, 1Q23 revenue in Europe more than tripled.

This has the potential to be a multi-year tailwind because of the seriousness of the requirement to now never need to rely on Russia for energy again. Europe was already well advanced in its decarbonization plans and this has only accelerated their quest to be as self-sufficient as possible. This will be a monumental task, and the theme extends far beyond solar inverter companies, but it is clear Enphase and other providers of solar inverters will be huge beneficiaries.

Risks to the Thesis

The investment thesis rests on continued strong demand from Europe coupled with a misunderstanding (or miscommunication) of the NEM 3.0 legislation in California.

If Russia suddenly turns on the taps to Europe again and gas starts flowing again, the urgent drive towards energy security may recede. While this may be partially true, I think Europe has likely been spooked enough that it won’t wish to take that risk of relying heavily on Russia for energy again.

With respect to California, it is of course a risk that management could simply be wrong regarding their expected take up of batteries to support the new pricing regime. The market certainly seems to think they are. Just because it occurred in Europe, is no guarantee the same dynamics will be repeated in California.

Another risk remains the higher interest rates currently in the market. Solar photovoltaic systems are a large capital expense for homeowners and are often debt-financed. Higher lending rates reduce the economics of such a purchase, especially when there is a financial return implied in owning the asset. Combine this with the uncertainty surrounding NEM 3.0 and you should now have a good understanding of why the stock has been sold down this year.

While these risks are present in the investment case, as I will now discuss, Enphase remains very attractive on a risk-adjusted basis as it has likely been oversold.

Forecasts and Valuation

As discussed, the fall in share price and the P/E of Enphase tells me that the market remains concerned over the NEM 3.0 risks. Homeowners seem to be in agreement – at least for now – demonstrated by the NEM 2.0 rush.

However, Wall Street analysts seem to agree with Kothandaraman, which is demonstrated in the continued upgrades of consensus forecasts through the year.

For the 2023 year, FactSet consensus EPS estimates have remained stable, while the FY1 (2023) P/E has fallen from 76x in December 2022 to 32.5x today.

Looking ahead one year, the 2024 FactSet EPS forecasts have increased from $6.74 (as observed in November 2022) to $7.29 (observed July 24, 2023). This means the FY2 (2024) P/E has decreased from 62x to 24.6x.

Finally, FactSet EPS estimates have also increased for the 2025 year, from an EPS estimate of $7.75 observed in November 2022 to $9.40, observed July 24, 2023.

This shows that consensus is far more interested in the Europe story than the California story, but the investing public is far more interested in the risks from the California story. This has presented an excellent buying opportunity for the patient investor.

Using these EPS forecasts, that implies a 33% growth rate for 2023 and a 29% growth rate for 2024. This is a PEG ratio of close to 1.0 for 2023 and for a company that produced a 25% return on invested capital in 2022, this is very attractive.

This is a timely opportunity to buy a high quality company at a very reasonable price.