zhongguo

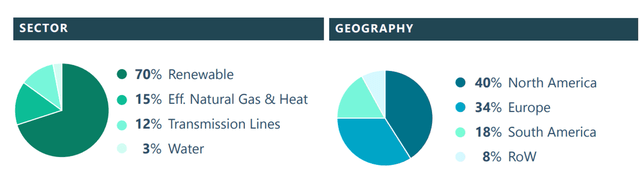

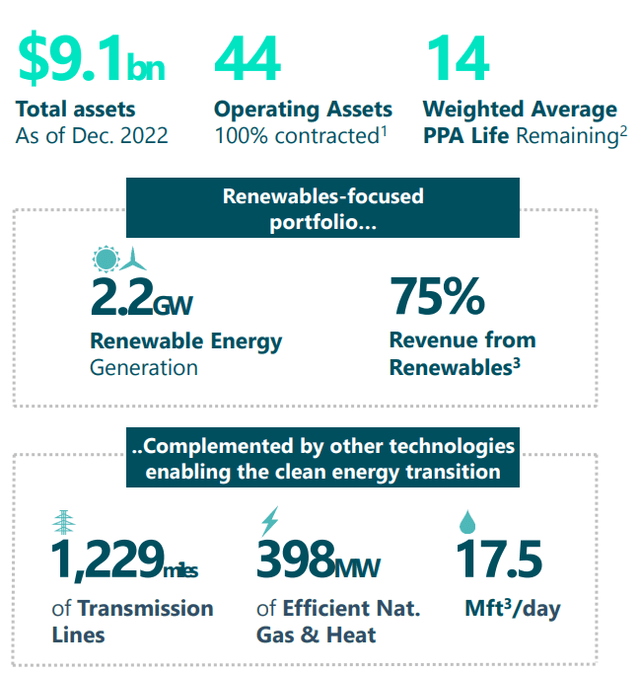

Atlantica Sustainable Infrastructure plc (NASDAQ:AY) owns and operates a portfolio of renewable energy, natural gas, hydro and transmission assets. The renewable portion, which is primarily solar, dominates the portfolio both in terms of size and revenue contribution. AY has its footprint in North America, South America, Europe and Africa.

Q1-2023 Presentation

With an aim to generate stable cash flows, AY generally has long term agreements in place for its assets. The average contract life remaining on its 44 assets at the end of 2022 was 14 years.

Corporate Presentation

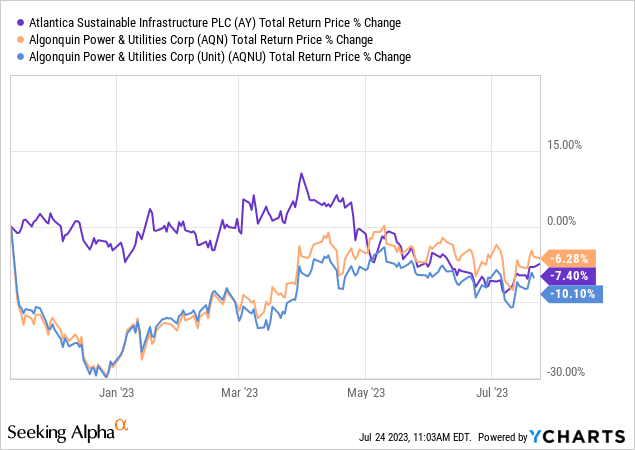

The company was a hot commodity in 2021 when everyone chased all yield assets in the name of “TINA” (there is no alternative). We last covered this company in November 2022 and had compared it to Algonquin Power & Utilities Corp. (AQN), who owns a controlling stake in AY. We also threw in the preferred shares of AQN into the mix, Algonquin Power & Utilities Corp – Units (AQNU). AY came out ahead in our verdict at that time, based on its comparatively lower leverage and better financial results. We were not ready to go hand over fist on it though and concluded the piece with our buy under price.

AY is actually the best of the three securities here and is close to a buy point for us. AY trades at 14X cash available for distribution and carries lower leverage than AQN. Its Q3-2022 results were weak, but still better than what AQN reported. CAFD was still up 3% year over year, and it has far more discretion over its capex than AQN.

We still think even AY struggles to get any growth traction as with cost escalation and higher interest rates, things look difficult for the company. Nonetheless, the valuation is modestly attractive, and we would look to buy under $24.00 per share.

Source: Algonquin And Atlantica Sustainable: Paying The Piper

None of three tickers has impressed its investors since then, with AQN coming out ahead in relative terms. AY was a close second.

A couple of financial results have been released since our last public review of this company. Let us go over the most recent one next and then see if the stock actually has appeal at this point.

Q1-2023 Results

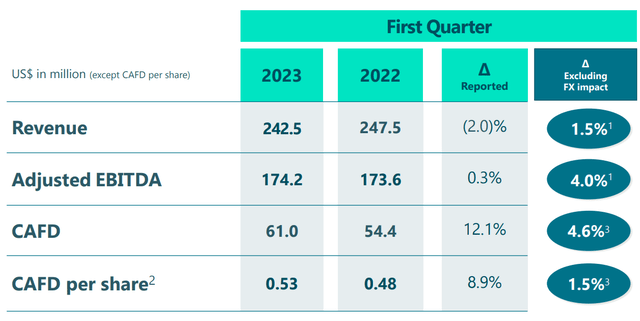

For Q1-2023, AY reported rather tepid results on the revenue and adjusted EBITDA fronts. Note the two sets of numbers below, with and without impact of currency.

Q1-2023 Presentation

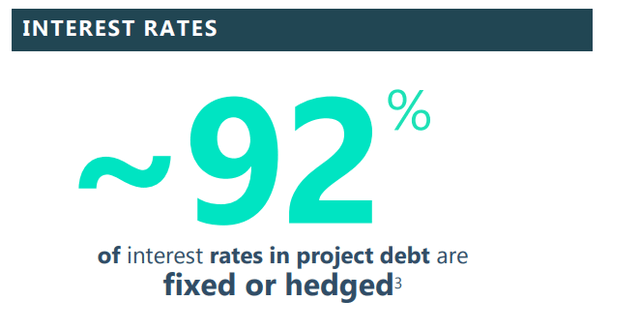

Interestingly, the Cash Available For Distribution, or CAFD metric, improved a lot more relative to the first two lines. The general trend in recent times is to observe the opposite as a lot of companies went hook, line and sinker on variable rate exposure for their debt. So EBITDA would tend to better than after interest metrics, but here we saw the opposite. AY of course has not taken the risk, so that was not a worry.

Corporate Presentation

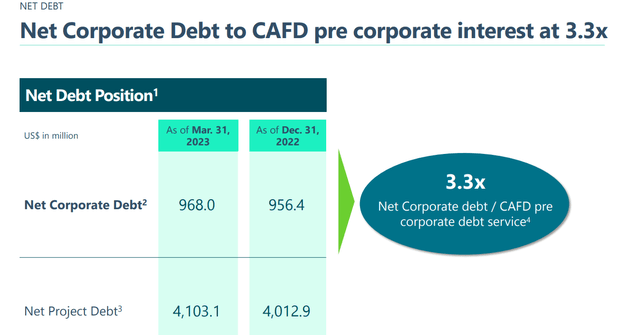

What we instead saw was the benefits from movement in working capital adding a small boost to CAFD for 2023 versus 2022. The longer term trend here has been that AY has been able to consistently cover the dividend from CAFD every single quarter. Even though some investors may gripe at the fact that the company has increased its dividends very modestly in the last two years, we think building a better buffer on the payout ratio is the right priority. The company has also kept its liquidity relatively healthy and this has been done by having a ton of debt at the project level. Corporate level debt looks quite fantastic by comparison.

Corporate Presentation

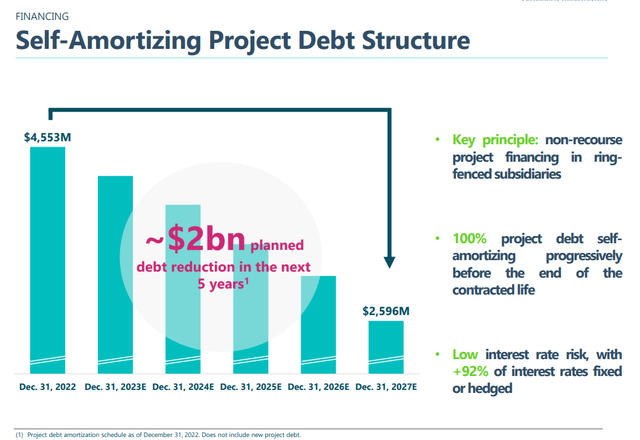

Further, the project level debt is scheduled to be amortized at a brisk rate over the next 5 years.

Corporate Presentation

Finally, investors should note that the CAFD metric is after this debt amortization.

Valuation Relative To Peers

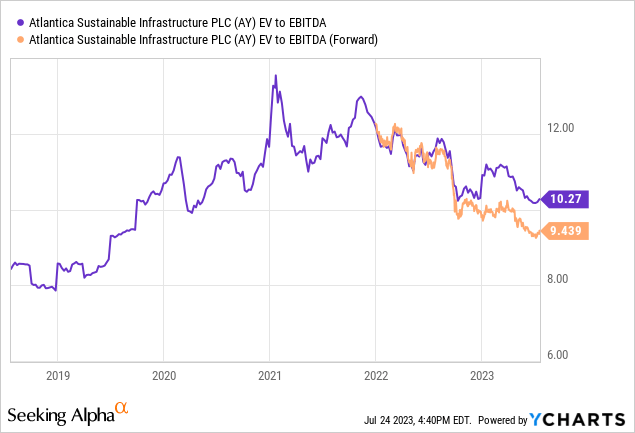

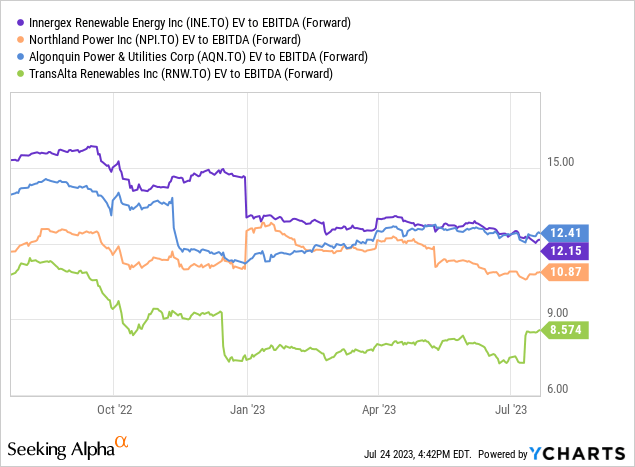

AY trades near 9.4X forward EV to EBITDA and this is a welcome relief compared to the madness that transpired in 2021.

While 4 to 5 multiples of P/E ratio may not sound like a lot, on the EV to EBITDA scale they mean the difference between a good entry point and a guaranteed longer term loss. Currently the company is cheap as well relative to the best comparatives which include Northland Power Inc. (NPI:CA), Innergex Renewable Energy Inc. (INE:CA). TransAlta Renewables (RNW:CA) does look cheaper but that has its own drama going on. Brookfield Renewable Partners L.P. (BEP) (BEPC) trades near 14X, although YCharts was pulling that at 24X, so we left it out.

AY also has the best yield if we exclude TransAlta Renewables and its global footprint is very appealing.

Verdict

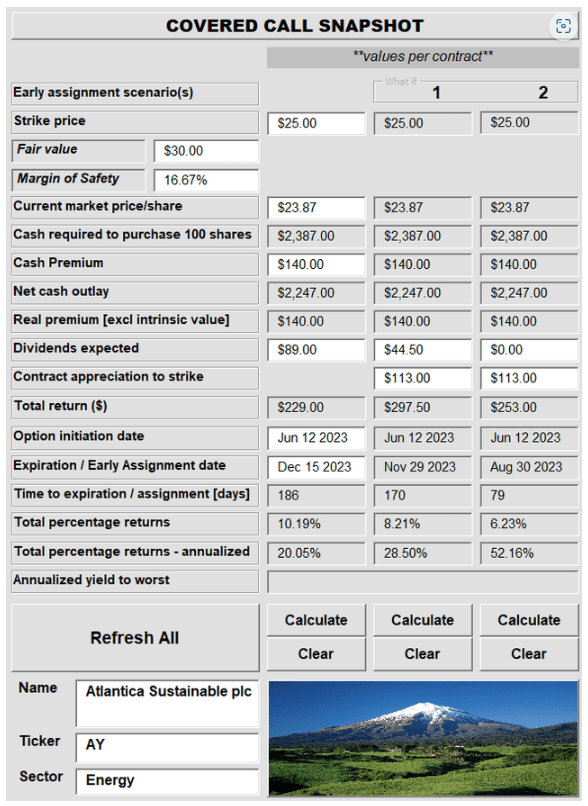

We like it here. We have been accused of constantly harping on the negatives, but if we get a good setup, we will take it. AY was no different. It did breach our buy point briefly and we executed our trade with a margin of safety. We sold a $25 strike covered call that expires in December of this year when the price was $23.87. If the stock closes under $25 at option expiration, we pocked the premium, making a not so shabby 20% annualized including the dividends.

Conservative Income Portfolio Trade Alert 362

The stock currently trades at $24.39. If the price appreciates to over $25 before the expiration date, the counterparty could exercise their right to buy the shares and we may miss out on some dividends. We can see from the above graphic, that only makes our returns stronger and frees up our cash to rinse and repeat with other bargains out there. By combining our assessment of the companies fundamental and options, we locked in our a very strong and defensive yield on this renewable play when we had the chance.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.