bjdlzx

Cenovus Energy Inc. (NYSE:CVE) has grown tremendously since I began following the company years ago. Cash flow has grown from less than C$1 billion per year since my first article announcing the takeover of the partnership interest that ConocoPhillips (COP) had. The stock price has not come close to matching the cash flow improvement in that time period.

Like so many other companies in North America, the Cenovus Energy key ratios have been in the bargain basement for some time. But Cenovus is now an integrated company just like many majors. It will take some time to optimize operations from all that growth. Therefore, profitability is likely to improve for some time to come just from acquisitions already made.

Then again, it appears that management will likely proceed at a slower pace in the future with acquisitions. But growth will likely remain in the picture. Cash flow is such that the dividend is likely to grow well into the future at a rapid pace.

The source of the growth is likely to be the integration that has reduced the company exposure to the discounted pricing of heavy oil. That discounted pricing often expands during times of commodity price weakness (and for other reasons as well). Therefore, the upgrade to refined products from the integration progress has made for a less volatile exposure to those products. In addition, management now has added profitability from the refining process.

This does not eliminate the cyclical nature of the business. But it does reduce some of the volatility that selling heavy oil used to expose the company to. Mr. Market is going to have to get used to the “new” Cenovus. But that will not take a lot of doing on the part of management.

Debt Reduction

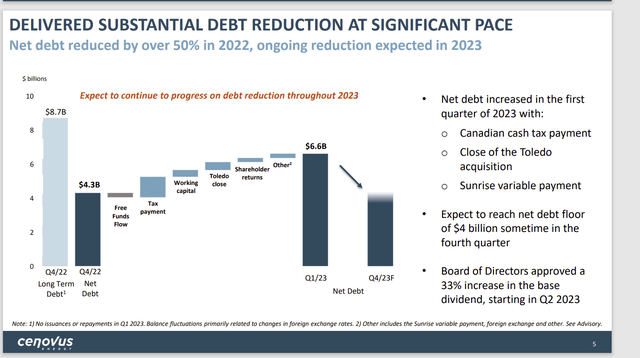

This Canadian producer that reports in Canadian dollars (unless otherwise noted) made good progress in debt reduction until they had a lot of growth-oriented payments in the first quarter of fiscal year 2023.

Cenovus Energy Debt Addition Payments Detail And Debt Guidance For Fiscal Year 2023 (Cenovus Energy First Quarter 2023, Earnings Conference Call Slides)

Management detailed what happened with the debt levels in the first quarter. Much of these payments went to corporation growth. Therefore, the effect on debt ratios was muted. Nonetheless, management is going to be reducing debt levels in the future.

A sign of faith in the future was the increase in the dividend by 33% from the previous level. Now that will slow the debt repayment from all of the first quarter activity. Then again, management needs a decent outlook to increase the dividend, or they likely would not do such a thing. The low visibility necessitates being very careful about things like dividend increases.

Against this optimistic view has to be the lower prices foreseen that delay the debt repayment throughout the fiscal year. Still, those prices are decent enough for a dividend increase because that dividend the management expects to defend throughout the business cycle.

Heavy oil companies have a cash flow advantage in that many projects require a lot of capital upfront. Therefore, well run heavy oil companies often cash flow well (even when the company is losing money) when commodity prices are weak.

Capital Simplification

Cenovus management just announced the repurchase of most of the outstanding warrants. This fits into the category of returning capital to shareholders by preventing the dilution that would occur when these warrants convert to common shares.

Management has been working on the capital structure for some time and has in the past repurchased shares. This further simplifies the capital structure (which makes the balance sheet easier to understand).

Sometimes warrants prevent the share price from appreciating until those warrants convert. This prevents that perceived overhang situation that at least some observers believe hinders stock price appreciation. Therefore, for shareholders, this represents (probably) a significant step forward.

Other Growth

The company has restarted the Superior Refinery. That is likely to have negative cash flow at first until they get the refinery operating as it should. The negative cash flow will change to positive cash flow faster than the process of optimizing operations at the refinery.

But the Superior Refinery is brand new and recently rebuilt from the “ground-up” after a fire a few years back. This refinery is likely to feature all the modern “bells and whistles” that refining has achieved over the last few decades. More importantly, Cenovus can and probably did rebuild the refinery to meet the needs of the company. The prime need would be to handle as much thermal oil as possible.

Similarly, the Toledo Refinery (50% of this was acquired from the joint venture partner recently) has now restarted. Cenovus is far more likely to run this refinery in a superior fashion with a lot less downtime due to “unexpected events” that sometimes resulted in injuries and deaths. Cenovus now owns this refinery itself (completely) and therefore no longer needs the approval of a partner to get things done. That is likely to make a big difference.

In addition, there is an offshore project that will begin production in future fiscal years and the Sunshine acreage is now 100% owned.

Investors can likely expect a slower growth rate going forward because the company is now much larger. But the current trend of relatively small acquisitions appears to be something that will opportunistically happen in the future.

Even if there are no more acquisitions, ever, starting tomorrow, the company has plenty of work to do to optimize what it has. Management is well aware that others with these types of assets get better results. But that optimization process is likely to take a few years given the sheer volume of acquisitions.

Key Ideas

Cenovus is likely to continue to grow profitability at a decelerating rate compared to the blistering rate of the past 5 or so years. But the growth ahead is likely to result in a combined return that averages out in the teens in the future.

The production is now far better protected from the periodic widening of the thermal oil discount than was ever the case in the past. That alone should lead to a far better cyclical performance than Mr. Market currently projects.

But management will likely continue to optimize operations through a lot of low-cost fast payback proposals. This implies superior profitability lies ahead to improve the overall cyclical performance.

Improving cyclical performance often takes time for the market to actually give management credit for that kind of improvement. Nonetheless, this management has some darn good assets that it purchased for very good prices. Chances are very good that the upside potential for the common far exceeds the downside potential (long-term).

Management still has a fair number of thermal areas to develop as well. Therefore, cyclical growth is likely to be the main story here for the foreseeable future.

At the current price, Cenovus Energy Inc. stock is probably a strong buy consideration due to the relative undervaluation of the stock compared to the profitability improvements that have already happened. Management needs to build a track record for the “new” Cenovus as currently configured. But that should not be a big deal. Many of the acquisitions were ending joint ventures that management had a lot of experience with. The Husky Energy acquisition (OTCPK:HUSKF) was the big exception. Even there, there was another refining partnership already in place that probably allowed management to gain considerable experience before the acquisition was made.

The time to buy cyclical stocks is when conditions are perceived to be weak or hostile. Now is that time to consider purchasing Cenovus Energy Inc. shares because the good times always arrive at some point in the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.