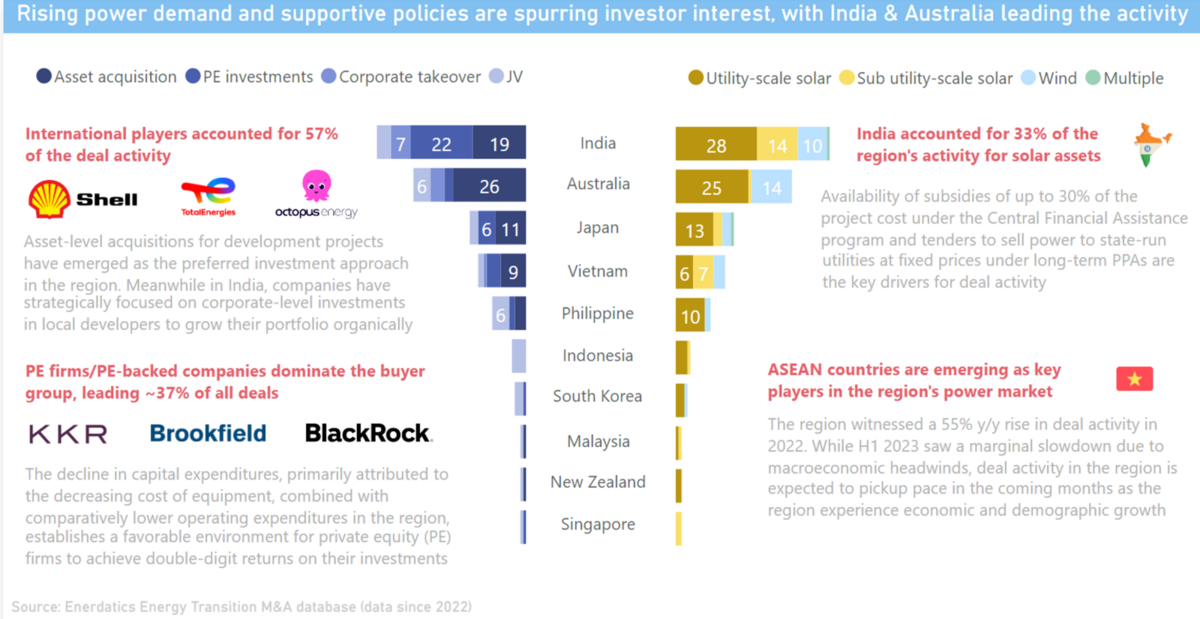

Rising power demand and supportive policies are spurring investor interest, with India & Australia leading the activity.

– International players accounted for 57% of the deal activity: Asset-level acquisitions for development projects have emerged as the preferred investment approach in the region. Meanwhile, in India, companies have strategically focused on corporate-level investments in local developers to grow their portfolio organically.

– PE firms/PE-backed companies dominate the buyer group, leading ~37% of all deals: The decline in capital expenditures, primarily attributed to the decreasing cost of equipment, combined with comparatively lower operating expenditures in the region, establishes a favorable environment for private equity (PE) firms to achieve double-digit returns on their investments.

– India accounted for 33% of the region’s activity for solar assets: Availability of subsidies of up to 30% of the project cost under the Central Financial Assistance program and tenders to sell power to state-run utilities at fixed prices under long-term PPAs are the key drivers for deal activity.

– ASEAN countries are emerging as key players in the region’s power market: The region witnessed a 55% y/y rise in deal activity in 2022. While H1 2023 saw a marginal slowdown due to macroeconomic headwinds, deal activity in the region is expected to pick up pace in the coming months as the region experienced economic and demographic growth.