FrankRamspott/iStock via Getty Images

Introduction

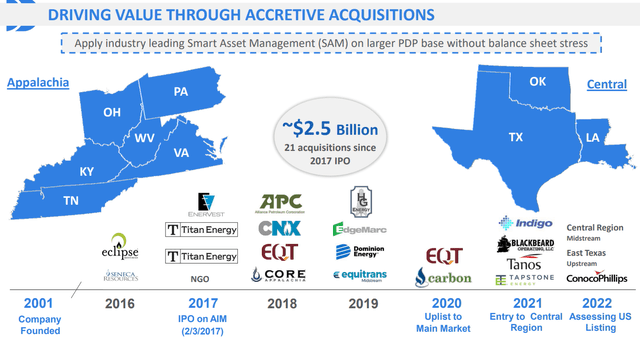

Diversified Energy (OTCQX:DECPF) is a producer of natural gas. The company specializes in buying old and semi-depleted natural gas wells off the hands of larger companies that are no longer interested in investing in them and want to take the long-term environmental liabilities to abandon these wells off their books.

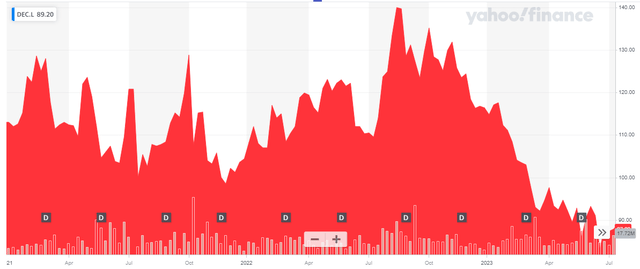

Yahoo Finance

The company has its main listing on the London Stock Exchange where it’s trading with DEC as ticker symbol. The average daily volume in London is approximately 3 million shares per day, for a total of 2.9M GBP ($3.5M). There are currently 971M shares outstanding resulting in a market cap of 890M GBP or approximately $1.17B.

Buying old wells – simple yet efficient

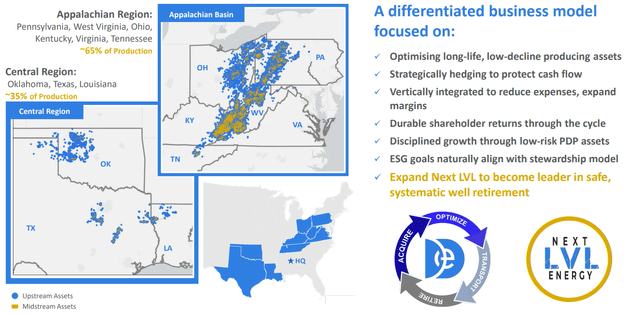

This means the business model is simple. It buys existing wells with existing production and existing reserves and extends the useful production life for as long as possible. The focus is completely on the US where the company focuses on the Appalachian and OK/TX/LA states.

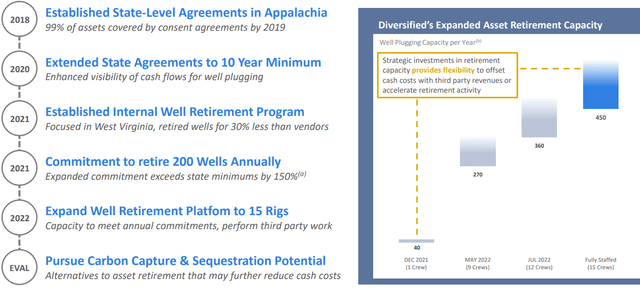

Diversified Energy Investor Relations

There are advantages and disadvantages to this strategy. The main advantage is obviously buying something where you “know” what you are getting. And what I think is the biggest advantage is the fact that these mature wells have very low decline rates (6%-7%). Which basically means the company is assured of predictable but gradually decreasing cash flows. Diversified is not really in the business of drilling new wells (it occasionally does so) but there are opportunities to “clean out” existing wells to ensure a better flow and a temporary boost in production results.

The main disadvantage are the environmental liabilities. Diversified Energy is the “final stop” for all those natural gas wells as DEC will have to abandon and plug them – it’s unrealistic to think they will be able to sell them to another party.

Diversified Energy Investor Relations

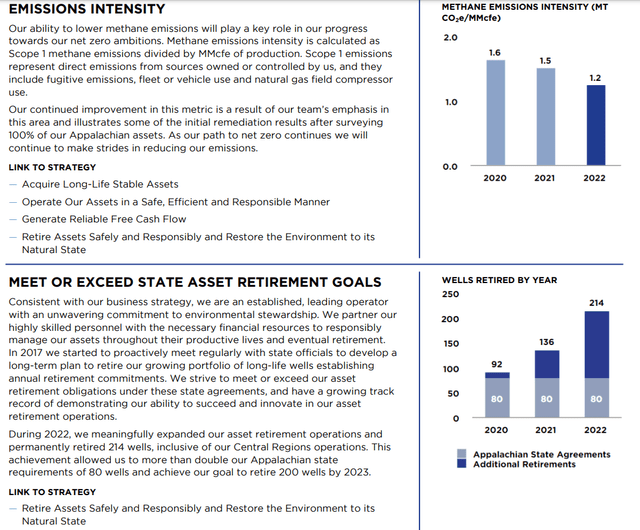

This created some issues not in the least when in 2021 Bloomberg fired a few torpedoes at Diversified Energy claiming that keeping the natural gas wells open causes pollution. While in theory correct, I think this was a very cheap shot because A) Diversified is really on top of the current well performance whereas these wells were semi-neglected by previous owners which focused on expanding production and B) Diversified does a good job in actually abandoning and correctly plugging wells.

Diversified Energy Investor Relations

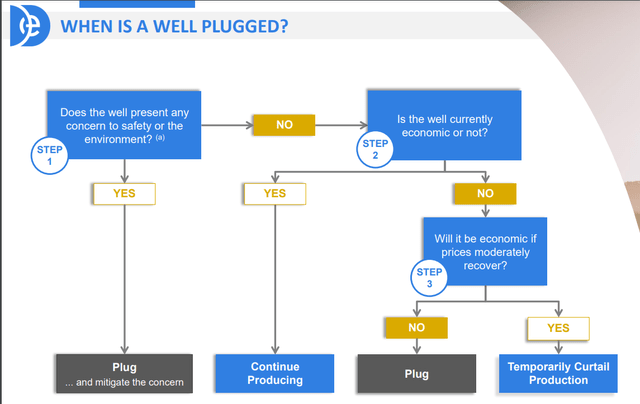

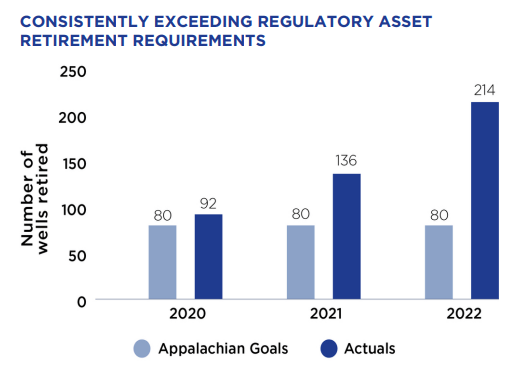

Diversified is actually abandoning and plugging wells at a faster rate than the respective minimum objectives put forward by the states it’s operating in, and it will continue to step up its efforts as it now has a capacity to plug and abandon almost 500 wells per year.

Diversified Energy Investor Relations

Diversified takes the environmental clean-up seriously (you also don’t want to risk getting sued in the US) and provides a presentation solely on its abandonment strategy and progress.

Diversified Energy Investor Relations

So while it’s a liability that we will have to keep an eye on, I do not consider it to be a major risk, not even if the natgas price drops to US$2 this year (I will explain the pricing risk in the next section, discussing the hedge book).

Diversified Energy Investor Relations

The hedge book caused severe headaches in 2022, but the cash flows remained strong

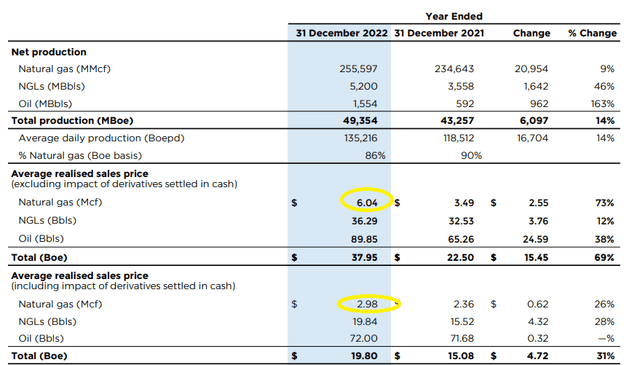

Diversified produced an average of 135,000 barrels of oil-equivalent during 2022 of which approximately 86% consisted of natural gas. The exit rate was closer to 140,000 boe/day so we should see another year of production increases in 2023 despite having to deal with the natural decline rate.

Diversified Energy Investor Relations

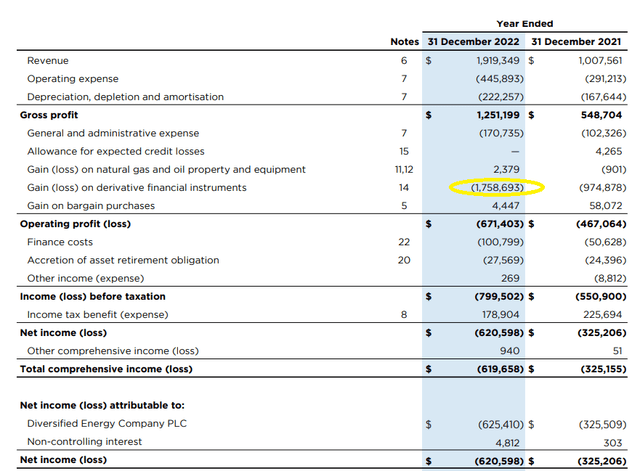

What the image above also shows you is the average sales price of natural gas. Diversified has a very extensive hedge book which it traditionally enters into when it purchases an asset (to minimize the financial risk related to the acquisition cost, operating cost and cleanup risk) which means the company had a massive amount of hedges below market prices. Not only did this weigh on the average realized natural gas price, it also caused a loss on derivatives of almost $1.8B.

That also is the reason why I wasn’t immediately convinced about Diversified. While hedging provides excellent visibility on future revenue and cash flow, it is not unheard of that the counterparties request additional (cash) collateral from the hedger. I think that was the biggest risk in 2022 but that risk has now come down considerably as the natural gas price has come down (and the risk for the counterparty has decreased). I also expect Diversified to post a substantial profit on its hedge book in the current financial year (if the natural gas price remains at the current levels).

Those losses on the hedge book are the reason why we should take the net loss with a grain of salt. As you can see below, the vast majority of the expenses (and the sole reason for the net loss) are related to these hedges.

Diversified Energy Investor Relations

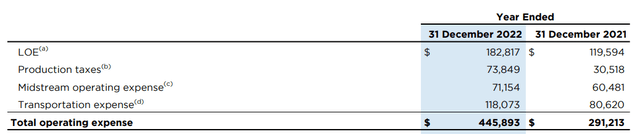

What’s attractive about Diversified is its very strong gross profit. OK, this includes the natural gas price before the impact of the hedges is taken into account, but I’m still very pleased with the total operating expenses of less than $450M. The “pure” operating cost is even much lower than that as the second largest operating expense is actually the transportation cost.

Diversified Energy Investor Relations

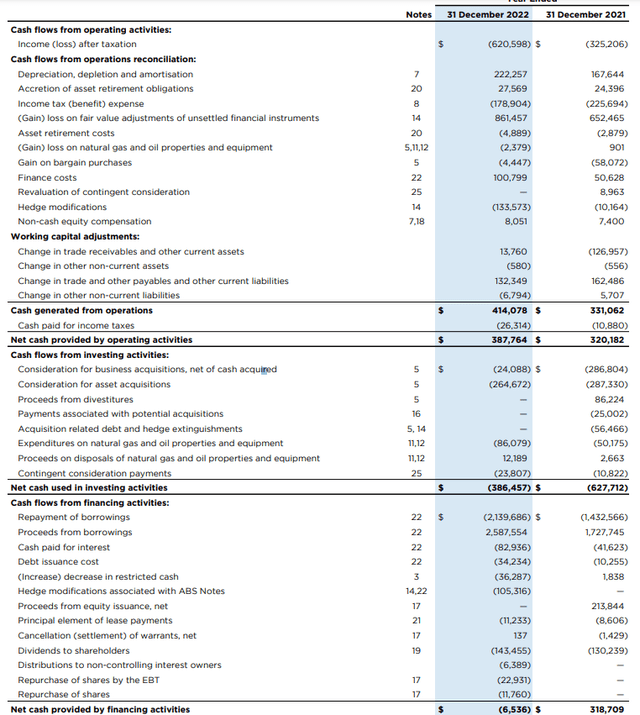

So rather than focusing on the massive net loss, we should look at the cash flow statement as that provides a better overview of the situation. The realized hedging losses (leading to the realized natural gas price of $2.98) are still recorded but the unrealized losses are filtered out.

The reported operating cash flow after taxes was $388M (given the hedge book performance no corporate tax would have been payable based on the FY 2022 results, but I’m erring on the side of being cautious here).

Diversified Energy Investor Relations

After adjusting the operating cash flow for changes in the working capital (minus $128M), the interest payments ($83M) and the lease payments ($11M), the underlying operating cash flow was $166M.

We see the total capex was $86M which is an increase of 70% compared to FY 2021 and I do expect the future capex to decrease again. The sustaining capex is somewhere in the $40-60M range on an annual basis which means the underlying free cash flow was $116M. That being said, keep in mind Diversified also spent $133M on hedge modifications. These are not repurchases of existing hedges but literally just shaking them up a little bit by purchasing longer-term put options to satisfy the needs and requirements of fresh asset-backed debt.

As this is a non-recurring item, one would have a strong case to argue this should not be included in the normalized free cash flow calculation. A view I agree with as the odds of seeing these modifications on an annual basis are pretty low. This means the underlying sustaining free cash flow is approximately $250M, still using the average realized natural gas price of $2.98 as starting point. There were 829M shares outstanding, resulting in a sustaining free cash flow of $0.30 per share. Using an GBP/USD exchange rate of 1.22 USD per GBP, the FCF per share expressed in pence came in at 24-25 pence.

The $0.30 per share in sustaining free cash flow (excluding debt amortization) also means the current dividend of $0.04375 per quarter ($0.175 per share per year) is fully covered. This means the current dividend yield is almost 15% which is actually working against the company in the current investment climate (a 15% dividend yield surely must be unsustainable, right?’). One important element to take into consideration here: Although Diversified is a British company with a listing in London, it’s subject to the US tax code as all of its operations are in the US. This means the dividend withholding tax will be the usual 15% for non-US residents that are able to use the double taxation treaty.

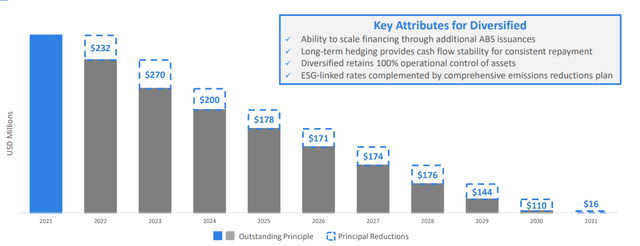

There’s one issue with the high dividend payments: Although the net free cash flow definitely covers the current dividend, we also should keep the debt structure in mind. As of the end of December, Diversified had a total net financial debt (excluding leases and asset retirement obligations) of $1.43B. While that is high, there are two important elements here. First of all, the debt is self-amortizing.

Diversified Energy Investor Relations

As you can see in the image above, the debt is self-amortizing as Diversified continues to make annual repayments of the principal amount. Note: The image above is for illustrative purposes only as Diversified has the option to “throttle” the repayment pace. For 2023 we see the company plans to repay $270M in principal of the debt which means to keep the dividend and be able to afford the planned debt repayment, Diversified needs to generate $410M in free cash flow. That’s based on the year-end 2022 situation. Subsequent to the end of 2022, Diversified announced a capital raise (priced at 107 pence, so more than 15% above the current share price) to 971M shares. This means the cash needs to maintain the dividend have increased to $165M and the total cash outflow for this year (including the debt repayment) will be $435-440M.

That capital raise was conducted in connection with another acquisition. An acquisition which will further increase the consolidated production rate by more than 10% while generating $107M in additional EBITDA in the process using January strip prices. So a value-accretive move but the acquired asset will need some “managing” based on the current residual reserve life index. A $25M capex program is budgeted for 2023 to finish some almost-completed wells.

Going back to the debt situation on the balance sheet. It will be a relief to see the majority of the debt has fixed interest rates and classified as asset-backed securities. This also means Diversified will continue to borrow money against assets and PV10values of those assets. That perhaps won’t work really well with Henry Hub spot prices below $2.50, but given the self-amortizing schedule of the existing debt, there isn’t really a need to refinance the debt as long as Diversified is able to gradually reduce its debt. And if it repays $270M this year, it will see its interest expenses decrease by in excess of $10M.

Diversified Energy Investor Relations

All the ABS notes have a legal maturity date in 2037 and beyond but have an initial amortization period which sees the debt being paid off by 2030. But by having a legal maturity date that’s much further out in the future, Diversified may have some flexibility to scale its payments and repayments.

And finally, there’s a possibility Diversified will be able to continue to sell non-core assets like earlier this week when it sold non-producing acreage for US$16M. While US$16M isn’t a whole lot in the greater scheme of things, it will for sure make things easier for the company. Another small sale was completed in June, which also helped the company to realize US$40M in proceeds. Combined, this $66M takes care of about a quarter of this year’s debt repayments.

A look at the hedges for 2023 and beyond

In any case, the main question this year is obviously “will it be able to generate $450M in free cash flow this year?” as that is the total amount of cash it needs to comfortably cover the dividend as well as the scheduled repayments of the principal of the existing debt.

We know the company generated $300M in operating cash flow in FY 2022 based on an average production rate of 135,000 boe/day and a realized natural gas price of $2.98. We know this year’s production will come in at 158,000 boe/day. Let’s be conservative and use 155,000/day (the Q1 exit rate was 145,000 boe/day, and the sale of the 3,000 boe/day in June will also put pressure on the full-year target). That’s a 15% increase vs. 2022 which will already result in a $50M OpCF uplift to $350M.

What’s now perhaps even more interesting and important is the hedge book for 2023. While Diversified had quite a few hedges at low prices in 2022, the company took advantage of the higher natural gas prices in 2022 to start hedging a higher percentage of the 2023 and 2024 production at higher prices.

I would normally refer to the year-end hedge book, but Diversified has recently been pretty active, resulting in the following breakdown (as of the end of FY 2022).

Diversified Energy Investor Relations

For FY 2023, the company hedged a total of 230M MMbtu (not to be confused with Mcf) of natural gas at an average price of $3.57 (that indeed is about 20% higher than the average realized price in FY 2022). That’s 85% of the anticipated production which means the company is exposed to the spot price for just 15% of its production (note: the company continues to update its hedge book so we will likely see new numbers once the H1 results will be published). Even if we would use an average natgas price of $2.50 for the spot price this year (I think it will come in higher as I expect higher natural gas prices in the second half of this year; the average price for delivery in the final quarter of this year is currently approximately $3.10), the average realized price would be around $3.42, an increase of 15% vs. 2022. This would provide an additional uplift of approximately $131M pre-tax and about $100M after-tax to the operating cash flow (all other operating expenses will obviously remain unchanged so we need to increase the revenue by 15% and not just the operating cash flow). In this simulation, Diversified Energy will indeed generate about $450M in operating cash flow and about $400M in free cash flow.

That would not be sufficient to cover the anticipated dividend + debt repayment schedule but keep in mind the $2.50 market price is perhaps a bit conservative and keep in mind Diversified sold just over $50M worth of assets on a year-to-date basis. Should the forward curve be correct, a full-year price of $2.75-2.90 appears reasonable. This still makes it tight but let’s not forget 2023 is the final year of a rather high principal repayment. The amortization schedule sees the principal amount drop by $70M in 2024 followed by another decrease in 2025. So basically Diversified only needs the $435M this year. The cash needs next year will decrease to $355M (including also reduced interest expense).

And one element I haven’t discussed yet: For FY 2023, Diversified has already hedged 4.7 million barrels of NGL at $37.3. That’s 90% higher than its 2022 hedges (at $19.84/barrel!) and although this is only a small portion of the production, this pretty much ensures an additional 80M bump in the net revenue and in excess of $50M in additional after-tax free cash flow. This will likely be the swing factor in determining whether or not Diversified can cover its cash outflow plans. At this point and based on the current market prices and including the proceeds from the asset sales, I’m leaning toward “yes.”

Diversified Energy Investor Relations

Investment thesis

I’m scratching my head when I see Diversified’s share price performance. When the natural gas price was moving up, investors were (correctly) pointing at the hedge book as a reason why the share price barely moved. But now those hedges are proving to be very valuable, the market is now pointing at the low natural gas price on the markets as a reason to avoid Diversified and that makes no sense as the average realized price of Diversified this year will

Personally I’m not too thrilled about the high dividend as it’s clear the market does not appreciate it. If Diversified would propose a 50% cut and pledges to use the remaining cash to reduce its net debt (or perhaps buy back some shares) I’d be 100% in favor of that plan.

Diversified Energy is not a “buy and hold forever” company. But I do think the market is misinterpreting the company’s ability to generate positive free cash flow. While the combination of dividend plus debt repayment may be tight this year, it will only be tight this year and an average natural gas price of US$3-3.25 should be sufficient to cover all cash needs from 2024 on (including the 15% dividend). I expect the market to realize this sometime over the next 12-24 months, and that also is the time horizon for this investment. I expect to realize a total return of 20%-25% per year over the next two year period. To achieve that, the share price realistically only needs to increase to 115-120 pence as the overly generous dividend already takes care of a return of 15% per year.

I have a substantial long position in Diversified Energy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.