grandriver

Over the past three weeks, crude oil has made an eye-catching break higher after three months of consolidation. From a technical standpoint, this upward move is a potentially bullish indicator, suggesting that crude oil may finally leave the tight trading range it held since the end of 2022. Oil’s fundamentals also support this change. Due to low prices and lackluster demand growth, oil producers have aggressively cut their drilling activity, suggesting an impending decline in US oil production. The same is generally true for most oil-producing countries worldwide. Further, although the economic slowdown moderates US oil demand, shallow historical oil inventory levels could cause a more asymmetric price rise due to the possibility of shortages.

In my view, this potential breakout may be a great opportunity for certain oil-producing stocks such as Coterra (NYSE:CTRA). CTRA has lost around a third of its value since its 2022 peak due to the sharp contraction in oil prices. The stock has risen by around 10% in value over the past three weeks due to the small breakout in crude oil, suggesting strong upside potential in the event of a prolonged oil breakout. That said, Coterra also faces notable risks today, primarily due to the lower price of oil that may cause its EPS to contract. The company also generates around half of its typical sales from natural gas, which is cheap today and likely pushing against its long-term breakeven costs.

Accordingly, while Coterra is a powerful way for investors to gain exposure to changes in oil prices, the breakout is not strong enough to definitively say a new bull market is starting. Thus, investors should be cautious due to CTRA’s high material reversal risk for the company. That said, the company is generally on a solid footing to take advantage of improved fundamentals in the oil market.

A New Oil Bull Market Rally?

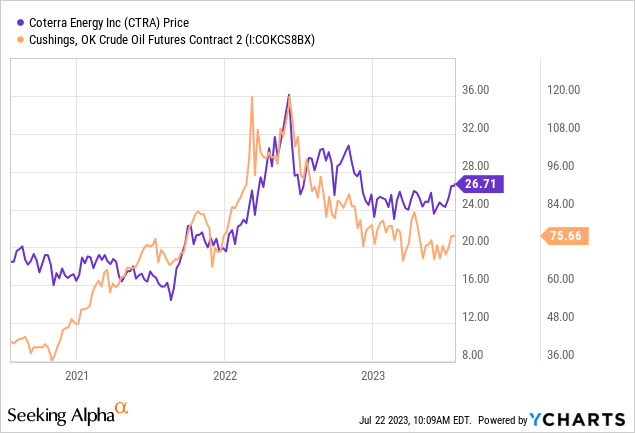

CTRA is highly correlated to the price of energy commodities, primarily crude oil, and natural gas. Thus, the macroeconomic outlook is of primary importance for assessing the stock’s immediate potential. Crude oil remains very cheap compared to its price levels in 2022 but has seen a notable increase in positive volatility since July began. See below:

It is possible that this small move is a head-fake and that oil will soon return to or below the $70 level. However, the commodity created a strong support level at that $70 level in 2021 and rested very close to it in recent months. Over the past year, OPEC and Russia have agreed to make small reductions in output levels and will likely continue that trend if oil falls close to or below the $70 level (which is near the breakeven production cost for many new wells). Thus, it is generally unlikely that oil will cross below that threshold without a severe economic disturbance similar to 2020.

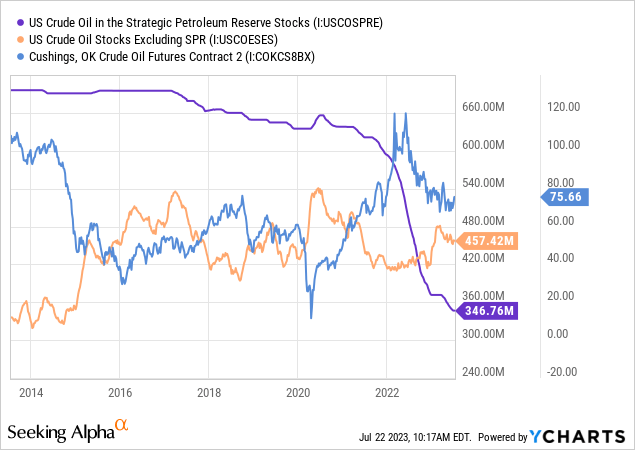

The Biden administration also plans to repurchase oil to refill the depleted Strategic Petroleum Reserve, offering some pricing support for oil in the case of a decline. That said, the SPR has continued to face some depletion in recent months, suggesting that it may not be able to repurchase oil unless economic demand plummets. Oil remains inversely correlated to commercial oil storage levels. See below:

The primary catalyst for the decline in oil prices in 2022 was the massive release of the Strategic Petroleum Reserve. There was a significant oil shortage then, with the oil futures market hitting a record-high “backwardation” level, meaning spot oil prices were significantly above long-term futures prices. This futures curve “backwardation” indicates a significant shortage in the market since immediate prices are more expensive than future prices. Today, the crude oil futures curve remains slightly backward, with one-year out prices around 6% below spot prices. That figure indicates that the market remains concerned about a shortage despite the increase in commercial oil inventories, suggesting that the SPR release artificially holds prices down.

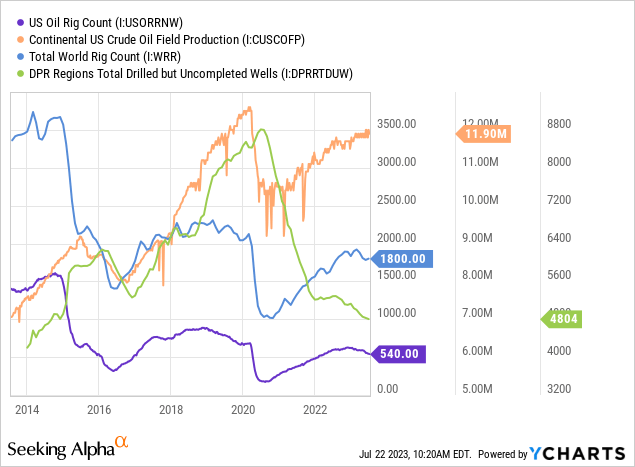

Crucially, US and global oil production levels may soon decline regardless of OPEC. In response to low prices, the US and global rig counts have begun to decline, with the US rig count showing a clear negative trend. As the rig count decreases, oil production will eventually follow suit because there must be a relatively high constant drilling activity level to replace lost output from wells. This is particularly true due to the rise of shale oil, which has substantial production declines (70-80%) after the first year of well completion. The number of US “drilled but uncompleted” wells is also meager, meaning producers can no longer complete previously drilled wells to maintain production. In other words, that suggests the active rig count must be higher to maintain a flat total production level. See these figures below:

Overall, these data strongly suggest that US oil production will not return to pre-COVID levels and is more likely to decline over the coming months. Currently, the decline in the rig count is not quick enough to suggest a huge rapid production decline such as that seen in 2020. However, it is similar to the trend seen in 2016, which resulted in a ~15% production cut over the following months. Again, because the number of drilled-but-uncompleted wells is so low, I believe the production impact from a rig count decline should be more significant than in the past.

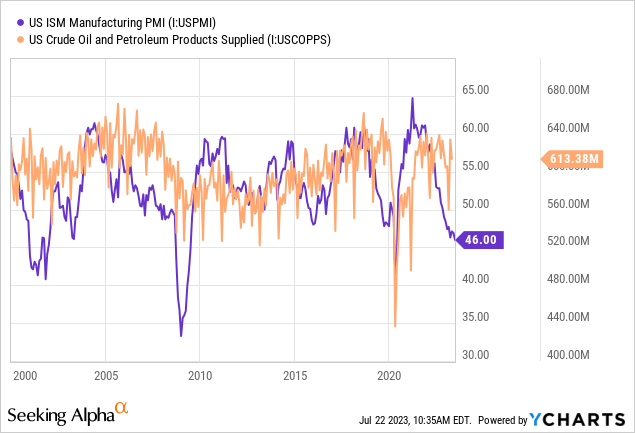

Of course, there are concerns that oil demand will decline due to the ongoing slowdown in manufacturing and the potential for a recession. A slowdown in demand is likely; however, it may be minimal compared to 2008-2012. Indeed, the correlation between economic strength (as measured by the PMI) and oil consumption is relatively weak. See below:

The relationship between oil consumption and economic growth is vague and not stable. In general, recessions lead to lower demand for oil as some people and businesses reduce unnecessary spending. However, I do not believe the relationship is very strong today compared to the 2000s for a few reasons. In the 2000s, oil prices were much higher, peaking at around $175 per barrel in today’s dollars (inflation-adjusted). Vehicles were also far less efficient, and high prices combined with the 2008 recession were a significant catalyst for increases in vehicle fuel efficiency. Today, oil is comparatively cheap, and fuel efficiency is much better, so unless many people (and trucking companies) flock to electric vehicles during a recession, I do believe oil demand will fall so significantly in a downturn. However, due to recession fears, oil producers are reducing output; thus, a recession could be a net benefit, particularly considering the lack of emergency storage that could otherwise be used to stabilize prices.

What to Expect From Coterra

Overall, these data present a generally positive picture for Coterra regarding crude oil. In my view, the US and global oil production outlook have become increasingly negative over the past few months as the rig count level plummets. I expect demand will soon begin to outpace supply, causing storage levels to decline without the SPR being able to make up for the shortage as it did in 2020. Oil prices are comparatively low on an inflation-adjusted basis, and production costs are rising, so I believe oil could easily rise above its 2022 peak should production fall quickly compared to demand.

Of course, the fact that oil producers are reducing their rig count is a sign that many face some degree of financial strain today. Coterra’s quarterly income and cash flow remained very strong in Q1, mainly due to price hedges made in 2022 that will no longer benefit the firm. Over the following quarters, only around 15% of its oil and gas production is hedged, meaning it will now sell at much lower prices.

Fortunately, as many oil exploration and production firms focused on Texas, Coterra has very low breakeven production costs. Labor and other shortages have led to increased costs over recent years, so I will forecast the firm’s profits using the high-end of its per BOE expense guidance. As detailed in its last investor presentation, the firm expects its total expense per barrel of oil equivalent to be around $17.55. The most significant cost components are depreciation at $8 per barrel (a key factor due to well output declines), transportation at $4.5 per barrel, and lease operating expenses at $2.25. One barrel of oil equivalent equates to ~5.8 MMBTU of natural gas, so its gas cost per MMBTU is ~$3.03, which is likely not breaking even on that commodity today.

The company estimates production levels of ~90K barrels per day of oil and 2.78K MMCF per day of natural gas. Over one year, this equates to ~32.9M barrels of oil and 1.01M MMBTU. At current spot prices, we would expect the firm to generate total sales of ~$2.52B from oil and $2.75B from natural gas. Expenses should total ~$577M for oil and $3.06B for natural gas. Combined, this gives us an operating income outlook of approximately $1.66B, not accounting for hedges (which should be more inconsequential going forward). Differences between my perspective and that of other analysts are primarily due to my view that its production costs rise at the high end of the guidance estimate, notably harming its profit on natural gas sales.

The company also had $70M in stock-based expenses over the past year, which appear to be performance-driven, so I’ll estimate that figure at $40M based on this income outlook. Coterra also has very low debt leverage, with interest costs of only $90M annually. Together, its pre-tax income should be around $1.53B, or ~1.22B, after 20% in taxes. With 757M in shares outstanding, this estimate equates to a forward EPS outlook of $1.62 per year, giving CTRA a forward “P/E” of ~16.1X.

Based on that outlook, CTRA would not be discounted today and would likely be trading near or slightly above its fair value. “P/E” valuations among oil and gas producers are usually much lower due to the higher cyclical risks facing the industry. That said, CTRA benefits from a very low debt level and is a strong inflation hedge, so I would be willing to buy the stock at a historically higher forward “P/E” valuation of ~15X, equating to $24.2 today.

As mentioned in another analysis, I expect natural gas to rise to ~$4/MMBTU over the next year as the market readjusts. I also expect crude oil to rise to $90/barrel based on the indications of a slight supply crunch. Of course, much higher commodity prices could be realized if economic demand does not fall, if OPEC+ pursues surprise cuts, or if the Biden administration makes material efforts to refill the SPR. However, I believe these estimates are most reasonable given today’s relatively precarious energy market situation.

Coterra’s oil revenues would rise to around $2.96B at these commodity prices, while its gas sales would be about $4.04B. After production costs, its oil operating income would be ~$3.47B, and $980M for natural gas, $4.45B. Accounting for an estimated $70M in stock-based expenses and $90M in interest, its pre-tax income would be around $4.29B or $3.43B after taxes. This estimate gives us a much stronger EPS outlook of $4.53 annually. Cyclically high earnings usually bring “P/E” valuations lower. Still, I believe a 10X valuation would be fair since I expect this profit level will be sustained due to systemic global production shortfalls, equating to a price target of $45 per share, or 68% above its current price.

The Bottom Line

Overall, I am bullish on CTRA stock because I believe it is an ideal instrument to make a speculative bet on higher crude oil and natural gas prices. Compared to its peers, it is larger, has very little debt, and has much lower oil production costs, offering significant leverage on those commodities with little company-specific risks. Even if commodity prices fail to rise as expected, I do not believe the stock will face substantial losses, potentially worth around $24 at the low-end estimate. Further, a relatively conservative increase in oil and gas prices to $90 and $4, respectively, would push its potential fair value up to an estimated $45 per share, giving it strong upside potential.

The chief risk in CTRA is a decline in oil or gas prices. The company will likely struggle to profit on natural gas at current production levels but should remain profitable on its oil sales due to low costs. For the company, oil is its “bread,” while natural gas is its “butter.” Outside of extreme circumstances, it should remain cash-flow positive on oil and could see material increases in oil profits given a conservative rise in oil prices. Natural gas remains less profitable but could become extremely profitable should prices rise well above $4/MMBTU as they had last year. I do not expect that to occur anytime soon, but it may if the gas market falls back into a chronic shortage. A more considerable sustained increase in natural gas could easily make CTRA worth far more than my $45 price target. However, even based on today’s commodity prices, I believe CTRA is attractive due to its strong financial stability and ample price support in the oil market.