alvarez

Thesis

In my last article I detailed the financial stability of the Dynagas Partners (NYSE:DLNG) and how it related to the preferred shares (Series A and B). Two quarters have passed, and the financial outlook has improved thanks to higher shipping rates, an improved backlog, and lower debt. It is now time to ask if it is finally time for the common unit holders to get paid.

Over the last two quarters, the partnership has taken action to consistently lower debt levels and has made significant prepayments of $19 million and $31 million towards the outstanding credit facility. Tailwinds are starting to emerge once Arctic Aurora begins its new time charter. The new contract starting in Q3 of 2023 will award the partnership a significantly higher charter rate that will pave the way for significant free cash flow growth.

However, rising interest rates pose a risk to forward looking cash flows by driving up interest expenses and consuming this newly found cash flow. This article will review the feasibility of reinstating the distribution for the common unit holders and evaluate the company’s long term outlook for the common units.

2023 outlook

With all six vessels in the fleet contracted on long term contracts, consistent results should be expected from a revenue standpoint. Starting in Q3, the Arctic Aurora will begin its new charter contact at an elevated rate. This vessel will fetch an average daily rate of $106,000. Assuming the previous fleet wide average rate of $67,683 per day per vessel, this new contract could contribute roughly $38,000 per day uplift to the company.

To strengthen its contract mix, DNLG was also able to add $270 million to its backlog. The partnership was able to extend the time charter of two of its vessels with a two-year extension for the ship Clean Energy, and a seven-year extension for the Arctic Aurora. This puts three vessels fully contracted through 2028 and three vessels contracted through 2033, making for a consistent revenue stream.

Covenants

I’ll start this analysis with a cautionary note regarding this thesis. The covenants of the partnership’s credit facility preclude it from paying distributions to the common unit holders. Therefore, this analysis is heavily based on the assumption that this restriction will be removed upon refinancing which will be required to be complete on or before Q3 of 2024. Therefore this thesis bears some risk that future loan agreements may retain these covenants.

FCF analysis

As mentioned earlier, DLNG operates on long term contracts, making the revenues and income figures fairly repeatable. The largest variable in these numbers is rising interest rates on its credit facility. The partnership has been able to manage the effective interest rate to around 3% using interest rate swaps. If the ability to do so is lost after the eventual refinancing, the partnership will see an increase in interest related expenses. The table below shows the potential quarterly impact of refinancing the projected $421 million that remains on the credit facility. This assumes the refinance occurs at the beginning of 2024 and no addition prepayments occur.

| Interest Rate | 5.0% | 5.5% | 6.0% | 6.5% | 7.0% |

| Quarterly Interest | $5.26m | $5.8m | $6.3m | $6.8m | $7.3m |

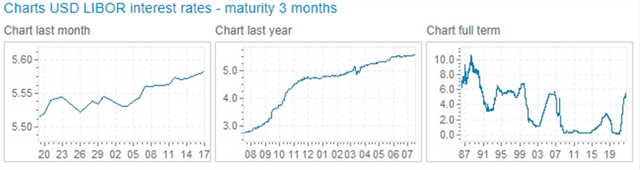

As shown below, we can see interest rates are hanging in the mid 5% range. For this analysis I will assume that DLNG is able to refinance at a fixed 6% rate and will continue the principal repayment of $12 million per quarter. Under this assumption, these terms will reduce quarterly cash flows by about $3 million from the current operating model.

global-rates.com

In Q1, the partnership was able to generate approximately $4 million in positive FCF if the voluntary debt prepayment of $31 million is excluded. After the increased interest expenses are factored in, DNLG is left with a positive cash flow of roughly $1 million.

However, the partnership will experience increased cash flows starting in Q3 of this year due to the vessel Arctic Aurora starting a new contract. Will this new contract be sufficient to justify ownership of the common units? A little math can go a long way here.

Taking an estimated revenue increase of $38,000/day over 365 days will generate $13.9 million of cash that should flow straight to the bottom line. Conservatively, I will knock this down to a $10 million annual boost in the event Arctic Aurora was already pulling in more than the average charter rate.

On an annual basis this leaves us with $11 million in cash that has not been distributed or utilized. Spread out over 36.8 million common units, leaves a maximum distribution of $0.30/share, however it is unreasonable to assume that the partnership would be willing to distribute all of its FCF without benefiting the partnership first. If the partnership were to keep 50% of these funds for debt reduction or capital purposes, that would still leave $0.15/share for distributions or a 5% yield at today’s prices.

Additionally, in 2024 all dry dockings will be complete. The next dry docking is not scheduled until 2027 (occur on 5-year frequencies). This will be important for preserving FCF and provide a degree of margin should the distribution be reinstated.

With the number of conservatisms built into my projections, it can be said that a distribution to the common unit holders is mathematically possible. However, as mentioned earlier, this will only be possible once the credit facility is refinanced AND the covenant restricting payments to the common unit holders is lifted.

Risks

This biggest risk to investors is ultimately one that cannot be controlled by the partnership. If prospective lenders are unwilling to alter the covenant to allow the common units to be paid, then no matter how well the company performs it will be immaterial to the commons. Under that scenario, investors would have to wait until the credit facility was paid in full to have the option to receive payments. Obviously, this would take some time, and one would incur significant opportunity costs while holding the stock.

Compounding the issue, is the inherent inability to grow the business without taking on more debt. Having fixed rate charters is great for dependable cash flows but also robs the partnership of the ability to raise shipping rates. This leaves only one method to grow the partnership; buy more vessels to increase revenue.

Acquiring additional vessels will require taking on more debt. The general cost for a newbuild would be a significant hurdle for the partnership given its size, cash balances, and already high debt levels. For context, competitor FLEX LNG (FLNG) gave some color for the new build market on its Q1 conference call.

We are at around $260 million for newbuilding prices for LNG carrier today, you are quite lucky if you managed to get still a ship for 2027. The window is now closing in on 2028 deliveries. So these ships that have this price tag for delivery of 2027, 2028….

Purchasing a new vessel will be an eventual reality and the partnership must think long term given its fleet is somewhat aged. Financing a new vessel will be a heavy lift given the high interest rate environment we are operating in today. Therefore, refreshing the fleet to sustain the partnership and also reinstating the common distribution would not be financially feasible.

Ultimately, the long term health of the partnership will/should take priority over distributions. Therefore I can only conclude that the common units will likely continue to not see any distributions for the foreseeable future.

Summary

2023 looks to be a somewhat tight year given the current trajectory of interest rates. Despite this, DLNG has faithfully paid down debt and continued to pay distributions on the preferred shares. The damage resulting from rising interest rates has been somewhat mitigated by interest rate swaps, but this method has a ceiling.

2024 provides significant uplift in free cash flow thanks to the new charter rates of Arctic Aurora and no scheduled dry dockings. I believe the company will prioritize the additional revenue toward debt reduction. It should also consider allocating capital toward refreshing its fleet instead of unit holder distributions.

Given the risks created by the current covenant associated with the credit facility, the common units do not appear to be an avenue if you are in search of yield. For a yield seeking investor the smarter move for someone who wants to be invested in this space may be the preferred shares, which have been consistently paying out since 2016.

The common units may appreciate on a long term horizon as the company works down its debt profile. It has been very successful in doing so over the last several years and I don’t see that changing going forward. Retiring debt will give it financial flexibility to acquire new vessels. Growing the partnership will be key to see share price appreciation.