Darren415

A bit over a year ago, BlackRock introduced a trio of buy-write fixed-income exchange-traded funds, or ETFs. Buy-write or covered call funds are familiar to income investors, particularly in equity sectors. These funds hold a basket of stocks and sell call options, on either indices or individual stocks. These BlackRock fixed-income funds do the same thing, except they do it for corporate bonds rather than stocks. In this article, we take a look at these funds and specifically discuss the iShares High Yield Corporate Bond Buywrite Strategy ETF (BATS:HYGW).

Fund Snapshot

HYGW is a buy-write or covered call fund. It basically holds two things: sister bond fund iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and a short call option on HYG.

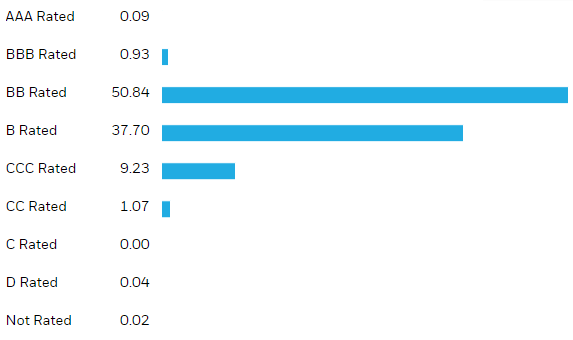

HYG – the main holding of HYGW – is a high-yield corporate bond ETF. From a credit perspective, about half the fund is in BB-rated bonds and about 10% is in bonds rated CCC and below. The fund has a fairly modest duration of 3.7.

Blackrock

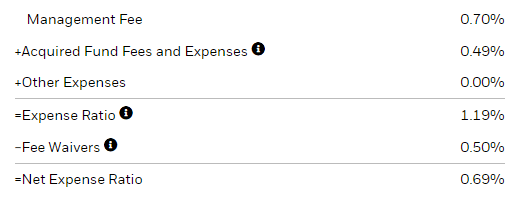

HYGW has net expenses of 0.69% which is fairly high for a passive ETF. It’s also about double of the fees of its sister buy-write ETFs iShares Investment Grade Corporate Bond Buywrite Strategy ETF (LQDW) and iShares 20+ Year Treasury Bond Buywrite Strategy ETF (TLTW), which execute the same strategy but on investment-grade corporate bonds and Treasuries, respectively.

Blackrock

HYGW charges 0.2% above the fee of HYG. Overall, this isn’t too bad in the context of a 8.6% yield on the underlying bond portfolio, as well as the potential additional return from call selling.

A Word About Yield Distributions

It can be difficult to come to grips with the various yield metrics of a fund like HYGW. For one, there is a whole slew of yields which are all over the place. The SEC yield of the fund is 5.65%, its average yield to maturity is 8.6%, its annualized trailing 12-month yield is around 19%, and what BlackRock calls its option-adjusted yield (the sum of the portfolio yield) is 17%. That’s quite a range.

The SEC yield is a measure of a fund’s interest less expenses for the last 30 days. Although the SEC yield was created to provide a fair apples-to-apples comparison, it is arguably the worst fund yield metric and, in our view, investors should disregard it.

For one, it ignores the pull-to-par component of bond yields – a big component of the overall yield. For example, the weighted-average bond price in the high-yield corporate market is roughly $89 which works out to a yield of 2.75% given the rough weighted-average maturity of 4 years. The result is that the SEC yield will understate high-yield corporate bond yields by nearly 3%.

The second reason why the SEC yield is not appropriate in this context is because of the additional call premiums received by the fund. The option-adjusted yield of 17% is the sum of the cash distribution and call premiums received over the month. As just discussed, the cash distribution of the fund’s bond portfolio is roughly its SEC yield. This means that the additional yield contribution from call premiums is about 11.35% (17% – 5.65%).

To get a better gauge of its overall yield, we should then add this call premium yield of 11.35% to its bond portfolio yield-to-maturity of 8.6% which gets us to around 20%.

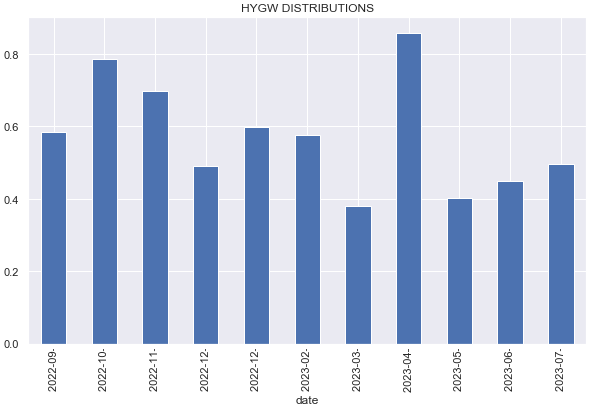

However, there are a couple of strong caveats in using this yield. First, the fund’s distributions are quite volatile, so the annualized yield for any given month is not a great one to go by.

Systematic Income

And, more importantly, the yield of a covered call fund is not really the same kind of yield as the yield of a bond portfolio. This is for the simple reason that the “principal” of the covered call fund is not static in the same way as the principal of a bond portfolio.

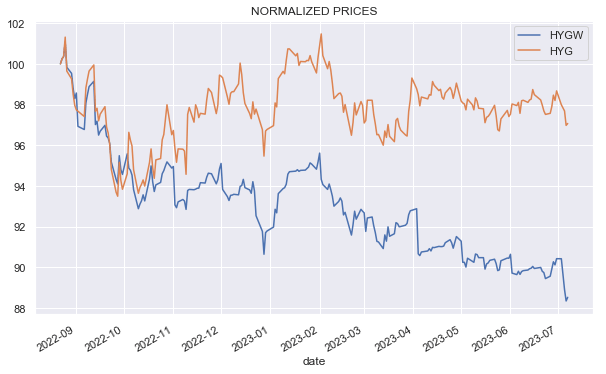

A covered call fund earns call premiums for selling away its upside. The call premiums are distributed to shareholders in their entirety, however the lost upside comes out of the fund itself. We can see this dynamic in the prices of HYGW versus its underlying bond portfolio, HYG. We see that the “principal” of HYGW is eroded quite quickly, which reflects this lost upside.

Systematic Income

In other words, a lot of the fund’s yield is financed by its own principal. This is often a red flag for many investors, however this is simply what a covered call strategy does. The hope is that the premiums received from covered calls are more than enough to offset the lost capital from selling away the upside.

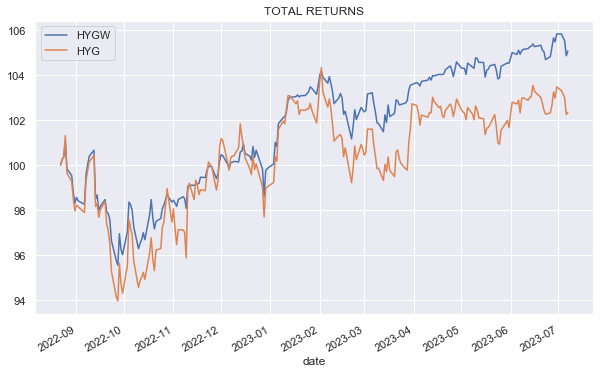

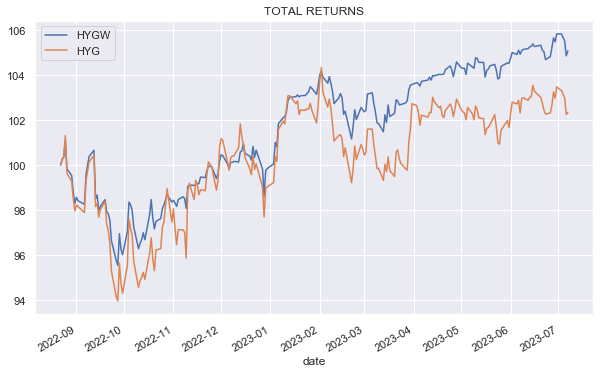

This is why the best way to think about covered call funds is not by looking at their yields, but by looking at their total returns. The chart below shows this from the fund’s inception relative to HYG. What we see is that over the last 11 months or so, HYGW is ahead of HYG by about 3%. This 3% represents a roughly 40% advantage relative to the yield-to-maturity of the HYG bond portfolio.

Systematic Income

To be clear, this is not the real-and-true yield of the fund, as such a thing doesn’t exist. The fund’s performance relative to HYG will depend on the behavior of HYG. A sharply rising HYG trend will very likely cause HYGW to underperform. Other scenarios such as a very slow rise, a drop or a mean-reverting environment should likely allow HYGW to outperform.

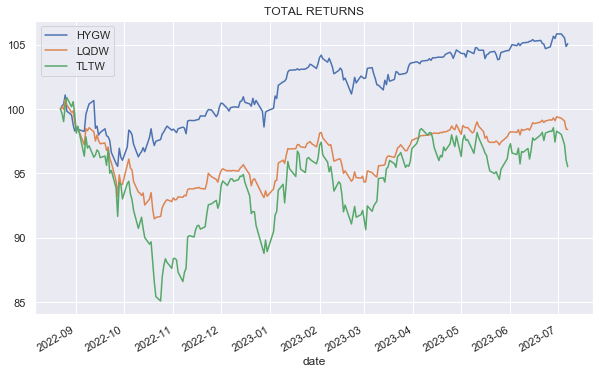

Something else worth nothing is that, as highlighted above, HYGW is one of three funds in the BlackRock fixed-income buy-write family. Since the inception of the 3 funds, it has performed the best, even though the yields of the 3 types of bonds have risen by about the same. We attribute this to the higher yield profile of its underlying portfolio and to a higher level of implied volatility for high-yield corporate bonds.

Systematic Income

Reasons For Considering HYGW

Apart from the “optical” reasons for considering HYGW touched on above, such as its yield and outperformance (relative to HYG and relative to LQDW/TLTW), there are a couple of other reasons for considering the fund.

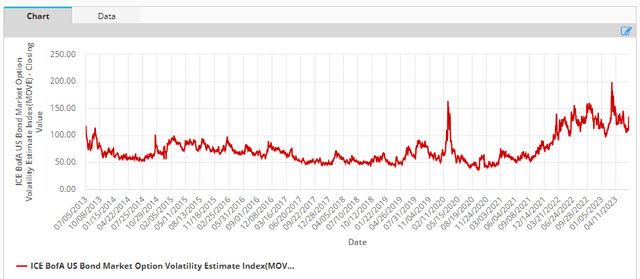

First, interest rate volatility is relatively high. The chart below shows the MOVE index, which is an index that measures implied volatility of Treasuries and is viewed as a “VIX for bonds.” High implied volatility means higher prices of bond options and higher call premiums received by HYGW, all else equal.

ICE

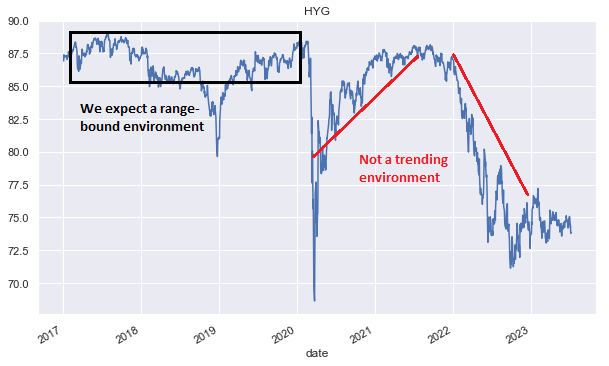

Two, we don’t expect the underlying ETF to trend for long periods of time like what we have seen since 2020. A buy-write fund should outperform in a mean-reverting environment. The reason we don’t expect a sharply trending environment is because credit spreads are likely to offset the move in Treasury yields to a large extent. For instance, if we hit a recession and credit spreads widen out, Treasury yields should fall to partly offset the rise in credit spreads. The reason we got trending environments in 2020 and in 2022 was due to extremely high credit spreads in 2020 and an unusual combination of low Treasury yields and credit spreads in 2022. This is not an environment of today.

Systematic Income

Three, HYGW has outperformed HYG since the start of the year, which has been a broadly range-trading environment.

Systematic Income

A Few Risks

One key risk for HYGW is that implied volatility falls, and call options are no longer particularly attractive. If this happens, it will actually boost the performance of the fund over the period of falling volatility. It will also allow investors to rotate into another, more attractively priced security. However, investors who are not able to track the level of implied volatility may miss a good time to rotate away from HYGW.

Another risk is that, in contrast to our expectation of a range-trading environment, HYG rallies sharply. In this scenario, HYGW will miss out on a large part of the rally because it is selling away the upside via calls. This scenario could happen in an “immaculate disinflation” scenario where inflation falls sharply and remains low. In this case, we would expect both Treasury yields and credit spreads to fall sharply, driving a significant rally in HYG. HYGW would miss out on a substantial chunk of that rally, leading to positive performance but significant underperformance relative to HYG. In our view, a rally in HYG is certainly possible, but its scale is limited due to relatively low credit spreads.

A final risk worth highlighting is that the fund could grow significantly, making its footprint too big for the HYG option market, pushing the premiums it receives for selling calls lower. So far, the fund is relatively small at $29m. However, its size is worth watching.

Takeaways

The suite of BlackRock fixed-income buy-write funds has now been trading close to a year. In our view, so long as investors are mindful of the yield optics and potential risks, they are worth a look. iShares High Yield Corporate Bond Buywrite Strategy ETF looks most attractive within the trio for investors comfortable with a sub investment-grade allocation.