HAYKIRDI

The natural gas market’s tumultuous period has finally quieted as the market shifts back out of a glut dynamic. More recently, sweltering summer weather has increased the demand for natural gas while its production outlook slows. The Henry Hub natural gas spot price has slightly increased since bottoming, resulting in positive returns for the natural gas ETF (NYSEARCA:UNG). Notably, I was bearish on the natural gas ETF UNG last year, believing that shortage concerns in regard to Europe were vastly overestimated. My view became more neutral early this year as it appeared those factors were fading and that the spot natural gas price may reach a bottom. Since April, I have had a bullish view on UNG, seeing that the commodity may shift back into a shortage dynamic sufficiently large to overcome UNG’s significant contango decay risks.

Since April, the natural gas market has moved about as expected, although gas storage levels remain above seasonal norms. Natural gas producers have significantly reduced their active rig count, signaling an impending decline in output levels. Low EU natural gas prices have improved domestic supplies by reducing LNG exports, a factor which should continue unless Norway reduces output or, more likely, Ukraine blocks its critical gas transit pipeline from Russia (currently supplying ~5% of EU gas). US manufacturing strength has declined dramatically, particularly notably steel producers (which use immense power). That said, high summer weather has increased power demands to offset the recessionary trend. Further, as is usually the case, volatility in natural gas production is more important than changes in demand, which are usually much lower than supply volatility today.

UNG faces some new risk factors, particularly regarding changes in export demand. However, I believe recent developments give some caution to my bullish position in UNG, although with ample caution. Looking forward, UNG may continue to rise, but it remains unlikely the ETF will see extreme performance as it had in prior years. As such, it is a good time for investors to consider UNG’s fundamentals better to assess its immediate and long-term risk and reward factors.

Natural Gas Production Should Decline Soon

In 2020, natural gas and crude oil performed very well as producers cut output and drilling levels far too aggressively for the short-term situation. Indeed, they had no choice due to a lack of available storage capacity. Crude oil prices did not rise as sharply as natural gas due in part to the release of immense Strategic Petroleum Reserves last year. Natural gas also rose too high as many speculators bet on the commodity due to its importance in EU and Russian trade. However, as described last year, US LNG export capacity is insufficient to fix lost Russian sources. Hence, the importance of this factor on US gas prices is marginal (though not entirely inconsequential).

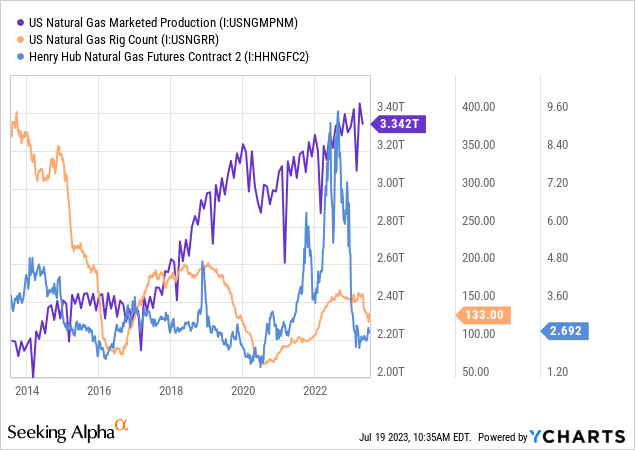

Natural gas is hardly a globally traded energy product compared to other commodities, with prices varying tremendously between continents due to its pipeline dependency. In the US, natural gas spot prices remain below breakeven profit levels, roughly $3/MMBTU, although that figure has risen due to labor and supply cost increases. Further, because most producers raced to increase output last year due to high prices, very few hedged their prices last year, so they’re now facing negative cash flows the more gas they sell. As a result, the natural gas rig count is falling fast, meaning producers are reducing the rate at which they drill new wells. See below:

The falling rig count indicates that natural gas is now firmly below breakeven price levels, causing producers to lose money. This issue is clouded by the fact that most gas producers were making record profits just one year ago, so much of that bullish momentum continues to benefit gas producers. That said, I suspect many stocks in this industry will see massive earnings declines in Q2 earnings reports as that momentum slows. Further, although the high-profit season in 2020-2022 allowed many to reduce leverage levels, many, if not most small-to-midsized natural gas and crude oil producers were at high risk of bankruptcy in 2019 due to chronically negative cash flows. Accordingly, I doubt many companies in this category can survive a prolonged depression in natural gas prices, as we’re starting to see today.

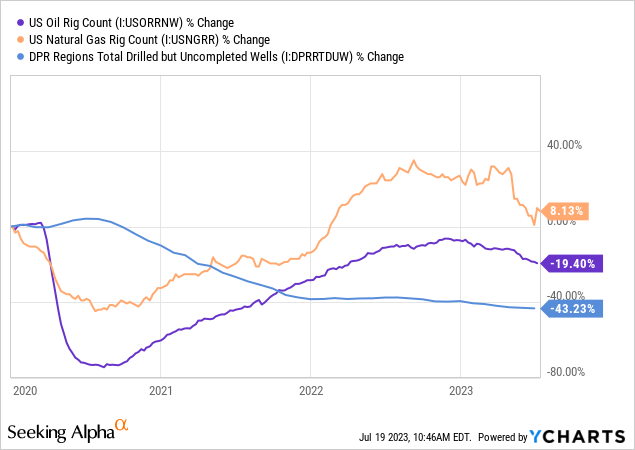

Historically, natural gas production levels lag behind the rig count by 6-18 months. Most natural gas wells will produce for 20-30 years, but most of their output occurs during the first year or two due to pressure levels, often falling by 70% during the first year and 90% by the second year. Further, following the 2010s Permian Basin fracking boom, many wells have become much older, making total US gas production levels far more sensitive to immediate changes in the gas rig count. Crude oil and gas are often produced together, so high crude prices can lift natural gas production even if that commodity is underpriced. Today, we’re seeing a sharp decline in natural gas and crude oil drilling levels as both commodities fall near or below breakeven profit levels. Additionally, the inventories of previously drilled but uncompleted wells have fallen to historic lows. See below:

Following the onslaught of shortages in 2021, many producers could increase output without drilling (rig count) by activating drilled but uncompleted wells. Since the inventory of these wells has fallen, the rig count must maintain a higher level than it had in 2021-2022 for total production to be constant. As a result, the recent sharp rig count declines are likely to result in a more rapid decline in gas and oil production than in previous cycles.

Overall, these are strong indications that natural gas supplies in the US will fall significantly by year-end. As is historically common, this trend should result in an overshoot whereby total output levels fall too quickly compared to changes in demand. The US manufacturing PMI of 46 is the lowest since 2008, excluding the temporary extreme decline in 2020. Should this data indicate a manufacturing recession, we’ll likely see a slight decline in natural gas demand. However, that data also encourages gas producers to cut production in expectation of a recessionary demand decline.

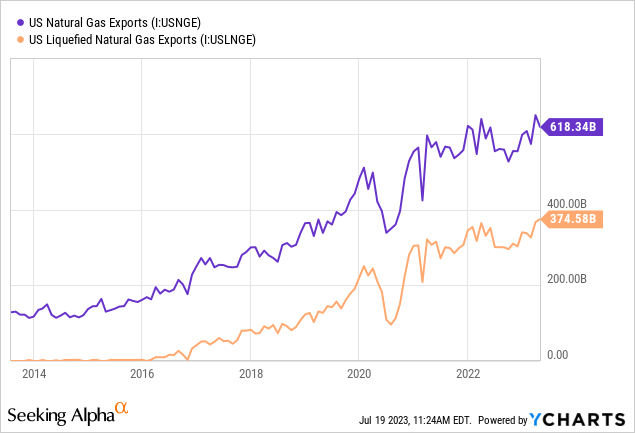

US natural gas exports remain high at 618B cubic feet, near a record level, primarily due to the growth of LNG exports. This factor has contributed to the shortage in the US, and exports likely rose in recent months due to the reopening of the Freeport LNG facility. See below:

Problematically, EU natural gas prices have fallen by over 90% over the past year and are equivalently around $7.5/MMBTU today. Accordingly, the spread between US and EU gas prices persists, but it is not large enough for LNG processing and exporting to be very profitable. High exports persist due to contracts created during the shortage last year; however, I suspect they will fall sharply over the coming months should EU gas remain comparatively cheap. In my view, combined with the recessionary trends in manufacturing, these are negative factors facing natural gas prices today that could offset the supply declines.

Can UNG Continue Higher?

Overall, there is a combination of bullish and bearish factors facing natural gas today. As expected, low prices are causing drillers to slow activity, likely resulting in a more significant supply decline; however, lower economic demand and decreased US exports could offset that. Total US gas storage levels remain elevated compared to the historical seasonal norm, with a surplus of roughly 350 Bcf. Over the past decade, natural gas has generally cost between $2-$3/MMBTU, given this surplus level, so it is nearly fairly priced today. Temperatures were above the seasonal norm but are now back in the normal range, so the gas surplus should remain relatively persistent.

Fortunately, some of the “contango” has come out of the gas market, meaning forward prices are not excessively expensive compared to spot prices. In February, natural gas was subject to nearly 60% in annual contango, so the commodity needed to rise by that level for UNG to break even (since it buys future contracts that decay toward spot). Today, the August 2023 gas futures price is $2.61, while the August 2024 price is $3.37, or ~29% higher than the current price. Gas has generally tracked the futures outlook it had in February, meaning UNG can hold a relatively constant value.

Despite the risks, natural gas will likely return to $3.37 by next August as producers will cut output until prices return to breakeven levels. Thus, I expect UNG may remain in its current range at worst but may rise much higher if demand does not decline too quickly. Again, although I am bullish on UNG, I do not believe it will see a 50%+ price increase this year unless an exogenous and unpredictable shock occurs. However, because UNG is a relatively independent commodity, it offers diversification value as long as it is not likely to suffer from significant contango decay (as it often does in bear markets). That said, I generally expect gas spot prices will rise back into the $4 range by 2024, which would still bring double-digit net returns for UNG.