Timon Schneider

Introduction

In one of my previous articles, I highlighted a significant increase in LNG shipping stocks over the past year. However, since the start of this year, the LNG market has stabilized, resulting in a slowdown in the LNG shipping sector. The UP World LNG Shipping Index (‘UPI’) declined 3.79% in the second quarter, while the S&P 500 (SPX) index saw gains of 8.41% in the first quarter and 14.26% in the first half of the year. UPI gained 1.5% in the first half of 2023. You can see both indices represented in the chart below.

Weekly chart of the UP World LNG Shipping Index with S&P 500 (UP-Indices.com)

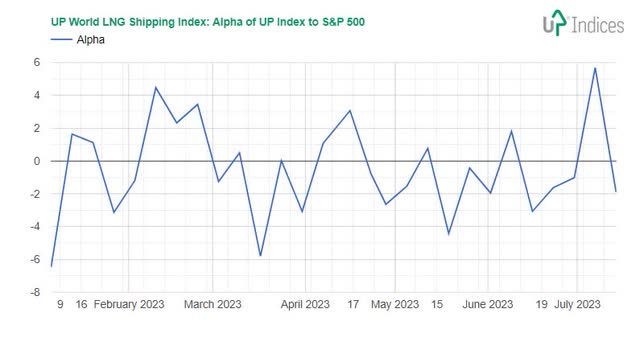

Negative Alpha

The following chart displays the performance of UPI compared to SPX. A negative number denotes lower gains for UPI compared to SPX and vice versa.

During the second quarter, SPX was more successful than UPI. Until March, the UPI was increasing steadily and setting new all-time highs. I was optimistic that the upward trend would continue until May, but UPI plateaued and failed to reach a new high. The UPI has gone sideways for six months.

Performance of the UP World LNG Shipping Index to the S&P 500 (UP-Indices.com)

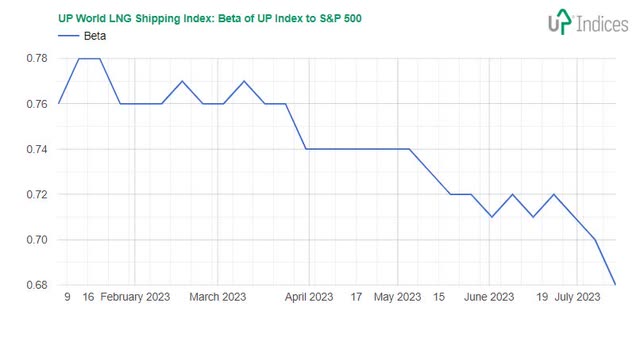

Decline of volatility

The volatility of UPI to SPX is shown in the following chart. Beta was declining, and the decrease continued in July. The chart also demonstrates how the UPI has been developing sideways, with smaller movements leading to smaller volatility.

Volatility of the UP World LNG Shipping Index to the S&P 500 (UP-Indices.com)

Constituents

This report focuses on the second-quarter gains and losses of nineteen international LNG shipping companies from the U.S.A., Europe, and Asia. The table lists the companies’ tickers and ranks them based on their Q2 gains, with the top gainers appearing first.

During the second quarter, LNG shippers tend to experience a lull as the winter season has ended, resulting in a decrease in new deals and spot rates. The top spot rates for a ME-GI carrier were close to $500,000 per day, falling below $100,000 in spring. However, investors have held their positions this year, with UPI remaining stable at a price above 140 points. Even when it temporarily fell below, it quickly rose back up.

The first two companies on the list experienced gains due to corporate actions. Cool Company (CLCO) dual-listed its shares on NYSE in March, while Awilco LNG declared its first dividend. The table displays Cool Company’s gains on the Oslo stock exchange; all profits and losses are counted in local currencies.

|

Name (Ticker) |

Performance Q2 2023 |

Performance H1 2023 |

|

Cool Company Ltd. (OSE: CLCO) |

+ 16.80% |

+ 35.77% |

|

Awilco LNG ASA (OSE: ALNG), (OTCPK:AWLNF) |

+ 14.71% |

+ 17.65% |

|

Kawasaki Kisen Kaisha, Ltd. (“K” line) (TSE: 9107), (OTCPK:KAKKF) |

+ 13.52% |

+ 31.21% |

|

Qatar Gas Transport Company Ltd. (Nakilat) (QSE: QGTS) |

+ 9.92% |

+ 7.03% |

|

Capital Product Partners LP (CPLP) |

+ 6.72% |

+ 1.92% |

|

GasLog Partners LP (GLOP) |

+ 3.86% |

+ 36.83% |

|

Mitsui O.S.K. Lines Ltd. (TSE: 9104), (OTCPK:MSLOY) |

+ 2.70% |

+ 9.19% |

|

Nippon Yusen Kabushiki Kaisha (TSE: 9101), (OTCPK:NPNYY) |

+ 0.72% |

+ 7.43% |

|

MISC Berhad (KLSE: 3816), (OTC:MIHDF) |

+ 0.00% |

-0.69% |

|

Shell plc (SHEL) |

-0.31% |

+ 5.47% |

|

Korea Line Corporation (SM Korea Line) (KRX: 005880) |

-3.11% |

-1.70% |

|

Golar LNG Limited (GLNG) |

-3.72% |

-7.05% |

|

UP World LNG Shipping Index |

-3.79% |

1.50% |

|

New Fortress Energy Inc. (NFE) |

-4.56% |

-29.53% |

|

Chevron Corporation (CVX) |

-6.14% |

-10.88% |

|

Dynagas LNG Partners LP (DLNG) |

-7.38% |

-16.33% |

|

Exmar NV (BSE: EXM) (OTCPK:EXMRF) |

-8.08% |

+ 39.50% |

|

Flex LNG Ltd. (FLNG) (OSE: FLNG) |

-8.65% |

+ 1.53% |

|

BP. p.l.c. (BP) |

-10.68% |

+ 2.41% |

|

Excelerate Energy, Inc. (EE) |

-11.11% |

-12.37% |

Three highlights

The information presented in the table highlights three key points regarding the LNG shipping sector.

Firstly, big investors are showing interest in the industry, evident by recent IPOs, merger deals, and takeovers. Secondly, the year’s second quarter tends to be a slower period for LNG shippers. Lastly, investors still appear to have faith in the sector’s potential.

To delve deeper into this thesis, it’s worth noting that all three significant corporate action types occurred during the year’s first half. Norwegian Cool Company successfully dual-listed on NYSE, increasing trading volume and accessibility to international investors. Similarly, another Norwegian company Flex LNG, achieved the same in 2019.

The year’s second half saw GasLog Partners and Exmar experience significant gains in the prices of their shares, thanks to the major holders. GasLog Ltd. (ex-GLOG) made a merger offer in February, and Saverex announced a public takeover plan in April.

Conclusion

The worst part of the year for LNG shippers is behind, and a new winter season is coming. It will be the first new-scheme winter period when all business parts can be prepared for European demand. This time will show if there were any changes in settled behavior.

All these positive expectations will impact the UPI, which should try to cross the 155 mark during the second quarter, if not directly rise to 160 points.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.