William_Potter/iStock via Getty Images

Thesis

I usually don’t cover ETFs, but Moat has really caught my attention, so enjoy. VanEck Morningstar Wide Moat ETF (BATS:MOAT) invests in companies that have very strong competitive advantages and are trading below their fair value, hence the ticker moat. MOAT tracks an index comprised of attractively priced companies with sustainable competitive advantages according to Morningstar’s equity research team. The ETF has been able to outperform the S&P 500 over the past 10 years, 5 years, 3 years, and YTD.

Overview

MOAT was incepted back in 2012. The ETF focuses on U.S. companies that Morningstar believes possess sustainable competitive advantages and are trading at attractive prices relative to Morningstar’s estimate of fair value. The top 10 Holdings of the ETF are listed in the table below.

Seeking Alpha

For one to know if an ETF or a money manager is performing well. They compare them with the S&P 500. For this article, I will be using the Vanguard S&P 500 ETF (VOO) for comparison. As you can see from the chart below, MOAT by far outperformed VOO on a 10-year run. MOAT returned 216% and VOO 167%. MOAT has also outperformed VOO over a 1-year, 2-year, 3-year, and 5-year period.

Seeking Alpha

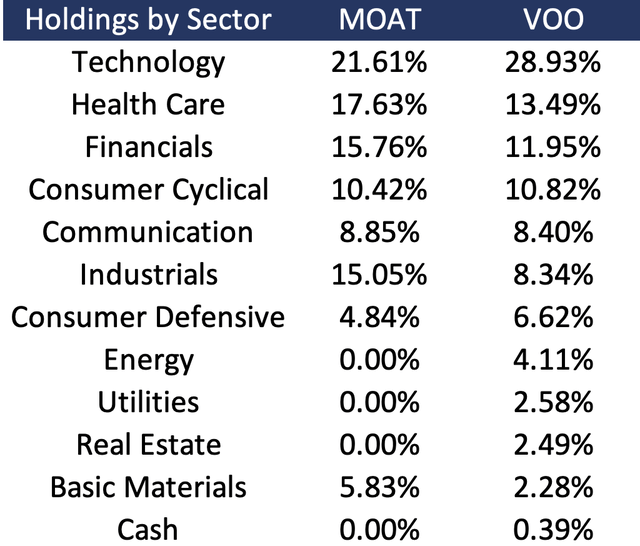

The ETF is also very diversified in its top 10 holdings, accounting for only 26.48% of total assets. The biggest holding in the ETF doesn’t even account for 3% of assets. When compared to VOO Apple at 7.5%, Microsoft at 6.96%, and Amazon at 3% (MOAT doesn’t even own any Apple shares). MOAT only has 54 total holdings when compared to VOO’s 505 holdings. VOO is more diversified across companies and sectors in its portfolio, as you can see below.

Created by the author using Seeking Alpha

I believe there are two reasons why one would prefer to own VOO over MOAT. First is the expense ratio; VOO has an expense ratio of 0.03% and MOAT of 0.46%. Second is dividend yield, VOO has a dividend yield of 1.49% and MOAT of 0.98%. As you can tell, there is a huge difference when it comes to the expense ratio between the two ETFs. This is probably why VOO has more than $300 billion in AUM, whereas MOAT only has $10 billion.

How does Morningstar determine a Moat?

Morningstar assigns the company a wide economic moat when its competitive advantages can last more than 20 years. If the firm can only fend off competition for 10 years, it’s assigned a narrow moat. Morningstar uses five pillars or sources to identify these moats. The network effect, intangible assets, cost advantage, switching costs, and efficient scale.

The network effect is when a company’s product or service becomes more valuable as people use it. For example, The more people join Facebook, the more valuable it becomes to both the company and the customer. I like to describe it as a snowball effect.

Intangible assets can be patents, logos, brand names, and more. Companies with strong intangible assets include Domino’s Pizza, Coca-Cola, and Google. These intangible assets help the companies stand aside from competitors. For example, Patents in the pharmaceutical industry usually last for 20 years, So the patents a company gets for a drug protect it from other companies trying to replicate that drug.

Cost Advantage is when the company can negotiate favorable deals to cut costs while maintaining or increasing its margins. For example, Apple can negotiate better prices for the chips used in their iPhone given the high demand for its product. Companies that possess a cost advantage have access to the same services as competitors but at a much cheaper price.

Switching costs occur when the customer really likes the company’s product and still uses it as the firm raises prices. This gives the company pricing power. Some companies that I think have pricing power are Facebook, Apple, Google, and L’Oreal.

Efficient scale is when a market is dominated by one or a few companies. For example, According to the stat counter, Google has a 92% market share in the search engine market. The search engine market is mainly dominated by two companies: Google (Google Search) and Microsoft (Bing). The following is an example from Morningstar’s website to further explain efficient scale:

For example, midstream energy companies such as Enterprise Products Partners EPD enjoy a natural geographic monopoly. It would be too expensive to build a second set of pipes to serve the same routes; if a competitor tried this, it would cause returns for all participants to fall well below the cost of capital.

All of the holdings in the ETF were assigned a wide economic moat by Morningstar. This means Morningstar believes all the 54 holdings can fend off competition for more than 20 years.

Outlook

It is hard to forecast or predict how an ETF will do in the future, especially the ones that are diversified among many different sectors. What I believe one should do is look at the company managing the ETF and see how well they have done. VanEck is the company that manages the ETF, but it uses Morningstar’s equity research to find companies with strong moats that trade at an attractive valuation. I have done some research on Morningstar, and so far, the reviews I have seen on some blogs seem satisfying. I wasn’t very surprised when I found out that the firm’s research was highly rated because not any ETF or investment firm can outperform the S&P500 over the long run. MOAT has done that at almost every time period since its inception in 2012. So I think the ETF will continue to do well because it is underpinned by a great research team.

Why is MOAT a buy?

I assign a buy rating to MOAT because the ETF has a great track record, is underpinned by a great equity research team, and its holdings are high-quality companies. I resonate with Morningstar’s analysis of moats because nearly every mega-company that has been able to fend off competition possesses at least four of the pillars I mentioned above. I believe ETFs are for buy-and-hold, and one can’t time them.

Risks

There aren’t many risks to MOAT, but there is one I would like to discuss. The ETF isn’t exposed to certain sectors. For example, Energy stocks can be used to offset or hedge against losses in some sectors. In 2022, Most oil stocks shot up due to all-time high profits, while tech and consumer stocks took a nose dive.

Takeaway

The main takeaway is that MOAT is an ETF focused on investing in companies with sustainable competitive advantages trading at an attractive valuation. This strategy has allowed the ETF to beat the S&P500, which is pretty hard to do. As for the future of MOAT, it is almost impossible to predict it, but considering management, companies owned, and the solid track record, In my opinion, it is pretty safe to say the future is looking bright for the ETF.