bjdlzx

(Note: This is a Canadian company that reports in Canadian dollars unless otherwise stated.)

I have always looked for that extra edge when it comes to investing in small companies, because small-caps have a tendency to self-destruct in ways that are hard to imagine when one is considering investing in small companies. Therefore, risk reduction is absolutely essential, in addition to a strong balance sheet and all the other usual considerations. In fact, risk reduction probably overshadows the other considerations by quite a bit. Kiwetinohk Energy Corp. (OTCPK:KWTEF) may well meet that goal despite its short history as a public company.

The CEO, Pat Carlson, has an impressive history of being backed by ARC Financial (in Canada) when bringing a new company public. The last one that he was CEO of was purchased by ARC Resources (OTCPK:AETUF). You often need that record of success in small-cap plays to counteract the tendency of small companies to self-destruct in all kinds of creative ways. Small companies have a way of depleting your investment resources creatively time and time again.

This does mean that Mr. Carlson is a very valuable part of the company, and his loss would likely be a major blow. However, that risk is more than offset by the experience and previous successes he brings to the table.

Company Operations

Currently, Kiwetinohk Energy Corp. is an upstream operator with good success in the usual Canadian basin areas. However, management does have some future projects in the planning stage (or planning plus as some would say) to minimize carbon footprints in the future.

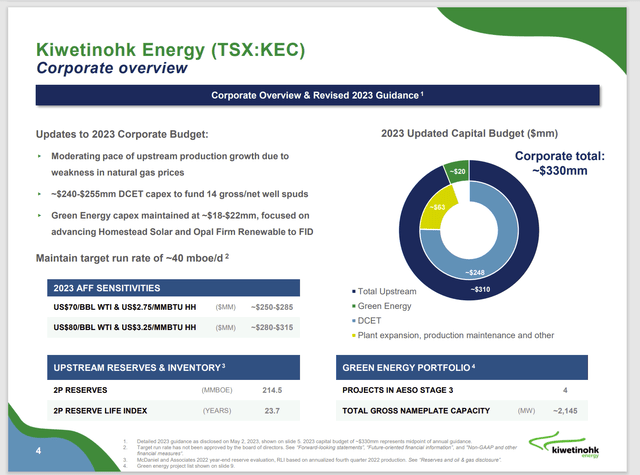

Kiwetinohk Energy Budget Guidance (Kiwetinohk Energy May 2023, Corporate Presentation)

Right now, as the budget shows, this is a typical upstream company that focuses really on natural gas production with some liquids. The Cardium (Duvernay and Montenay intervals) has been around (and producing) for ages. But recently, new technology advances have led to a revival in this area.

The company does have decent cash flow with better than average debt ratios. This is a sign of management experience. The “good old days” of leveraging the company to drill for reserves and then sell the whole thing for a big profit are gone. Now, if you want to build and sell a company, you show a lot of free cash flow both reliably and over a wide variety of industry conditions. Clearly, this management “got the memo.”

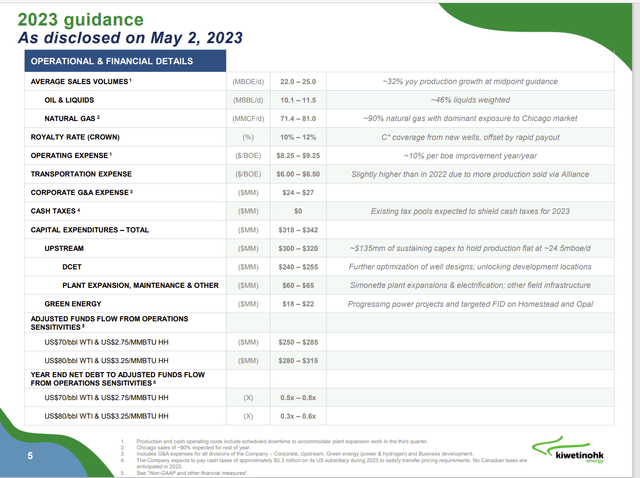

Kiwetinohk Energy Natural Gas Sales Strategy And 2023 Guidance (Kiwetinohk Energy May 2023, Corporate Presentation)

Another sign of management experience is the shipment of natural gas out of the basin of production to a stronger market (in this case Chicago). Many managements I follow just “dump” their production to the nearest seller in the basin. Few make sure that the production has access to a darn good market as this management has done.

Similarly, a management with the experience of this one will keep costs under control and can handle rapid growth. There is also access to debt that the experience enables, which is unusual for a company of this size. All of this will happen while keeping key balance sheet ratios very conservative.

The overall result is likely to be above-average growth with better than average profitability, while keeping that tendency to self-destruct out of consideration.

Business Direction

Upstream clearly provides ongoing cash flow. But management wants to enter the power generation business. That is an unusual (but not unheard of) diversification for an upstream company.

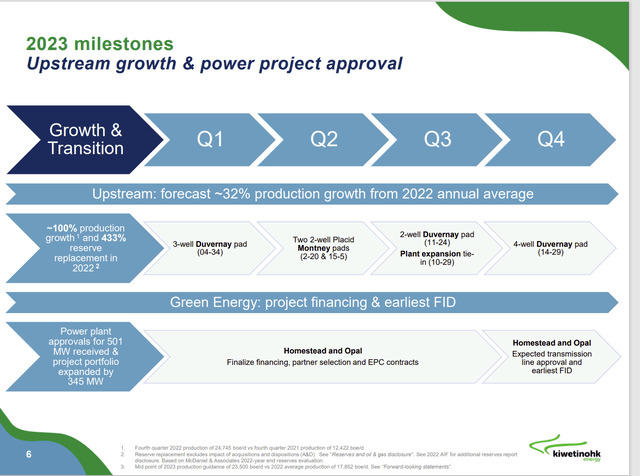

Kiwetinohk Energy Power Generation Plans Progress (Kiwetinohk Energy May 2023, Corporate Presentation)

Eventually, management has plans for a significant amount of power generation business. That would add an earnings stability that is not typically seen for pure upstream producers.

Depending upon how this all comes to fruition, the company may well be valued as a power generator with a typical utility type dividend in the future. It will all depend upon the relative size and influence of each part of the business.

I think the key idea is that a management of this experience level will likely produce above average profitability. This is shown by the natural gas being sold in the Chicago market as opposed to the nearby AECO market in Canada.

As long as management continues that “extra mile” thinking, this should prove to be a very rewarding long-term investment.

Most likely growth will be the main management focus. Therefore, income investors probably need to look elsewhere. These kinds of companies, if I get into, I tend to wait for the CEO (in this case) to sell his holdings or retire before I consider selling. CEO’s like this one tend to build companies to a certain point and then exit. So, I do not exit until they do.

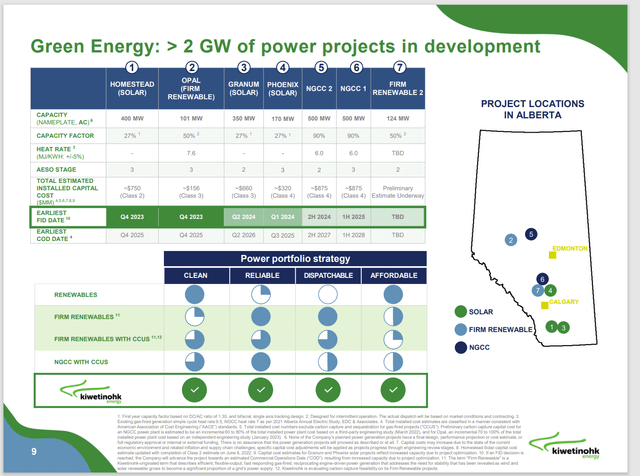

Kiwetinohk Energy Electrical Generation Specifics (Kiwetinohk Energy May 2023, Corporate Presentation)

The natural gas part of the company growth is fairly typical. What is different is shown above, as some of the company cash flow will support the electrical generation plans shown above. This company has a very practical way of heading towards “green” that I seldom see. The profitability picture in the future is also a good deal better than average as well.

Key Ideas

ARC Financial is backing this venture as it has past ventures.

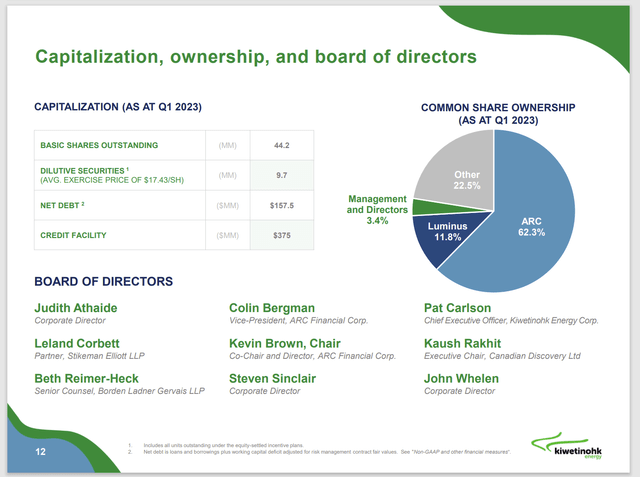

Kiwetinohk Energy Capitalization Details And Stock Ownership By Group (Kiwetinohk Energy May 2023, Corporate Presentation)

ARC Financial is a well-known venture capital firm in Canada. Backing like that does not “guarantee” success. But it certainly improves the odds, as there are resources there for a relatively new and small company.

Like any other venture capital company, ARC Financial will at some time want out. Therefore, growth and eventual sale will be the focus of this company. So those investors looking for capital appreciation from a growing company can consider this company.

For me, Kiwetinohk Energy Corp. is a speculative strong buy consideration, as management has an unusual amount of experience building and selling companies; and that management has very good backing from a known venture capital firm.

It is speculative, as Kiwetinohk Energy Corp. has a lack of operating history, the company is relatively small, and is currently fast growing. So, it is for those investors that do not mind a little extra risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.