LeoWolfert/iStock via Getty Images

By Daniel C. Roarty, Sarah Tunnell, William Johnston

Financial companies that help address some of the world’s most pressing socioeconomic challenges deserve attention from sustainability-focused investors.

When investors think about sustainability, environmental objectives and climate change are usually front and center. But social goals are also important, and financial companies play a vital yet underappreciated role in promoting sustainable development.

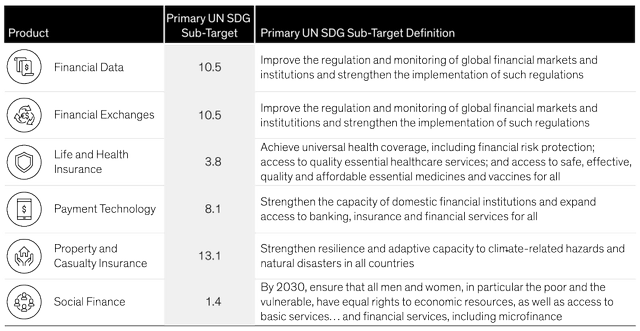

Financial firms are not often recognized as key players in addressing issues related to sustainability. Yet the United Nations Sustainable Development Goals (SDGs) highlight financial systems as targets for achieving important socioeconomic objectives. Oversight of financial markets and institutions, as well as access to financial services, are explicit sub-targets of several SDGs (Display). That’s because properly functioning financial markets are integral to empowering all members of society to increase their participation in the economy and improve their personal economic circumstances.

Several Financial Products and Services Support the UN SDGs

Source: United Nations and AllianceBernstein (AB)

For investors with an environmental, social and governance (ESG) focus, these SDGs can serve as a roadmap to identifying financial companies whose products and services support sustainable development. Then, by researching their businesses and corporate behavior, we can identify SDG–aligned companies with competitive advantages that underpin attractive return potential. We believe equity investors can access attractive companies that support the SDGs in the following parts of the financial sector.

Financial Exchanges: Leveling the Playing Field

Beneath the surface of every economy and society, financial markets ensure that capital flows freely to and from businesses and people. Academic research has long established the importance of well-developed stock markets in fostering economic growth via improved resource allocation, competition and innovation. Exchanges also help manage risks by reducing volatility of asset price movements that could undermine monetary stability or employment.

When markets are destabilized, everyone pays the price. Banks scale back lending, first to individuals with lower credit health and to small and medium-sized enterprises. Asset prices collapse and payments are delayed. Stock market instability shatters confidence in the financial and economic system, with devastating consequences for people’s savings and pensions. Those with less of a financial cushion to fall back on often suffer most in a financial crisis.

Transparency and liquidity are the foundation of stable markets, creating a level playing field for all market participants, including people who are traditionally underserved or excluded from the financial system. To promote transparency and liquidity, exchanges collect a vast array of data from companies and market participants. In some cases, this information is provided to regulators to help them oversee markets. As an enforcer of rules and regulations, exchanges aim to ensure that market participants behave fairly and ethically, protecting all investors.

Critics might argue that exchanges only serve wealthy investors. We disagree. From individuals seeking a loan to buy a house or car, to a business seeking to access capital for growth, a functioning financial market and economic stability benefit everyone.

Financial Data Providers: Information Supports Inclusion

If transparency and liquidity are the heart of a healthy, functioning financial market for all of society, data are its lifeblood. Better financial data is an essential ingredient to promote financial inclusion.

About 1.4 billion people worldwide still lack access to basic financial services and almost 850 million don’t have official proof of identity according to Experian, the Ireland-based consumer credit reporting company. In Brazil, 63 million people have unmanageable debts that affect their credit ratings. And About 28 million people in the US and 4–5 million in the UK are “credit invisible” because their financial profiles are too limited for lenders to assess them, according to Experian. Without access to affordable finance, people can’t buy homes, secure healthcare, pursue an education or start a business.

Credit bureaus provide information on a borrower’s creditworthiness that enables banks to lend and set appropriate interest rates. Lower-income customers and small businesses often struggle to gain a credit profile because they lack a credit history and are invisible to the system. Yet today, credit bureaus have new ways to help people strengthen their credit profiles using utility bill payments and mobile phone data. Credit bureaus have started to allow individuals to opt in to sharing information about the payments they’re making on time to help build or boost their credit score. This enables individuals to connect to the financial system, access cheaper sources of financing and tap additional services.

Payment Technology: Expanding Access to Financial Services

Using data to improve credit profiles is a step in the right direction toward expanding financial inclusion, but too many people are still left out of the traditional financial system entirely.

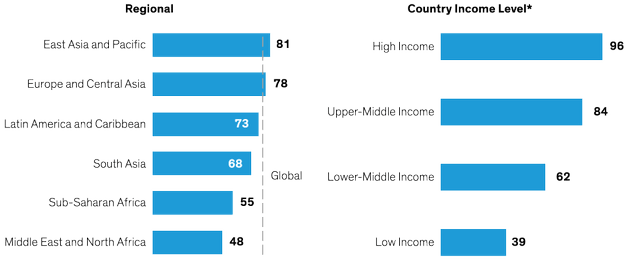

Worldwide bank account ownership has improved over the last decade from 51% of adults over the age of 15 in 2011 to 76% in 2021, according to the World Bank. But in lower-income regions and countries, many people still lack access to the system (Display).

Financial Inclusion Has Improved, But Many Still Lack Access

Percentage of All Adults with Bank Accounts (Age 15+, 2021)

Past performance and current analysis do not guarantee future results.Based on The Little Data Book on Financial Inclusion 2022. Data shown for 123 countries.*High income economies have a gross national income (GNI) per capita of $12,695 or more. Upper-middle-income economies are those with a GNI per capita between $4,096 and $12,695. Lower-middle-income economies are those with a GNI per capital between $1,046 and $4,095. Low-income economies are those with a GNI per capita of $1,045 or less. As of December 31, 2021 Source: World Bank, The Little Data Book on Financial Inclusion 2022 (Washington, DC: World Bank), The Little Data Book on Financial Inclusion 2022

Many governments have strategic plans to address the problem. However, like most of the world’s sustainability challenges, financial inclusion can’t be achieved by the public sector alone.

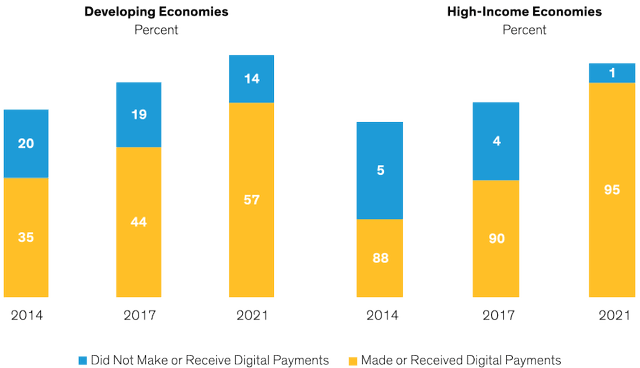

Payment technology companies are critical for those who lack access to traditional bank accounts. In 2021, 57% of people in developing economies used digital payments (Display), which are typically a gateway into other financial services, according to the World Bank. Mobile money is already commonplace in developed markets. These accounts help encourage saving and enable financial inclusion, particularly for lower-income people and women.

Digital Payment Use Has Grown Rapidly in Developing Economies

Past performance and current analysis do not guarantee future results.As of December 31, 2021Source: The World Bank—Global Findex Database

Insurance to Microfinance: Supporting the Most Vulnerable

Financial security is a multifaceted objective that must be addressed by a range of financial services firms, each contributing a solution to a distinct part of the problem. Insurance companies help manage threats to health, income and property that can devastate personal finances instantly. Life and health insurers that provide affordable protection and target at-risk segments of the population help families prepare for unexpected financial emergencies. Social finance services support the achievement of positive social outcomes in areas including basic infrastructure, access to essential services, affordable housing, employment, food security and microfinance.

With these examples in mind, we think equity investors focused on sustainability should take a fresh look at the financial sector. Guided by the SDGs, financial firms can be found that address some of the most pressing socioeconomic challenges of our age, which ultimately help reduce poverty, promote gender equality, support upward mobility and improve economic participation.

Ultimately, improved financial empowerment creates a virtuous circle that enhances economic growth and delivers economic benefits to a broader cross-section of society. Quality financial companies with clear competitive advantages and solid business models can allow investors to participate in efforts to empower individuals and small business as they strive to build a better financial future.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.