Bilanol/iStock via Getty Images

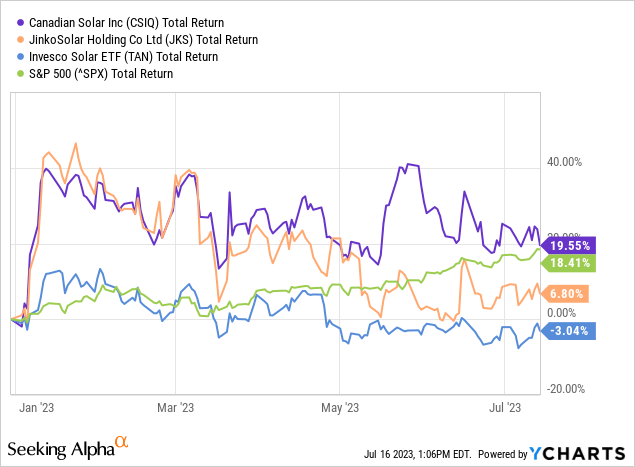

In general, solar stocks have underperformed the S&P 500 year to date. Yet, the energy transition to renewables is not slowing down at all. The international energy agency goes as far as calling out that annual solar PV capacity additions will increase every year for the next five years. Solar power capacity has recently overtaken wind power and is on track to take over coal capacity by 2027. In addition, solar panel makers are poised to expand profit margins, as polysilicon prices are declining. Therefore, Canadian Solar (NASDAQ:CSIQ) and JinkoSolar (NYSE: JKS) look prime targets for capital appreciation, while both trade at an attractive price to earnings and price to sales ratio.

Business Overview

Canadian Solar is a leading global provider of solar power solutions and a well-established player in the renewable energy industry. Founded in 2001, the company has grown to become one of the largest solar power companies in the world, with a strong presence in both manufacturing and project development.

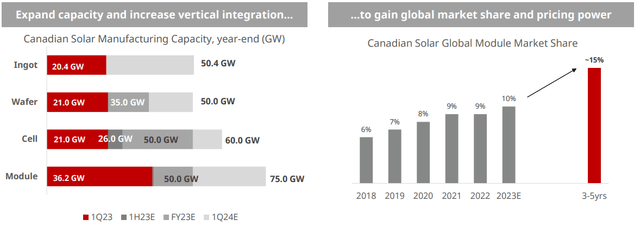

Canadian Solar operates a hybrid vertically integrated business model, which combines internal manufacturing with additional purchases of ingots, wafers, and cells, encompassing almost the entire solar value chain (excluding polysilicon). The company designs, manufactures, and sells a wide range of solar photovoltaic (PV) modules, inverters and energy storage solutions. With manufacturing facilities in China, Vietnam, Indonesia and Brazil, Canadian Solar has a robust production capacity, enabling it to meet the growing demand for solar products globally.

Canadian Solar Presentation

In addition to manufacturing solar products, Canadian Solar is actively engaged in the development and construction of solar power projects worldwide. The company leverages its extensive experience and expertise to develop utility-scale solar power plants, commercial and industrial solar installations, and residential solar solutions.

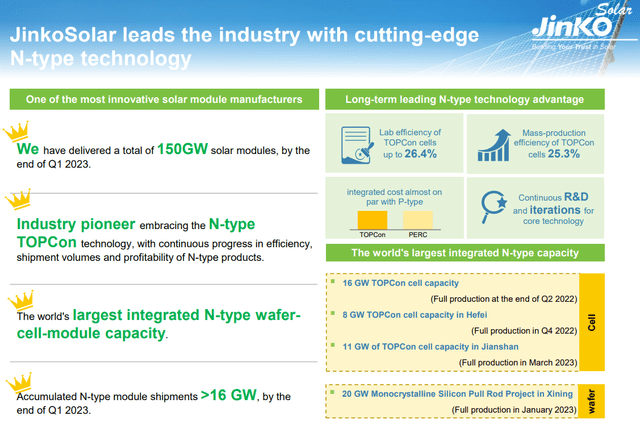

JinkoSolar is a leading global solar module manufacturer and renewable energy solutions provider. Established in 2006, the company has emerged as one of the largest and most innovative players in the solar industry. With a strong focus on research and development, JinkoSolar has achieved significant technological advancements and a solid reputation for delivering high-quality solar products.

JinkoSolar Presentation

JinkoSolar also operates a vertically integrated business model, encompassing the entire solar value chain (excluding polysilicon). The company designs, manufactures, and sells a range of solar PV modules, as well as other solar energy products and services. Wafers and solar cells that are not used in the solar module production are sold to peers in the industry.

The company has established a robust global presence, with a wide distribution network. The company has strategically positioned regional offices, warehouses, and subsidiaries in key solar markets worldwide, enabling it to effectively serve its customers.

JinkoSolar has achieved several milestones in solar module efficiency, including record-breaking conversion efficiencies for its products. By continuously investing in R&D, the company aims to stay at the forefront of technological advancements, improve energy generation efficiency, and drive down the levelized cost of energy for solar power.

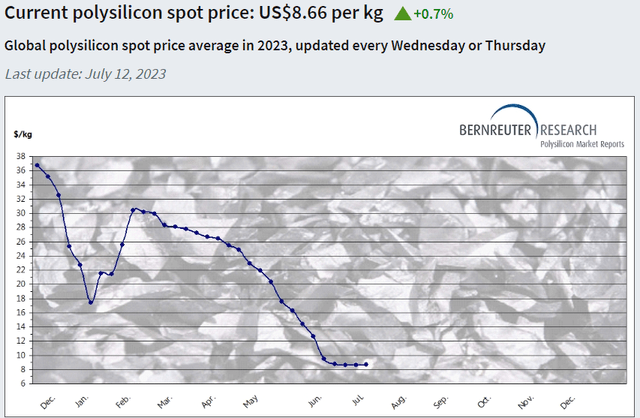

Polysilicon prices decline boosting margins for panel makers

Polysilicon production has been ramping up in the first half of the year, what lead to a steep decrease in polysilicon prices. Since Canadian Solar and Jinko Solar are both vertically integrated, excluding the production of polysilicon, means a decrease in polysilicon prices is a best case scenario for both. Lower polysilicon prices create lower raw material costs for the manufacturers of ingots, as a result downstream margins can increase.

Bernreuter Research

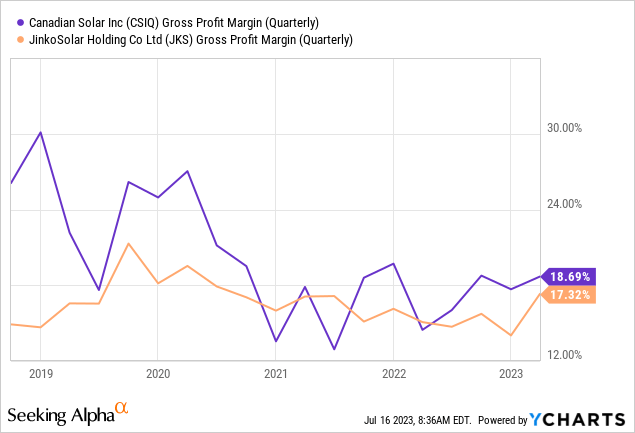

In Q1 2023, both Canadian Solar’s and JinkoSolar’s gross margins are steadily increasing. Either of the companies are still growing their revenue at a fast pace, so any increase in margins is substantial for the business.

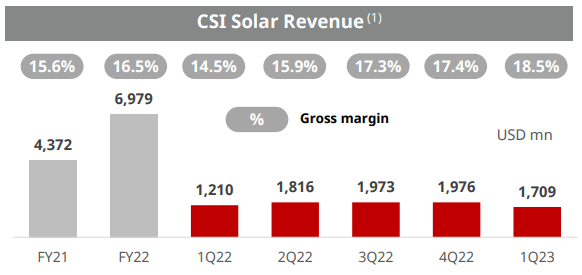

Canadian Solar increased module shipments by 66% year-over-year in Q1 and total revenue by 36% year-over-year. Higher margins resulted into a record high net income.

Canadian Solar Presentation

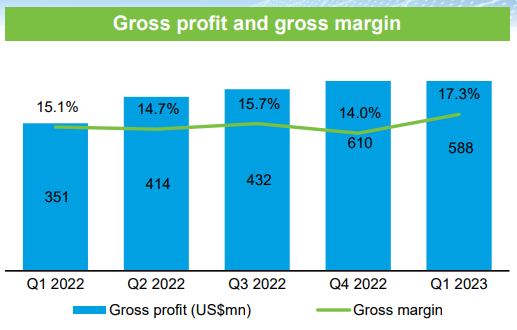

JinkoSolar increased shipments of module, cells, and wafers by 72% year-over-year and total revenue by 58% year-over-year. Higher margins caused adjusted net income to surge by 154% year-over-year.

JinkoSolar Presentation

Further, both companies are benefitting from the decrease in freight rates and lower manufacturing and logistics costs. This could accelerate margins even faster going into the next quarters. The effect of the lower polysilicon prices is not yet fully visualized in Q1 and will come to fruition in the following quarters.

Valuation

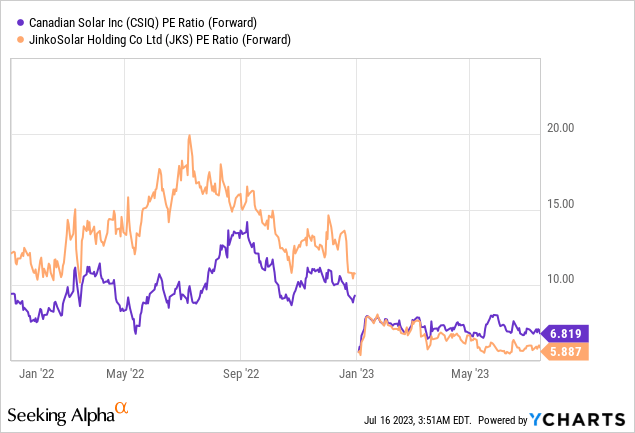

Turning to the valuation of both companies, we can see they have been tracking each other over the last year. Based on forward price to earnings, Canadian Solar is trading at 6.8x earnings and JinkoSolar at 5.8x earnings. Interestingly, JinkoSolar is trading at a slight discount to Canadian Solar, while the latter is growing slower.

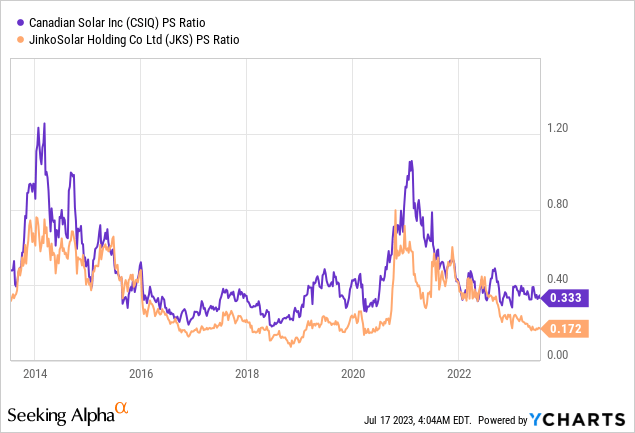

Canadian Solar and JinkoSolar have large revenues compared to their market cap. Historically, they are now trading close to an all-time low, with respectively a 0.33x price to sales and a 0.17x price to sales ratio. So any margin improvement can deliver a lot of profits for both businesses and make them even cheaper than they already are.

Polysilicon prices hit a low of $8.50/kg by the end of 2019, which benefitted solar module companies greatly. Profit margins soared to new highs and the same thing might happen again in the following quarters. This should boost both stocks higher at the already low valuation.

Balance Sheet

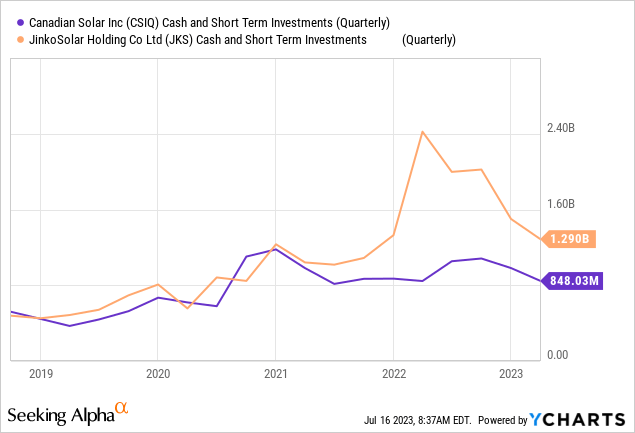

In addition, both are quite cash rich, with Canadian Solar having 35% of their market cap in cash and short term investments, and JinkoSolar having 58% of their market cap in cash and short term investments. Both companies have a current ratio just above 1. This is reasonable, as they have done a lot of investments to grow their capacity and help spread renewables into the world.

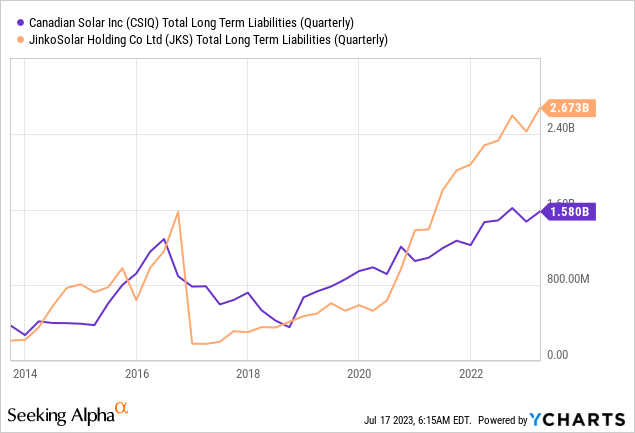

The solar module business with vertical integration is extremely capital heavy as can be seen by the incremental growth of long term liabilities. Investors should keep an eye on this and look for debt repayments with a possible windfall period in the coming quarters.

JinkoSolar announced in July 2022 the start of a repurchase program for up to $200 million or 8% of the shares outstanding. So far, I did not see any repurchases happen. The repurchase program is valid for 18 months and could limit downside risk in the stock or boost positive momentum.

Takeaway

Canadian Solar and JinkoSolar have proven their capabilities in building a fully integrated business model and serving the needs in the renewable energy space. Both businesses are poised to get more profitable over the coming quarters, which could boost the momentum in a positive direction for solar stocks. Next to margins, demand for solar modules is still high and is growing year over year. Canadian Solar and JinkoSolar look attractive to benefit from the further success of solar power.

Personally, JinkoSolar is more interesting than Canadian Solar in my eyes for a few reasons:

– Lower valuation

– Growing at a faster pace

– Slightly stronger balance sheet

– Share buybacks

Nonetheless, I have started a position in both stocks with a larger allocation in JinkoSolar. Consequently, I rate Canadian Solar a “BUY” and JinkoSolar a “Strong Buy”.

However, Investors should be cautious about the fact that both businesses are highly entrenched in China and have also been identified by the SEC under the Holding Foreign Companies Accountable Act. This means the company will be delisted by 2024, if they do not show the right auditing under the rules of the United States. The new annual report of 2022 of both should be under the rules of the PCAOB, as the PCAOB has secured complete access.