PM Images

At the risk of sounding like a used car salesman, there are some deals that are too good to pass up. Thank goodness that stocks routinely fall in and out of favor with the market, and it’s this irrational pricing that creates the best long-term opportunities. In the words of Warren Buffett, “I’d be sitting on the street with a tin can if stocks were priced appropriately.”

This brings me to the following 2 stocks, both of which are trading materially down from their 52-week highs, leading to impressive dividend yields that investors can write home about.

Both are in vastly different industries, thereby providing automatic diversification. In this article, I explore what makes each of them a compelling choice at their current price and yield, so let’s dive in.

Pick #1: AT&T

Most investors know AT&T (T) for its poor capital allocation over the past decade, from buying DirecTV at the peak to embarking in empire-building by acquiring Time Warner. More recently, its stock price has taken a beating, falling to a 52-week low, presumably on fresh worries over a WSJ piece on 2,000 lead cables of which Verizon (VZ) is also party to across the U.S.

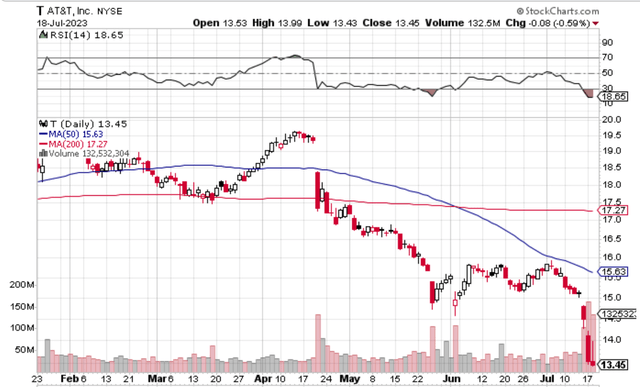

AT&T’s stock is now so cheap that it trades far below its 50 and 200-day moving averages of $15.63 and $17.27. It also carries an RSI score of 18.7, indicating that it’s well into oversold territory, as shown below.

StockCharts

While the lead-sheathed cabling may be a top-of-mind issue for investors, the issue may be blown out of proportion, as management stated that the company has previously tested lead-clad cables and continue to believe that they pose no public health risk. A recent report by Morningstar also confirms this belief, as noted below:

Both the CDC and NIH websites house research conducted in the 1990s around complaints to OSHA from wire strippers that reported elevated blood lead levels, with steps to ensure worker safety. The EPA has also studied cable sheathing materials, including through a partnership with the University of Massachusetts’ Toxic Use Reduction Institute. Nothing suggests that telecom firms failed to follow proper procedures to protect employees when dealing with these cables, which were last deployed in the 1960s.

Meanwhile, AT&T CFO Pascal Desroches recently spoke at a Bank of America (BAC) TMT Conference last month that it sees new phone customers in the range of 300K for Q2, below the 476K that Wall Street analysts are forecasting. This would be on top of the 400K postpaid net adds during Q1. He also reiterated that AT&T is on track to meet or exceed its goal of generating $16 billion in free cash flow this year, with FCF accelerating throughout the year due to “massive opportunities” to take additional costs out of the company’s operating structure.

For Q2, management expects to see between $3.5 to $4 billion in FCF, and hitting the $16 billion annual FCF target would mean that the $8.1 billion annual dividend would be well-covered by a 51% FCF payout ratio.

AT&T’s CFO also put to rest rumors that Amazon (AMZN) is looking into adding mobile service for Prime customers, noting that the wireless industry is not incentivized to work with Amazon. Moreover, AT&T expects to see 2 to 2.5 million fiber adds this year. This is a segment that’s gaining traction within the company, and AT&T’s bet on fiber could pay off in terms of higher profitability. This is considering the fact that fiber offers a high-speed data transmission rate while being low maintenance compared to copper wires, which AT&T expects to strategically decommission across its footprint in portions.

Risks to AT&T include its higher leverage than peers, with a debt-to-EBITDA ratio of 3.0x. However, management expects to be able to achieve 2.5x by 2025 through use of free cash flow to pay down debt. As such, management will need to balance capital spending on fiber with deleveraging of the balance sheet.

Nonetheless, I view this and other risks as being more than priced into the stock at the current price of $13.45 with an EV/EBITDA of 6.2, which as shown below, sits towards the low end of its 5-year range, and the lowest level since the spin-off of WarnerMedia earlier this year. Investors are also well-compensated by an 8.3% yield at the current price.

Seeking Alpha

Pick #2: Enbridge

Enbridge (ENB) is a high-quality energy midstream player with a network that spans across the U.S. And Canada, including a regulated gas transmission business in Canada. What makes ENB great I think for income investors is its steady contracted cash flows that are not correlated with commodity prices. This is reflected by the fact that 98% of ENB’s cash flows are cost-of-service/contracted, and 95% of its customers are investment grade, thereby reducing counterparty risk.

ENB’s contracts were also designed with risk scenarios in mind, as 80% of its EBITDA has inflation protections, while at the same time, less than 5% of its balance sheet debt is exposed to floating rates. ENB also has ample access to capital, with 25+ lender relationships and no U.S. regional bank exposure.

ENB demonstrated robust 8% YoY adjusted EBITDA growth during Q1, putting it well on track to meet or exceed full-year guidance of $5.45 distributable cash flow per share at the midpoint. This would equate to a 5% CAGR since 2021. This month’s signing of an offtake agreement for the remaining 30% of ENB’s Woodfibre LNG project for export to Asia would contribute to that.

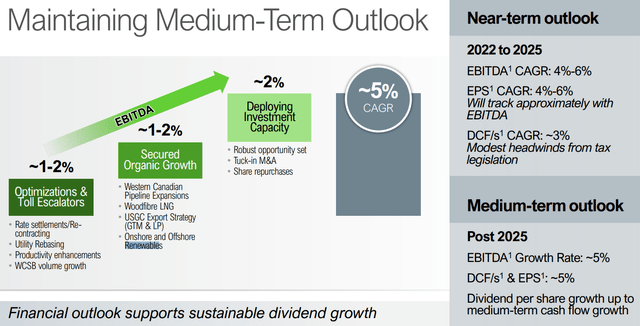

ENB is also well-recognized as being ahead of its peers when it comes to renewable energy transition, with both onshore and offshore assets. As shown below, its internal growth potential, combined with toll escalators and potential M&A/share repurchases make up the 5% EBITDA CAGR that management expects through 2025 and beyond.

Investor Presentation

Risks to ENB include litigation around its Line 5 pipeline, which runs through Wisconsin tribal land. However, a U.S. Judge has given ENB rights to keep operating it until June 2026, during which time ENB can relocate that section of the pipeline. ENB also plans to appeal the decision, and I would expect for that to be an overhang for the stock. Also, ENB carries more leverage than its peers with a debt to EBITDA ratio of 4.6x. This is offset by the quality of its cashflows and the utility-like nature of its business, and the ratings agencies assign ENB a BBB+ credit rating.

Meanwhile, ENB’s dividend is well-protected by a 1.77x DCF to dividend coverage ratio. The stock is also attractive priced at $36.63 with a price-to-cash flow ratio of 8.2x, which as shown below, sits near the low end of its 5-year trading range. Patient investors get paid an appealing 7.2% dividend yield while waiting for a potential turnaround in the share price.

Seeking Alpha

Investor Takeaway

Both AT&T and Enbridge are paying appealing dividend yields of 8% and 7%, respectively. Buying both today gives an investor automatic diversification in vastly different industries. While both have near-term issues that need to be worked out, that is what management is paid to do while they generate capital returns for shareholders. With plenty of risks already baked in, AT&T and Enbridge represent solid value at their current prices, offering the potential for material upside should their upcoming Q2 results exceed expectations.