Oh boy! Just another 23 cents and I can buy a share of Gear Energy.

Sally Anscombe/DigitalVision via Getty Images

Introduction

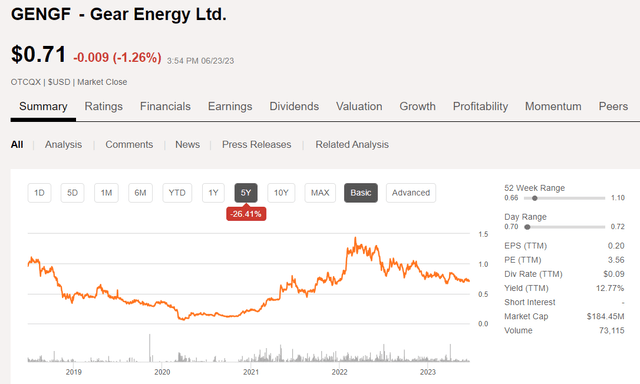

It’s high time we got around to Gear Energy, (OTCQX:GENGF) which I would suggest is in a buy zone, nearing support at $0.67 set in a double bottom between Mar 17th and 23rd. Intriguingly there was a big buy on April 3rd of ~1.5 mm shares, which suggests institutional activity, (what I like to call the smart money), that set off a rally to $.83 on the same day., and increased to $0.85 by the 11th This quickly faded given the horrific environment for everything oil a few weeks ago, but recently we have been seeing signs of life in the oil patch. That should be good news for Gear. Insiders have also been buying this year as well. All good signs.

Gear Energy price chart (Seeking Alpha)

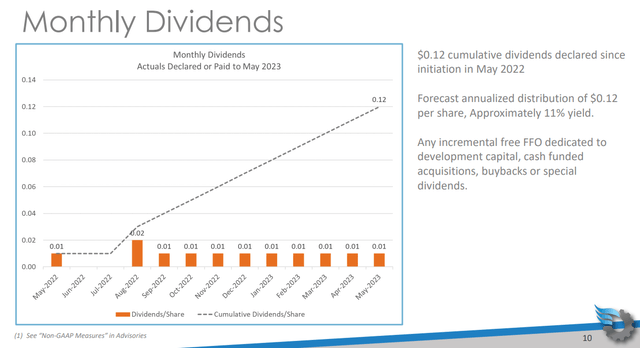

A topic of conversation in chat recently was the sustainability of the dividend, which is paid monthly and is currently yielding an eye-watering 12.77%. When you are looking to make ~12% on your money, you are understandably taking on some risk. But, just how risky is it? Costs have been increasing at a time when price realizations have suffered, and put a hit on cash flow.

On the risky side, they borrowed money to pay it in Q-1. On the plus side, they paid it. And, things might just be getting better, in terms of inflation related costs, and the WCS spread. Should Gear be considered a trading vehicle for hawk-eyed opportunists willing to follow the fast money, and jump in and out, or a reliable dividend payer that should be bought and held? Or both? Let’s see.

The thesis for Gear

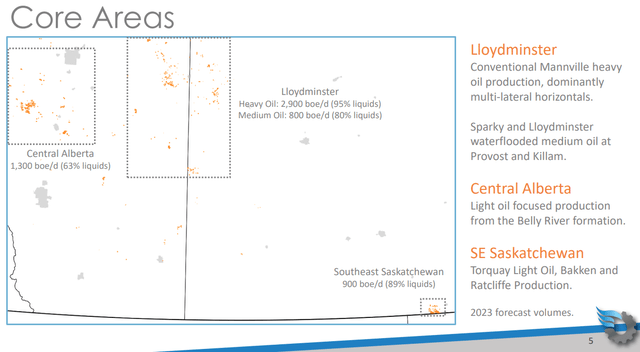

I have noted in past articles that waterflooding is the cheapest way to get oil out of the ground generally. Typically these operations involve conventional-highly porous rock and low cost, long-lived wells that don’t produce a lot, but produce it forever. (More or less.) Gear operates in some areas that are well known to us, as you can see below.

Gear Core areas (Gear Energy)

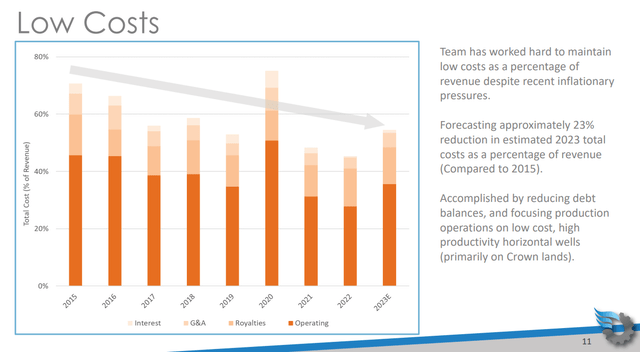

As the graphic below illustrates, everything but opex has been stable or declining since 2020. The cost inflation that has bedeviled everything seems to be abating somewhat as we crest the midpoint of the year

Gear costs profile (Gear Energy)

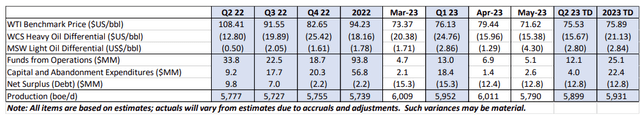

In Q-1, debt took a big bump from a mobilization to Wildmere heavy oil targets in the LLoydminster area and subsequent smaller drilling campaigns in Central Alberta, and covering their ~$2.6 mm monthly dividend obligation. As we have been discussing the thing that crushes Canadian drillers is the WCS differential when it blows out above $20 per barrel, as it did in Q-1. This metric seems to have improved markedly as noted in this June company update.

Gear cash sensitivity (Gear Energy)

2023 will be a year to maintain production in the 6K BOEPD range, and will require $58 mm to fund it and the ~$31 mm dividend.

They note their cash sensitivity as needing $70 WTI to deliver $62 mm in FFO for the year, with a $15 differential to WCS. This will still have them reaching in their pocket-debt, to cover lease, transportation, and SGA, so $70 doesn’t get them out of the woods.

Risks

As a microcap producer, Gear Energy runs afoul of the Law of Large numbers. With just 6K BOEPD of production there isn’t a big enough pot to distribute costs across. This makes the company a slave to higher oil prices than are now extant.

We opened discussing the dividend. It makes no sense to me that they are paying it, at least not until they retire some of that currently ~$12 mm in debt. They seem determined to pay it though as the slide below notes.

Gear Dividend plan (Gear Energy)

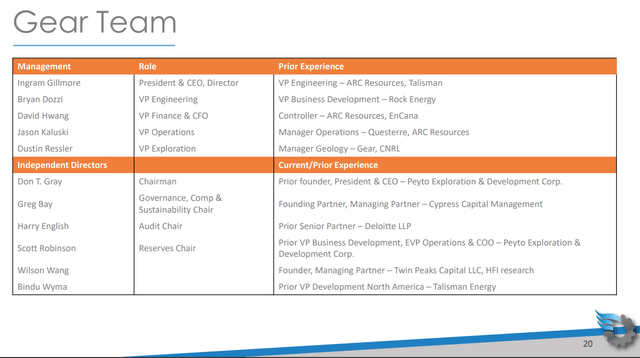

Your takeaway

Management matters. The Gear executive staff and Board are all seasoned oil company people, who know what they are doing. They have histories with companies we cover on a regular basis. ARC Resources, (OTCPK:AETUF), Enerplus (ERF), and Canadian Natural Resources (CNQ)-these guys aren’t rookies by any stretch of the imagination. That entitles them to the benefit of the doubt in my book. It is also intriguing that the top energy analyst blog on Seeking Alpha, HFI Research, actual name Wilson Wang, is a board member of the company. I would say that the management of the company provides the strongest case for taking a position and holding it for income.

Gear Team (Gear Energy)

The company trades currently at just 2.7X EV/EBITDA and $31K per flowing barrel. Not excessive by any stretch. It should also be noted the company has a $631 mm tax pool and shouldn’t be liable for cash taxes for a few years. With their low cost and steady production, combined with their 10+ year top tier drilling inventory, the company will see a sharp benefit when/if WTI prices rerate in a tightening market the second half of this year.

The company could also deliver an earnings surprise as it did in Q-4, 2022, beating estimates by $0.13 CAD per share. The analysts rate Gear as a hold with price targets that range from $1.00 CAD to $1.50 CAD. Q-2 earnings are forecast at $0.03 CAD.

Wrapping up, I think Gear is both-a trading vehicle and a (risky-given they did not generate free cash in Q-1) income play. I would have no problem entering the stock in the current range, with an idea of their beating by a few cents-which the lower WCS and reduced costs could deliver. Folks who were long when Q-1 results were released scored big time if they had a sell order in at a limit price on the day.

Conversely with the determination the company has shown to pay the dividend, I might just sit back and hold.

I don’t see a lot of risk at current prices. The company had already reduced the debt by $3 mm CAD from the Q-1 release to the update put out by the CEO on June, 21st. With their non-existent cash balance and stable share count, those funds could have only come from OCF. In my mind this also buttresses the notion of an earnings upside surprise in early July.

A possible catalyst for the company is the impending completion of the Transmountain Pipeline, and start of service in 2024. They noted in their slide presentation, they are currently being tagged with a slightly higher WCS discount thanks to reduced railing options, and increased diluent and transportation costs. If this abates, it should substantially reduce costs and send more money to the bottom line.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.