Zigmunds Dizgalvis

Investment Summary

FTC Solar (NASDAQ:FTCI) has niched itself in the solar market and focuses on manufacturing and distributing solar tracker systems. These come with associated software that helps enable customers to maximize the potential returns on making investments in solar panels.

FTCI did experience solid growth in terms of revenues which does seem to outpace the broader market right now. Revenue grew by 56% QoQ in Q1 2023. Seeing a similar momentum for the coming reports I think is right to assume. But unfortunately, FTCI is still very far off from reaching profitability. The gross margins are off 5%, up just 10 basis points QoQ. With a bleeding bottom line, this has resulted in significant share dilution over the last few years, which is to be expected with newer companies like FTCI. Only founded back in 2017 it has made strong steps nonetheless to grow its business. I find the investment case here to be a hold rating. A buy seems too risky right now until there is a proven business model that generates positive net income.

Solar Is Rising Quickly

The solar market is growing quickly and many new companies are entering, FTCI included. With only 6 years of operations, the company has experienced strong revenue momentum so far, the momentum that is even outpacing the broader solar market.

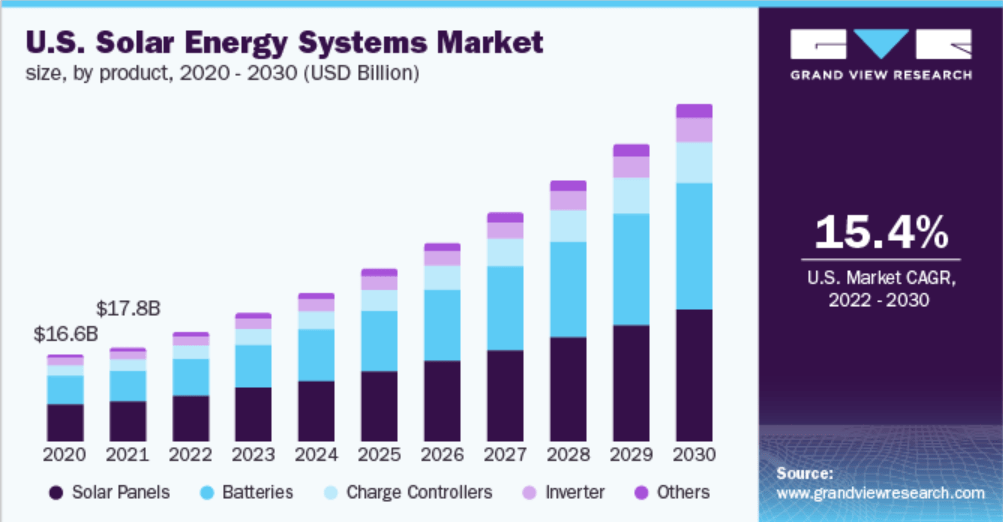

Solar Market Outlook (Grandviewresearch)

With operations primarily being in the US the company is right now a part of a market expected to grow 15.4% yearly between 2022 and 2030. This sort of momentum is setting the tone for a lot of excitement, but also a lot of competition. The market cap of FTCI is just under $400 million right now and has been fluctuating as the company saw revenues crash in 2022 compared to 2021. The share price is sitting about 50% lower than the 52-week high of $5.66. This shows the fact that FTCI is still a very speculative company, that could very well be outmaneuvered by larger corporations, or acquired as well.

In 2022 FTCI had a lot of issues maintaining revenues following the announcement that the then-current CEO Tony Etnyre is stepping down. Major shifts like this do create an imbalance it seems, certainly when the COO is also stepping down not long after the CEO’s departure. This is necessarily great news, but the Q1 report seems to have FTCI back on track for revenues. If they keep it up then 2023 could result in record-breaking revenues, which would be anything above $270 million. $40 million in Q1 and 56% QoQ makes this scenario realistic in my opinion.

Quarterly Result

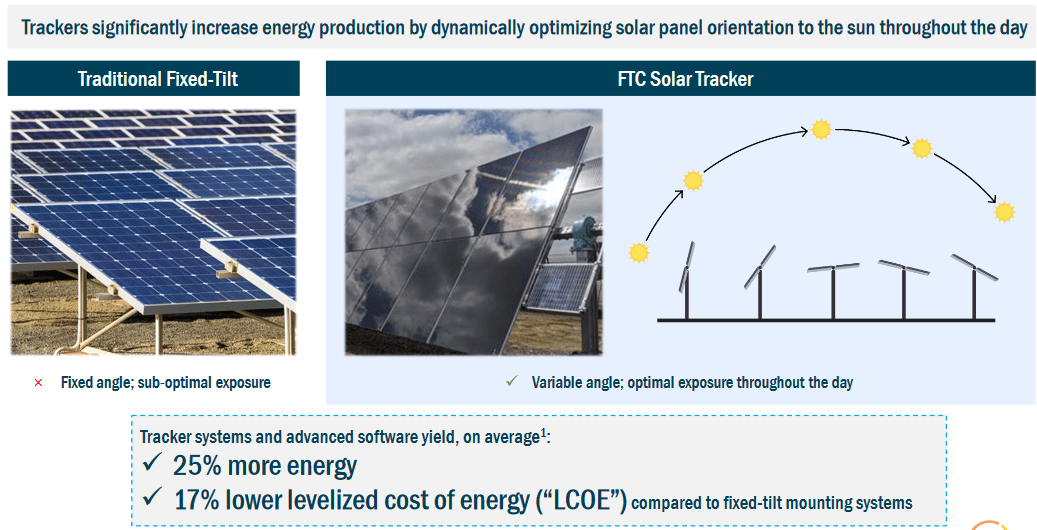

FTCI has niched itself quite well and offers customers software and tracker systems that aim to maximize the potential energy generated with solar panels. So far reaching over 140 customers and an installed base of 4.5 GW is being generated. The tracker that FTCI has is different from the traditional panels with a fixed position.

Company Product (Investor Presentation)

The company claims it helps generate up to 25% more energy which I can see as very appealing to larger operations or solar farms that wish to get the most out of the land they are using.

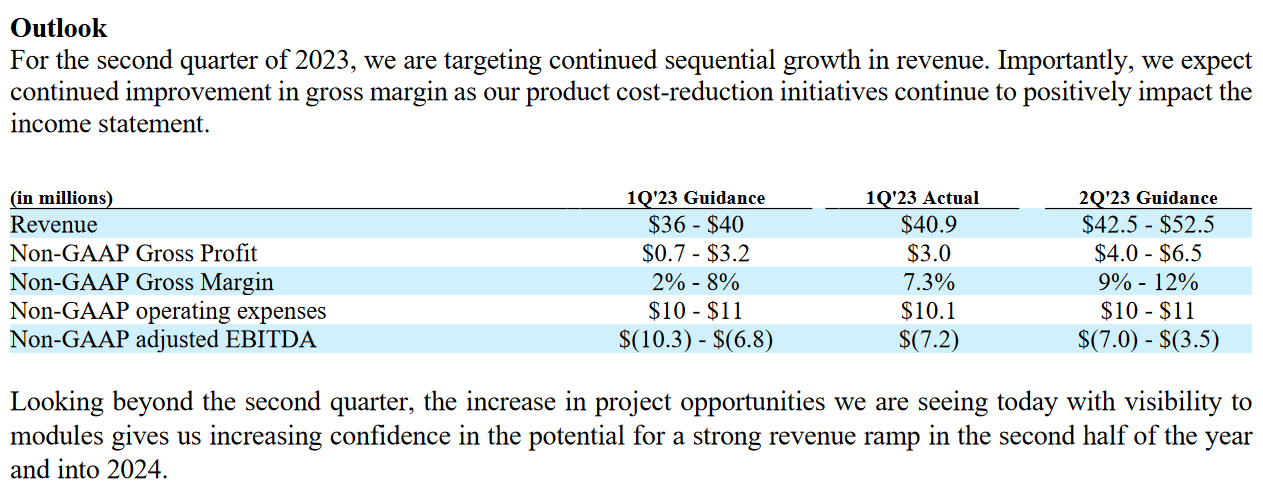

This seems to be catching on as well, as Q1 2023 showed revenues growing quickly, but the challenge arises to maintain the momentum and justify that FTCI can grow into a dominant position in the solar market. Despite revenues decreasing on a YoY basis, I think it’s important to view the gross margins instead. On a non-GAAP basis, the gross margins were 7.3%, this is a massive improvement from the negative 17.8% in Q1 2022.

2023 Outlook (Earnings Report Q1)

For Q2 it will be important to show that both revenues and gross margins can grow in unison. That will help create a better picture of what the future might hold for the company and when we might be able to expect them able to post a positive EPS. Anything under 9 – 12% in gross margins for Q2 I think will result in the share price diving deeper. It will ultimately translate to further dilution of shares to help fund operations. Total operating expenses for Q1 2023 were over $14 million. But I remain positive that they might improve upon this, as the largest portion comes from “general and administrative” rather than R&D expenses. It seems that the challenge is more about scaling the product they already have and securing more projects, after that revenues and strong net income will come.

Risks

When asses FTCI one cannot mention the fact shares are being diluted at a fast rate. Between 2020 and 2022 the shares have grown by nearly 40%. During that period the share price has fallen significantly too, which means that an investment into FTCI back then is deeply in the negatives.

But as margins expand the need to continue this practice should diminish in my opinion. The cash piston is currently sitting at $41 million, which only covers an additional 3 quarters of operating expenses until the cash runs out. Investors should therefore expect their positions to be further diluted and there might be more pain ahead until returns are visible. FTCI is a long-term opportunity but one that right now isn’t fitting into the buy case mold I have for companies, one that includes having a profitable bottom line and no large amount of dilution.

Valuation & Wrap Up

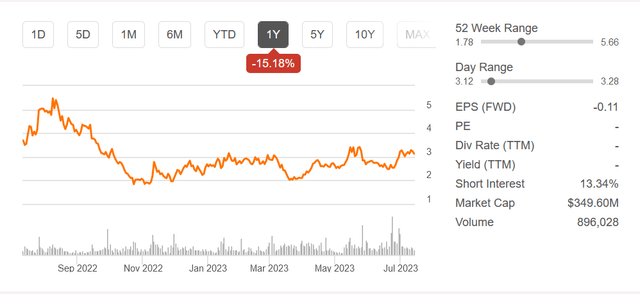

Measuring FTCI with a p/e metric would surface right now as the bottom line is negative. Rather, looking at p/s seems more appropriate, and right now it’s sitting at 2.83 using TTM numbers. As we have discussed 2022 was a difficult year as both the CEO and COO departures seem to have negatively impacted the revenues as the company was forced to adapt to the new circumstances.

Stock Chart (Seeking Alpha)

But on a FWD basis, the P/S is 1.32, which is just slightly below the sectors. Estimates suggest that by 2025 FTCI will have grown revenue to nearly $600 million if they are successful in their current expansions. That would put FTCI at a P/S of 0.59. A price that seems more reasonable to buy at. But as I remain skeptical until there is a positive EPS I am hesitant to make a buy case, and will rather rate them a hold.