Irina Gelwich

Dear readers/followers,

I’ve been writing on Enagas (OTCPK:ENGGF) a few times. Unlike many of my contributor peers, when it comes to energy investments, I tend towards the European, or “home” side of things for me, finding value in investments here. I’ve found value and profit by investing in companies like TotalEnergies (TTE), Eni S.p.A. (E), and Equinor (EQNR) – but also smaller businesses with a very strong appeal – such as Spanish Enagas.

In this article, I’m going to act on the relatively recent decline of the company, which dropped from a nice €18/share back down to below €16/share. If you recall my article, that €18 share came close to my original PT of €18.5/share that I wrote about for Enagas in my last article.

But this is not a problem for me. The company is a high-yielder, currently above 10% – what’s more, I consider that dividend to be well-covered, and the upside to be relevant.

Let me show you what I mean.

Plenty to like about a lower-valued Enagas.

Now, Enagas isn’t the troughing sort of table-pounding opportunity we might see everywhere, but I still consider it to be an attractive prospect. If you frequent the MSE or Madrid Stock Exchange, you’ll know a few companies here that might warrant your attention.

I’m also not recommending any overexposure to Enagas. Any company at a double-digit yield should be “handled with care” – but I certainly consider it to be worth more than €16/share.

Why is that?

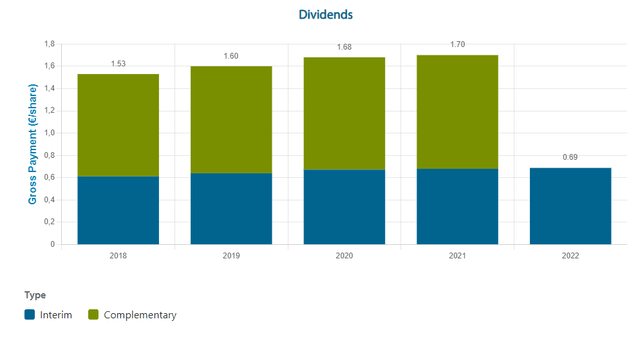

First off, let’s clarify the company’s recent-term dividend history, and why I believe this to be a decent income investment.

Enagas IR (Enagas IR)

The complementary dividend for 2022 is 1.032 euros on a per-share basis, paid about 10 days ago. So the company has mostly stuck to its high dividend level, meaning a yield of around 10.6% at this time.

Secondly, the real safety/appeal here apart from the income, is the underlying safety of this company – namely what it owns.

Enagas operations are part of the backbone of many of its operating areas, including areas in Mexico, Chile, Peru, Albania, Greece, Italy, and even the USA. It has taken stakes in Regasification across the world. Its legacy infrastructure covers all of Spain and goes into Portugal as well as France. These are extremely critical infrastructure assets because of the nature and expansion of the gas networks in these countries, and they are networks that aren’t going anywhere. What’s more, they are being fed almost not at all from the east, which is where central and eastern-European gas networks have seen difficulties after the Russian invasion of Ukraine.

The backbone of Enagas operations is 11,000 km of pipelines and 3 massive storage facilities while servicing several international connection points. Enagas also owns LNG terminals across the World, and has a 16% equity stake in the TAP – or the Trans-Adriatic pipeline, one of the primary feeds for Southern-European gas. This connects Turkey and Italy through Greece and Albania and is one of the most integral parts of the southern gas corridor, which supplies nat gas from the Caspian Sea.

The company’s international partners should give you confidence – because it’s businesses like Blackstone (BX), and it even has stakes in US pipeline companies, namely Tallgrass. The company is currently in the midst of asset rotation and divestments/investments to set Enagas up for nearer-term outperformance, including the sale of its Gasoducto de Morelos stake for just south of $100M, with a €40 net capital gain. This is part of the higher-level rotation plan currently undertaken until 2023.

So what is the company buying?

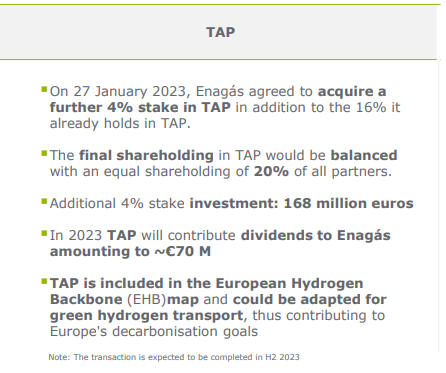

The TAP

Enagas IR (Enagas IR)

I believe Enagas to be an absolutely solid strategic player in this field, recognizing the potential of owning more and more of an asset like TAP – and you can see the dividends this will net the company, and how this may increase going forward as the stake grows.

Aside from this, the company is also buying native gas assets, such as the Reganosa lines and a regasification plant, allowing for synergistic operations. For Enagas, it’s all about owning the backbone, access, and supply of LNG and nat gas in Europe, and the way it manages its facilities and networks is confidence-inspiring.

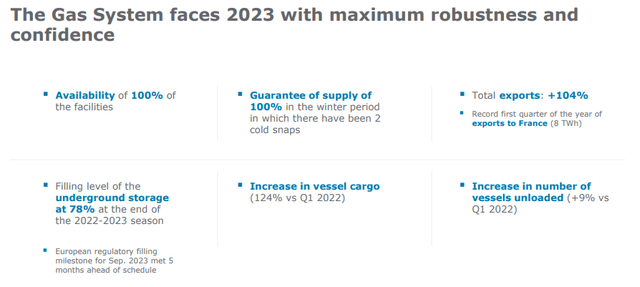

Enagas IR (Enagas IR)

Meanwhile, the actual demand for Natgas is actually down compared to 4Q22. This is primarily due to lower industrial consumption as a result of the war, not any downward major trend for gas. The company seeks to consolidate and be a major player in a gas network that might well serve as an entry point for large parts of all of Europe. Most of the company’s operations are already LNG-based, with 72% of its Natgas supply deriving from LNG, not standard NG.

The latest quarterly results put the company on track to meet the annual estimated results, not to mention the 2022-2030 strategic plan targets as well. The decline in overall net profit was fully expected. Debt evolution and leverage is on track as well – though I will say that this represents perhaps one of the larger issues and risks I see with the company. It’s going in with both eyes open into rising interest, and its leverage is already above 50% to long-term capital. Yes, it has a sound financial structure and has no issues with cash. It also has almost no maturities until 2025 and is BBB-rated. But it’s also at a 4.9x net debt/EBITDA with a financial cost of debt that’s up to 2.7% from 1.8% – and that rise is in less than 6 months.

I consider it likely that debt servicing costs will increase somewhat – though the company’s fixed-rate debt is around 80% of the total. It also has over €3.3B worth of liquidity available – so issues are actually unlikely here, as I see it.

Here are the company’s 2023 targets, along with its overall dividend policy – which I consider to be sound at this time.

Enagas IR (Enagas IR)

I consider it unlikely for 2Q22 to fundamentally change my positive thesis on Enagas here. If there is some fundamental change, I’ll likely edit this article somewhat – so keep an eye on it if you’re interested in this business.

The “right” investor for this company is an income-oriented investor that understands the risk profile of an investment in energy. Because of commodity exposure, Enagas does have the potential to JoJo up and down at times – but the backbone and assets of this company are going nowhere as long as European gas demand persists. Because much of Southern Europe is gasified, as opposed to say Scandinavia (less than 10 gas companies exist, and only 2 cities have gas networks, no gas networks are being built, expanded or done anything more than “maintained”) where I would never invest in a gas company, this makes the company very appealing to me.

The thing is still this.

Do not expect this company to massively bump its dividend. And by that I mean, on a 10-year forward basis. I don’t expect the company to cut it – as is expected by S&P Global here starting in a few years. More specifically, I don’t expect them to cut it unless something with one of their primary JVs goes horribly wrong or unless some macro consideration massively changes.

Enagas should be viewed as the equivalent of an NG bond with a 10% yield – for whatever appeal that may be for you.

Let’s look at valuation.

Enagas Valuation – The case is tricky but positive

Because the overall view of lower commodity prices, the expectation for Enagas is actually a lower earnings level going forward. This makes valuing the company tricky, because on a forward basis, including the increase in debt servicing costs, we’re forecasting it on a declining basis. That’s always tricky. Then there is valuing these types of companies overall, where seemingly any valuation method lacks the ability to capture the up and down potentials in the business.

What can be said is the following.

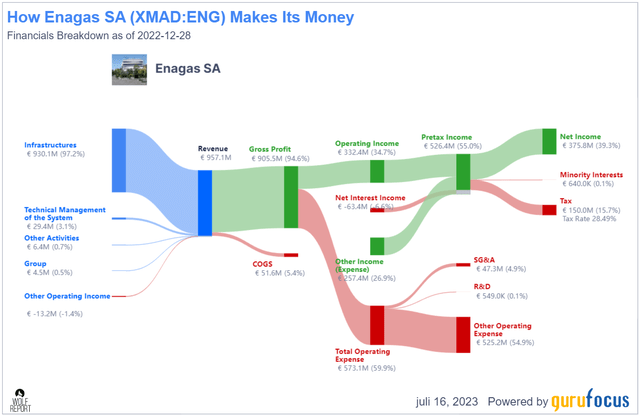

Enagas has one of the best operating and net margin numbers in the entire sector, that sector being regulated utilities. It “plays” alongside businesses like Snam SpA, APA Group, Atmos (ATO), Tokyo Gas Corp, and similar businesses, many of which have almost 10x the market cap that Enagas has. And it’s in the 90th percentile in both operating and net margin, with its 2022A net margin of 38-39% being in the 96th percentile in the sector (Source: GuruFocus).

Enagas revenue/net (GuruFocus)

The company lacks what I would view as any sort of massively-worrying fundamental signs. Revenue is fine, especially considering the current asset rotation. Cash and debt haven’t spiked or lowered worryingly. The increasing cost of dividends means, as I said, that you shouldn’t expect a raise here – but at current levels, those are covered.

Shareholder equity has actually gone up as a % of total assets. The absolute closest peer to Enagas is Italian Snam (OTCPK:SNMRY), which is a direct 1:1 comparison for operating the Italian gas transmission network, but I view Snam as having a far more unfavorable risk consideration, which is why my Italian focus is Enel here. The tricky part in comparing it is that Enagas operates zero percentage of electricity/generation networks. This greatly clouds multiple comparisons. As I see it, we should discount Enagas on the bases of this.

As I’ve been through previously – the primary risks I see here are actually political, owing to Spain, which I would view as one of the most unstable political areas in Europe next only to Greece and Italy, and what sort of margins the company can squeeze from its legacy network in a rising interest rate environment where there may – or may not – come pressure from the political side to consider pricing.

The last time I wrote on Enagas, we were talking about a share price of around €18.5. Today, we’re down to around €17/share. My own price target is unchanged, even in this article. Despite rising costs, I still view €18.5/share as a cheap price to own what is, clearly to me, one of the best legacy gas networks in all of Europe. Enagas now trades far below an NTM 15x P/E level, and I continue to view Enagas as likely to reach that 15x P/E fair level.

Still, it’s essentially a nat gas-bond type of investment – at least if you ignore the common shareholder risk. Look at the yield and the reversal potential. My reasoning for owning it is similar to telcos like Telenor (OTCPK:TELNY), which I recently wrote about. Inflation protection for my capital thanks to a good yield, coupled with good potential for reversal.

Thesis

-

Enagas is a classic bond-type play. You’re essentially paying the Spanish government your investment, and relying on legacy and a few growth assets to deliver a ~8-10% interest rate. You get inflation protection, and you get some safety.

- I would consider such a play to be a very attractive deal in the right environment and at the right price. The right environment is today. The right price, that’s something I believe we also have.

- For that reason, I’m going with a “BUY” here, and I’m investing more of my money in Enagas at a yield of 10.6% with a PT of €18.5

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I still believe this company fulfills every valuation criteria I have – for that reason, this is a “BUY”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.