Justin Paget/DigitalVision via Getty Images

Investment Thesis

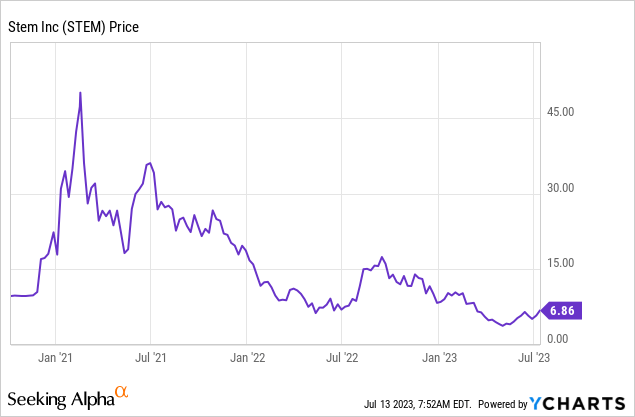

Stem (NYSE:STEM) is down over 80% from its all-time high in 2021, as the market sentiment on growth stocks has softened in the past two years amid rising interest rates. Unlike the share price, the company’s fundamentals remain intact. Its products are benefiting from favorable market tailwinds and demand continues to be strong. The traction is reflected in the latest earnings, with strong growth across the top line. After the significant decline, the company’s risk-to-reward ratio looks pretty compelling in my opinion.

Why Stem?

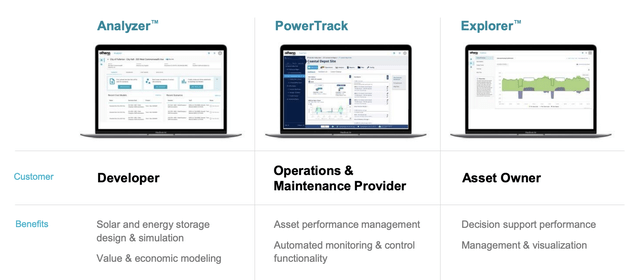

Stem is a California-based company that specializes in clean energy solutions. It bundles its own proprietary software with outsourced energy hardware and sells them to a wide range of customers. It also provides related services such as network integration, testing, and monitoring. The company’s current customers include multiple blue-chip companies such as Apple (AAPL), Home Depot (HD), and Walmart (WMT). Athena, its software solution, is the key and the hardware is basically a medium for the company to onboard the software and services.

Stem’s Athena is a software platform that allows customers to manage and optimize the value of their clean energy assets for battery energy storage, EV charging, grid power, and more. It has over 80 patents and is already adopted by over 500,000 devices. The platform can be used for predictive analytics, data acquisition, incident detection, and more. It also learns continuously through data to provide optimal performance. Athena is seeing strong demand as it generates great ROI (return on investment) for customers. By leveraging the platform, customers can easily improve operational efficiency and save energy costs.

John Carrington, CEO, on self-learning capabilities

Our AI-driven software benefits from a growing data advantage as well. We run approximately 8,000 simulations per month, which means Athena gets smarter and more accurate with real-world assets that drives better results for our customers.

STEM

Clean Energy Tailwinds

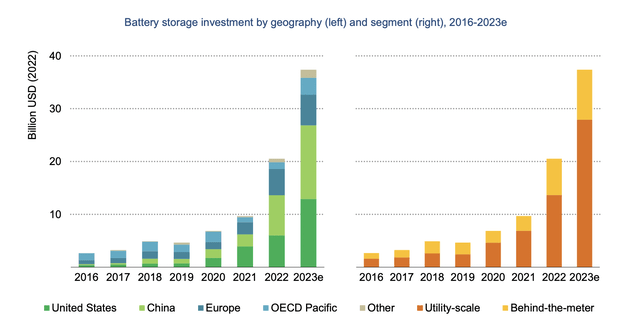

Thanks to the push for net-zero emissions, global investments and the adoption of clean energy have been rising exponentially in the past few years, and the trend is expected to continue moving forward. Battery storage is one of the fastest-growing segments of clean energy, as it plays a critical role in the whole ecosystem. According to the IEA (International Energy Agency), global investment in battery storage doubled from roughly $10 billion in 2021 and $20 billion in 2022 and is expected to grow another 85% this year, as shown in the chart below. Investment in other segments such as solar PV (photovoltaic) is also expected to expand by another 10% this year.

The rising investments should present significant tailwinds for Stem, as the growing amount of clean energy assets also increases the need for management software. For instance, Sysco (SYY) integrated Athena into its EV hub earlier in April this year. I believe the ongoing energy transition should be a major demand drive for the company moving forward.

IEA

Strong Revenue Growth

Stem’s latest earnings were very solid in my opinion. Although the bottom line weakened slightly, the top line continues to see exponential growth. The company revenue of $67.4 million, up 63% YoY (year over year) compared to $41.1 million. Bookings, an indicator of future revenue, grew 141% YoY from $151 million to $364 million, as demand for clean energy remains strong, particularly around storage and solar. On the software side, CARR (contracted annual recurring revenue) increased 39% from $51.5 million to $71.5 million.

The bottom line was weak amid the rising costs of hardware, which increased 121.4% from $28.8 million to $54.9 million. R&D (research and development) expenses were also up 50.6% from $8.9 million to $13.4 million. This resulted in the adjusted EBITDA declining 7% YoY from $(12.8) million to $(13.7) million. The adjusted EBITDA margin improved from (20.3)% to (31.1)%. The net loss widened from $(22.5) million to $(44.8) million, largely due to higher spending and the change in income taxes.

On a more positive note, the company reaffirmed its FY23 guidance. It is expected to report a revenue growth of 65% and generate a positive adjusted EBITDA in the second half, as operating leverage improves.

John Carrington, CEO, on guidance for FY23

Bottom line, we are reaffirming our full-year guidance, which includes revenue growth of 65% at the midpoint and reaching EBITDA positive in the second half of this year. Accelerating services growth will be the key factor that helps us achieve our goals this year, and for years to come.

Valuation and Risk

It is a bit hard to evaluate the company on traditional metrics as it is still not profitable yet. However, we can make some assumptions as the company is expected to be adjusted EBITDA profitable in the second half of this year. If it can generate a mere 5% adjusted EBITDA margin (or $41 million) next year, this will give them an EV/ FY24 EBITDA ratio of 32x (I am using the current FY24 revenue estimate of $828 million). This is very reasonable considering its strong growth rates and prospects. For instance, other clean energy companies such as Enphase Energy (ENPH) are currently trading at an EV/EBITDA ratio of 40x while growing revenue at a slower pace.

This is also where the risk comes in as well. I am not concerned about the top line, as the bookings and backlog should provide strong stability. However, whether the company can achieve its bottom-line target remains highly uncertain. As most of its hardware is outsourced from OEMs, costs can fluctuate a lot between quarters. The declining inflation should be positive, but profitability is definitely something to pay attention to moving forward.

Investors Takeaway

Overall, I believe Stem is a compelling small-cap bet on clean energy. The company is uniquely positioned in the industry with its software platform, and the energy transition trend should be a major growth driver for demand moving forward. As shown in the latest earnings, the company’s demand remains robust, with bookings up by triple digits. Considering the company’s strong prospects and growth, I believe it should have ample upside potential.