baona

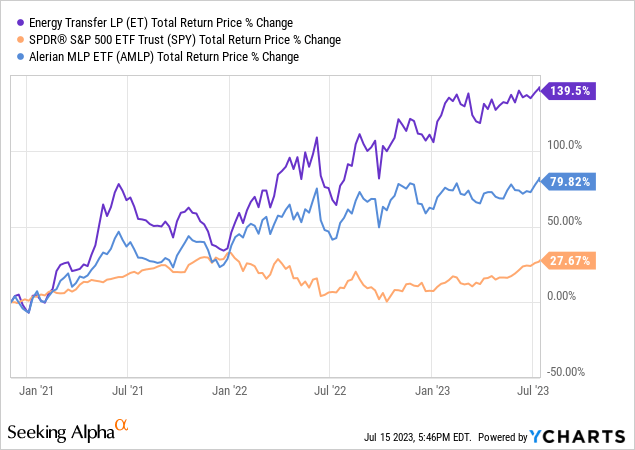

Energy Transfer (NYSE:ET) has been one of our biggest winners at High Yield Investor. We loaded up on units on December 3rd 2020 when our portfolio first launched. Since then ET units have crushed the S&P 500 (SPY) as well as the broader midstream sector (AMLP):

That said, we believe that ET units remain an ideal core holding for my high yielding total return focused portfolio. As a result, it is my largest holding at the moment. Here are three reasons why:

#1. ET Stock Offers A Well-Covered Near 10% Yield

First and foremost, ET’s distribution remains mouthwateringly attractive at 9.7% on an NTM basis. Given that my portfolio pursues a dual – and not mutually exclusive – mandate of generate lucrative and sustainable passive income as well as total returns that outperform the broader high yield sector, ET’s 9.7% yield serves me very well.

Given that the stock market appears to be quite overvalued at the moment, ET is likely to perform on par with or even better than the broader market from a total return perspective if all it does it pay out its distribution while maintaining its current earnings power and valuation multiple.

I am quite confident that it can do so because its 2023 expected DCF coverage ratio is 1.97x, not only making the distribution very well covered by cash flows, but also giving management plenty of retained cash flow with which to fortify ET’s earnings stream and potentially even grow it moving forward. Moreover, its current NTM EV/EBITDA multiple of 7.65x is well below its 10-year average of 10.89x, putting the odds in favor of long-term valuation multiple expansion rather than multiple contraction.

#2. ET Stock Is Nearing A Low Risk Rating

On top of its attractive and sustainable distribution, ET is moving closer to achieving a low risk rating in my view. Its past is a bit checkered, with trigger happy management making aggressive (some would even call them reckless) growth investments, getting embroiled in political and regulatory controversies, and ultimately having to slash its distribution in half in 2020 due to the COVID-19 lockdowns and oil price war between Saudi Arabia and Russia. However, this image of ET being one of the more aggressive and risky midstream businesses has changed over the past nearly three years.

Ever since halving the distribution, ET has paid down debt hand-over-fist, rapidly deleveraging the balance sheet while continuing to diversify and strengthen its asset portfolio. As a result, it now expects to remain near the low end of its target leverage range, is generating as stable and well-diversified cash flows as ever from one of the industry’s most impressive asset portfolios, and is even looking at a credit rating upgrade.

Given that all three major credit ratings agencies have it on positive outlook, it appears to be just a matter of time before ET earns a credit rating upgrade to BBB or equivalent. When combined with its significant and consistent free cash flow generation and well-laddered debt maturity schedule that make it nearly immune to current interest rate and capital market conditions, ET has all the makings of a low risk stock. Once it earns that credit rating, I will likely upgrade its risk rating from average to low, giving me additional confidence in holding such a large position of ET.

#3. ET Stock Remains Meaningfully Undervalued

Last, but not least, ET remains meaningfully undervalued. In addition to the aforementioned attractive distribution yield and its discounted valuation relative to its own history, ET also enjoys solid long-term growth potential and a deep discounted valuation relative to peers that we believe further strengthen its case for delivering outperformance moving forward.

First of all, ET management has announced that it plans to grow the distribution at a 3-5% CAGR moving forward, combining with the current distribution yield alone to provide a clear path to low to mid teens annualized total returns moving forward. This growth profile appears to be very achievable if not conservative given that ET is retaining so much cash flow, has plenty of growth investment opportunities, and has such a large coverage ratio of its current distribution which gives it plenty of room to grow the distribution even without further DCF per unit growth. With an average to low risk profile, this alone makes ET a compelling buy, especially for income-focused investors. The total return looks even more attractive when considering that ET’s distribution is typically tax deferred for people in my tax situation (please do your own tax due diligence as this is not tax advice).

On top of that, ET’s 7.65x EV/EBITDA multiple is well below that of peers. For example, Enterprise Products Partners (EPD) has an EV/EBITDA of 9.29x, MPLX (MPLX) has an EV/EBITDA of 9.35x, and Plains All American Pipeline (PAA) has an EV/EBITDA of 9.15x. While EPD is clearly higher quality than ET, a strong case can be made for ET being a superior investment to MPLX and certainly PAA. Yet, it trades at a deep discount to both of them. As a result, we think that ET will likely see significant continued outperformance not only of the broader market, but also relative to its investment grade midstream peers as its valuation multiple expands to become more in line with industry norms.

Investor Takeaway

ET has been a great investment for me, combining attractive current income, a blistering pace of distribution growth, and huge total returns. That said, I believe that it still has plenty of room to run thanks to its very attractive and well-covered distribution, improving risk profile, and deep discount relative to its own history as well as its peers. As a result, it is my largest position right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.