robwilson39

Dear readers/followers,

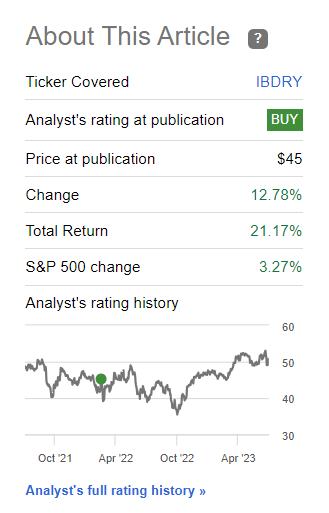

I am talking about Iberdrola (OTCPK:IBDSF), one of the two utilities that I bought more of back when I established my significant position in Italian Enel (OTCPK:ENLAY). The two utilities, together with Fortum (OTCPK:FOJCF), have been my “bets” on this market for some time, and all of them have showcased truly excellent overall returns. Iberdrola may not show as massively high RoR as Enel, but any 21%+ RoR in a time when the S&P has delivered no more than 3.2% is worth highlighting and very clearly noting.

Seeking Alpha Iberdrola (Seeking Alpha)

So because it was some time ago that I wrote on Iberdrola, this article will serve both as a reminder and an update on this great utility business – and to show you why the company may be a tad too expensive here (though most utilities have become more expensive overall).

Since I bought the company, it’s gone into a bit of a premium – this is not a positive for this company. What is positive is that the company has one of the best earnings growth profiles for any utility in Europe, and is one of the more stable ones I know.

Iberdrola – Plenty of fundamentals to like in the company

So, to say that Iberdrola has done well would be an understatement. 1Q23 is the latest report we have, and it saw EBITDA growth of 38% to over €4B, including an overall complete recovery of the retail deficit in the UK area. The company’s EU performance was solid despite lower wholesale prices, and Iberdrola has gone ahead and invested significantly in networks as well as its renewables ambition.

OCF is up to €3B for the quarter, with FFO/indebtedness at around 25.3% – not a worrying increase in the least.

In terms of high-level structure, the company has agreed to divest 60% of its business in Mexico for $6B, adding more to its balance sheet and scaling up its co-investment vehicles in conjunction with Norges Bank.

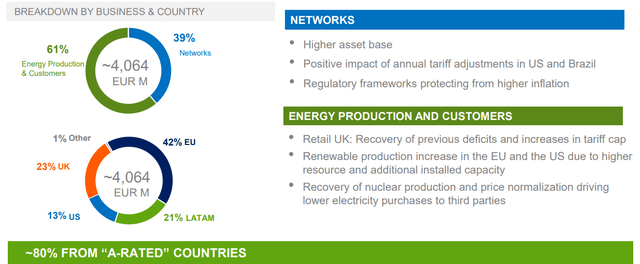

The company retains a very attractive mix overall.

Iberdrola IR (Iberdrola IR)

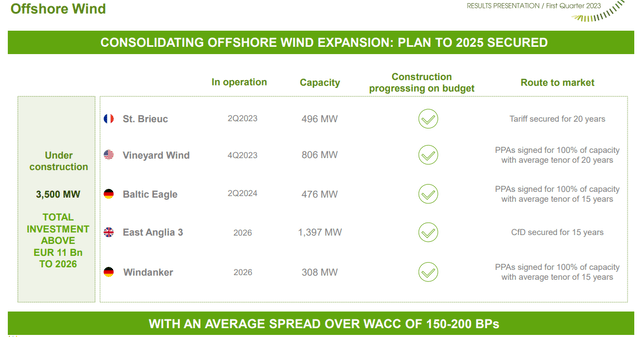

And Iberdrola is really ratcheting up its investments, with over €10B gross investments over the past 12 months, including a 45/46 split into renewables/networks with 9% in corporate/other energy production investments. This has improved the company’s overall diversification, and seen an increase in its asset base of 11%. The renewables investment resulted in an increase in renewables – offshore wind saw 30% of the amount, and 60% of the planned capacity additions are already either in operation or under construction.

Iberdrola is moving at breakneck speed to reach its ambitions, and shareholders are the primary beneficiaries of this development, with an RoR that is more than 8x’es the S&P500 in the same timeframe. In short, a great overall investment.

Some examples of offshore wind here…

Iberdrola IR (Iberdrola IR)

…and plenty of other great additions as well. The company’s fundamentals are solid. It debt is 87% fixed if excluding Brazil, with an average debt maturity of 6 years, and the company has cash and liquidity on hand to handle 22 months of operations without income. So plenty of safety here, and lots of reasons for the solid credit rating of BBB+. When I invest in utilities, I mostly look at those sorts of plays.

The company is also doing a partnership in Brazil, with a co-investment for 8 operating transmission assets, with the net result of removing debt by almost 3B BRL and the ability to access additional transmission auctions.

Overall, the company is giving us the picture that the energy crisis that’s been ongoing has been normalizing – and this is not just EU, but globally. The company’s gas storage levels are at record highs and could handle a winter with ease. Winters have been soft. Energy prices are starting to normalize, and the obvious source of the crisis to the company was the rising gas price due to fossil fuel dependence, which is now on a slow downward slope not only in the EU but elsewhere as well.

The quarter of 1Q23 was an outlier and a non-recurring quarter of positives though. The 40%+ YoY increase in net profit will not be repeated, as it was a result of substantially higher sales, much lower energy purchases at lower prices, a 2022 retail deficit now covered, and positive gas management effects – again, non-recurring.

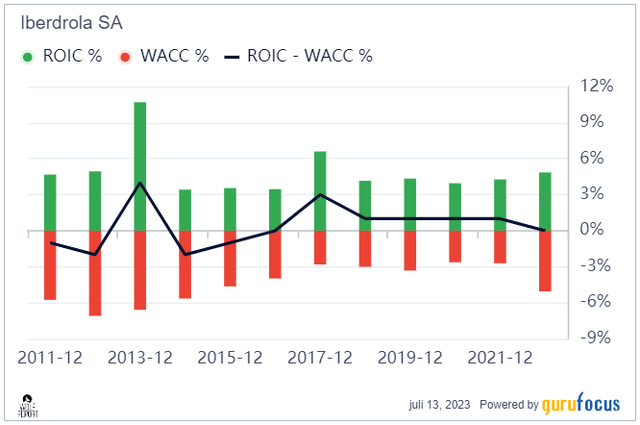

Still, Iberdrola is a massively qualitative business. It has an impressive 39% gross margin, with a 16.5% operating margin and an 8-9% net margin range. It’s not the best in the industry, but it’s up there. What’s more, the company has one of the best ROIC profiles in the entire industry and has remained profitable for years during which other companies saw issues with profitability. Its revenues are solid.

Iberdrola revenue/net (GuruFocus)

The company retains a more diversified mix than many of its peers, including Enel and E.ON (OTCPK:EONGY). The company is 36/26/23/15 for Brazil/Spain/US/UK in terms of networks, and a-near 50% Spain exposure in Energy production. It brings with it the stability of EU geographies, with the growth potential of South American markets.

In terms of shareholder rewards, Iberdrola takes a market-similar approach and targets 65-75% of earnings. Visibility for dividends is very high, as the company has followed E.ON and Enel and set a dividend floor at a €0.44 dividend. This dividend is set to grow, going forward.

On a high level, what should appeal to you about Iberdrola is still the mix of defensiveness in a good Utility well ahead of the curve in terms of its plans for renewables and new segments, but also the potential growth as it expects a 6% EBITDA CAGR until 2025. Because, as we’ve seen, this will also translate into more attractive dividends. The company has many similarities to Enel, and it together with Enel is a confirmation that just because a business is part of the PIGS geography, does not make it a bad investment. I have been investing in PIGS for several years, and not a single investment has ended up negative so far.

After all, it’s all about knowledge – knowing when to enter, when to exit, and when to buy more/start trimming. Valuation is key, same is true for Iberdrola. Despite the COVID-19 impacts over the past few years, Iberdrola has confirmed its 2025 targets, and the clarity towards these is looking better and better. While there will most certainly be some volatility to the company related to FX, interest rates, power price volatility, and the like, this company’s long-term targets seem to stand very clearly.

I said in my earlier article that Iberdrola is less risky than Enel. This is technically still true, but I will say at this juncture that Iberdrola has a lot more valuation risk than we’re seeing with Enel. Enel is still cheap – Iberdrola isn’t cheap by any metric. It’s not quite at a point where I would start rotating and trimming the gains in this investment, but it’s certainly getting there.

Let’s look at the valuation for this company, and why I would say that you shouldn’t invest in the company here.

Iberdrola – The valuation showcases a conservative upside of 8% to a 15x P/E

The company sometimes trades at a premium of 16-17x P/E – but I won’t forecast it at this level. If it rises that high – great. if it doesn’t, and I’ve bought at 15x P/E, that’s where my upside lies. With that in mind, the last time the company was attractive was in the fall of 2022. Since then, mostly a share price that I would consider to be too high.

Enel is the more attractive company to invest in – and I’ll be one of the first here in terms of analysts that it’s time to go “HOLD” on the company.

On a peer basis, Iberdrola is now no longer undervalued to the overall average. The company’s public comps are those of Enel, including Enel, ENGIE (OTCPK:ENGIY), VERBUND (OTCPK:OEZVY), RWE (OTCPK:RWEOY), and others – and many of those are now significantly cheaper than Iberdrola. Enel, for instance, trades at no more than 10.9x, and even today yields almost 6.5%. It’s a great, BBB+ rated utility – solid upside even on a 12-13x P/E.

The lowest that any analyst from S&P Global is targeting Iberdrola is a €9.4/share. The current relevant range is €9.4-13.80 with an average of €12.2. However, despite this lofty average implying nearly a 10% upside only 4 out of 24 analysts are at “BUY”. The vast majority, 14 of the analysts are either at “HOLD” or “SELL”. So their conviction when it comes to the targets for this company is very low, or at least that is how I see it.

I actually, obviously, agree with this sentiment – I just find it interesting that these analysts aren’t changing their recommendations, as their PTs change.

So, Iberdrola has been a great investment. Outperforming the S&P500 as I have is no small feat and I like what I see here. However, it’s not time yet to rotate or divest this holding. I believe it’s stable here, and might even go up. More importantly, not expensive/high enough to justify it.

At the same time, several other utilities are far more interesting here – higher yield, similar fundamentals, and better upside at a lower P/E.

That makes the company a relatively easy Thesis as I am updating this – and I confess to being surprised at being the first contributor for a long time to assign the company a conservative rating of “HOLD” – which I am doing here.

I say “HOLD” because I believe the annual conservative upside to be capped at around 7-8%, and 7-8% isn’t enough for me to invest in.

For that reason alone, here is my thesis on the company.

Thesis

- Iberdrola is a superb utility stock with plenty of upside at the right valuation. However, the keyword here is “right valuation”. At too high a valuation, the upside for these investments can go down to 4-7% conservatively even with a 3-4%+ yield, and this is where Iberdrola currently trades.

- I forecast the company a 15x P/E, and at that level, the company has no more than 7-8% normalized, which is not good enough for my investment targets, even with this company.

- I say that you should “BUY” Iberdrola at a price no higher than €10/share. That’s a normalized P/E 15x at the current 2023-2025E level.

- For that reason, it’s “HOLD” here.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

For these reasons, I consider the company to only be a “HOLD” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.