Fly View Productions

A Quick Take On Turbo Energy, S.A.

Turbo Energy, S.A. (TURB) has filed to raise $5.5 million in an IPO of its American Depositary Shares representing underlying ordinary shares, according to an SEC F-1 registration statement.

The firm sells products for solar installations in residential projects in Spain and various European countries.

Turbo Energy, S.A. is growing revenue but operates a low-margin business and is seeking a high valuation multiple.

I’m Neutral [Hold] on the IPO.

Turbo Energy Overview

Valencia, Spain-based Turbo Energy, S.A. was founded to sell a variety of solar energy generation electronics and related software to control and analyze the installation.

Management is headed by founder, Chairman and CEO Mr. Enrique Selva Bellvis, who has been with the firm since its inception and also is the Vice President of the Valencian Association of Energy Sector Companies.

The company’s primary offerings include the following:

-

Lithium-ion batteries

-

Inverters

-

Sunbox – all-in-one system

-

Software.

As of December 31, 2022, Turbo Energy has booked fair market value investment of $2.9 million in equity investment from parent firm Umbrella Solar Investment S.A. (100% shareholder).

Turbo Energy – Customer Acquisition

The firm sells its products through local distributors, and installation is handled by local installers.

The company aims to expand internationally and to offer its Sunbox to premium customers with premium services.

Selling & Administrative expenses as a percentage of total revenue have been stable as revenues have grown, as the figures below indicate:

|

Selling & Administrative |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Year Ended Dec. 31, 2022 |

6.6% |

|

Year Ended Dec. 31, 2021 |

6.6% |

(Source – SEC.)

The Selling & Administrative efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling & Administrative expense, was 6.8x in the most recent reporting period, as shown in the table below:

|

Selling & Administrative |

Efficiency Rate |

|

Period |

Multiple |

|

Year Ended Dec. 31, 2022 |

6.8 |

(Source – SEC.)

Turbo Energy’s Market & Competition

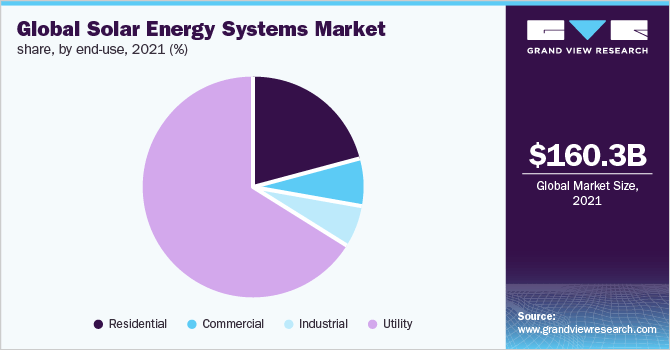

According to a 2022 market research report by Grand View Research, the global market for solar energy systems was an estimated $160 billion in 2021 and is forecasted to reach $595 billion by 2030.

This represents a forecast robust CAGR (Compound Annual Growth Rate) of 15.7% from 2022 to 2030.

The main drivers for this expected growth are increasing demand for sustainable sources of energy and lower prices for components making for improved economics for customers.

Also, the chart below shows the market share breakdown for various segments of the global solar energy systems market, with the residential sector being the second largest, as of 2021:

Global Solar Energy Systems Market (Grand View Research)

Major competitive or other industry participants include the following:

-

Zelfstroom

-

SMA Solar Technology

-

ESTG

-

Luxor Solar

-

Others.

Turbo Energy, S.A. Financial Performance

The company’s recent financial results can be summarized as follows:

-

Quickly growing topline revenue

-

Sharply higher gross profit and growing gross margin

-

Increasing but low operating profit

-

A swing to cash used in operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Year Ended Dec. 31, 2022 |

$ 34,263,544 |

81.6% |

|

Year Ended Dec. 31, 2021 |

$ 18,870,083 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Year Ended Dec. 31, 2022 |

$ 5,063,629 |

104.1% |

|

Year Ended Dec. 31, 2021 |

$ 2,480,804 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

% Variance vs. Prior |

|

Year Ended Dec. 31, 2022 |

14.78% |

12.4% |

|

Year Ended Dec. 31, 2021 |

13.15% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Year Ended Dec. 31, 2022 |

$ 1,837,880 |

5.4% |

|

Year Ended Dec. 31, 2021 |

$ 525,245 |

2.8% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Year Ended Dec. 31, 2022 |

$ 1,131,436 |

3.3% |

|

Year Ended Dec. 31, 2021 |

$ 293,944 |

1.6% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Year Ended Dec. 31, 2022 |

$ (6,211,736) |

|

|

Year Ended Dec. 31, 2021 |

$ 78,764 |

|

(Source – SEC.)

As of December 31, 2022, Turbo Energy had $552,844 in cash and $12.5 million in total liabilities.

Free cash flow during the twelve months ending December 31, 2022, was negative ($6.6 million).

Turbo Energy, S.A.’s IPO Details

Turbo Energy intends to raise $5.5 million in gross proceeds from an IPO of its American Depositary Shares representing underlying ordinary shares, offering one million ADSs at a proposed midpoint price of $5.50 per ADS.

Each ADS represents two ordinary shares of underlying stock.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Immediately post-IPO, the company will be a “controlled company” according to Nasdaq’s rules, with the CEO owning 78% of the outstanding shares of TURB.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $142 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 3.99%. A figure under 10% is generally considered a “low float” stock which can be subject to significant price volatility.

As a foreign private issuer, the company can choose to take advantage of reduced, delayed or exempted financial and senior officer disclosure requirements versus those that domestic U.S. firms are required to follow.

Management says the firm qualifies as an “emerging growth company” as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements; prospective shareholders would receive less information for the IPO and, in the future, as a publicly-held company within the requirements of the Act.

Management says it will use the net proceeds from the IPO as follows:

10% of the net proceeds (approximately US$0.5 million) for wages, payroll taxes;

40% of the net proceeds (approximately US$2.0 million) for software and hardware development;

25% of the net proceeds (approximately US$1.25 million) for developing new markets; and

25% of the net proceeds (approximately US$1.25 million) for general working capital and other operating expenses.

(Source – SEC.)

The firm apparently has an equity compensation incentive plan (Turbo Energy, S.A. 2023 Equity Incentive Plan) but has not provided any information about it.

The shareholder sale lockup period is twelve months following the IPO, or double the more typical period of six months.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm owes a yet-to-be-determined amount for infringing on the SOLARBOX trademark.

The sole listed bookrunner of the IPO is Boustead Securities.

Valuation Metrics For Turbo Energy

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$137,735,675 |

|

Enterprise Value |

$142,293,644 |

|

Price / Sales |

4.02 |

|

EV / Revenue |

4.15 |

|

EV / EBITDA |

77.42 |

|

Earnings Per Share |

$0.04 |

|

Operating Margin |

5.36% |

|

Net Margin |

3.30% |

|

Float To Outstanding Shares Ratio |

3.99% |

|

Proposed IPO Midpoint Price per Share |

$5.50 |

|

Net Free Cash Flow |

-$6,646,298 |

|

Free Cash Flow Yield Per Share |

-4.83% |

|

Debt / EBITDA Multiple |

4.85 |

|

CapEx Ratio |

-14.29 |

|

Revenue Growth Rate |

81.58% |

(Source – SEC.)

Commentary About Turbo Energy’s IPO

TURB is seeking a small U.S. IPO to fund its general corporate working capital requirements.

The company’s financials have produced sharply growing topline revenue, higher gross profit and growing gross margin, increasing operating profit and a swing to cash used in operations.

Free cash flow for the twelve months ending December 31, 2022, was negative ($6.6 million).

Selling & Administrative expenses as a percentage of total revenue have been stable as revenue has increased; its Selling & Administrative efficiency multiple was 6.8x in the most recent reporting period.

The firm currently plans to pay dividends, if any, based on various usual considerations as determined by the Board of Directors.

Turbo Energy’s recent capital spending history indicates it has spent little on capital expenditures despite producing negative operating cash flow.

The market opportunity for providing solar systems to residential customers in Europe is large and likely to grow substantially in the coming years.

Boustead Securities is the sole underwriter. The ten IPOs led by the firm over the last 12-month period have generated an average return of negative (56.1%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Business risks to the company’s outlook as a public company include its relatively low net margin environment and the commodity nature of its products.

Management is seeking to differentiate itself from competitors by offering its all-in-one Sunbox system to premium customers.

As for valuation expectations, management is asking investors to pay an Enterprise Value/EBITDA multiple of approximately 77.4x.

While the company is growing revenue quickly, it is seeking a very high EV/EBITDA multiple on what is a very low-margin business.

For investors to buy the IPO, they would have to believe in management’s ability to grow a higher-margin business in a short period of time.

I’m not convinced the company can accomplish it, so my outlook on the Turbo Energy, S.A. IPO is Neutral [Hold], although day traders may be attracted to its low nominal price and low float.

Expected IPO Pricing Date: To be announced.