bloodua

Tsakos Energy Navigation Limited (NYSE:TNP), referred to as TEN, is an oil and liquid gas tanker company which recently posted record revenue for Q1-2023. Disruptions from the Ukrainian War has caused a high demand for TEN’s energy shipping services. TEN claims in its recent Q1-2023 report that it has already signed charters for $1.6 billion in future revenue. The company pays out a dividend twice per year and has announced the possibility of a third payment for 2023. TEN’s stock price has been on an uptrend for the last twelve months, gaining over 100%. The company’s stock price hit an all-time high last March near $24.50 per share. I rate the stock as a buy. If the stock price returns to $24, one may realize a 30% gain. The company has long-term investment potential.

Operations

TEN has a fleet of sixty-seven double-hull tankers. The company has a mix of crude tankers, product tankers, and LNG carriers. It transports raw oil, processed oil, and liquid gas. The company has shuttle tankers under construction, which will carry crude oil from ocean rigs to refineries on the shore. The company reports 96.4% of its fleet was utilized during Q1-2023.

The company operates through charters or shipping contracts. Accordingly, TEN already knows its revenue potential over the next few quarters. The company reported that it has secured $1.6 billion in charters. TEN included in its Q1-2023 report that the Ukrainian War has caused trade imbalances in energy transport. The company credits the current market conditions to its record revenue.

Q1-2023 Financial Results

TEN reported $261 million in gross revenues representing a 74% increase YoY. The company showed a net income of $177 million, which includes $81 million from sales of eight vessels. TEN reported an EPS of $5.69 and positive EBITDA of $236 million. The company has $475.6 million in fee cash flow.

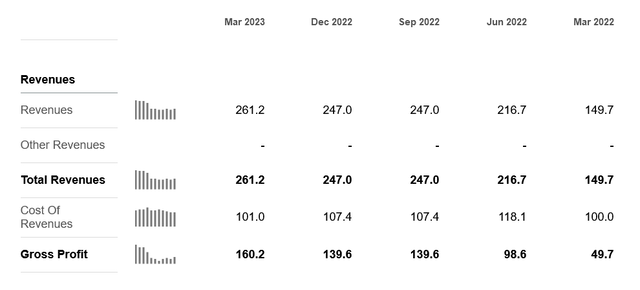

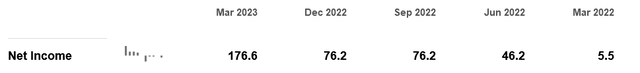

The following data from Seeking Alpha shows TEN’s revenue, profit, operating income, and net income for the last five quarters. The numbers are in $US millions of dollars.

Financial Data (Seeking Alpha)

Financial Data (Seeking Alpha)

Financial Data (Seeking Alpha)

TEN reported record revenue for Q1-2023 (Mar 2023). Revenue has increased each quarter as well as net income. The company will report Q2-2023 performance in September. Market consensus estimates $206 million in revenue and an EPS of $2.66. The number are in-line with Q2-2022 performance.

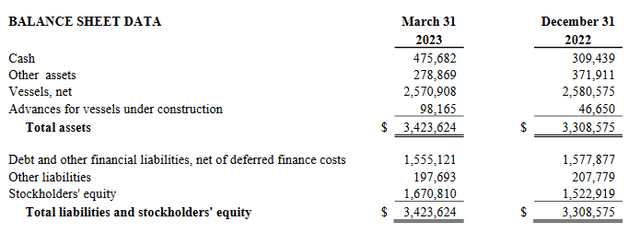

The following balance sheet is taken from the company’s Q1-2023 press release. Amounts are in $US thousands of dollars.

Financial Data (TNP Press Release)

TEN used cash from operations to pay down bank debt and is preparing to redeem a set of its preferred shares. The company plans a $.60 dividend to be paid out in two installments over 2023. The dividend has increased 140% compared to 2022. The company even has plans for a third dividend payment for 2023. TEN will make an announcement, if the third payment is to be paid. The company writes about this surprise dividend in its Q1-2023 press release:

In addition, and subject to ongoing strong freight market conditions, TEN’s Board of Directors could consider an extra dividend to common shareholders for payment within 2023. The amount will be determined at that point and details of the relevant payment will be communicated through a separate public announcement.

The company’s liabilities come in the form of bank debt which is not necessarily to be feared. TEN relies on bank financing to purchase new vessels and these transactions are made long in advance. The company attempts to offset the ongoing debt by selling older vessels. Overall, TEN’s assets outweigh its liabilities. The company enjoys free cash flow and a rich cash environment. The company reported $1.6 billion in charters, which ensures future operations.

Stock Price Uptrend

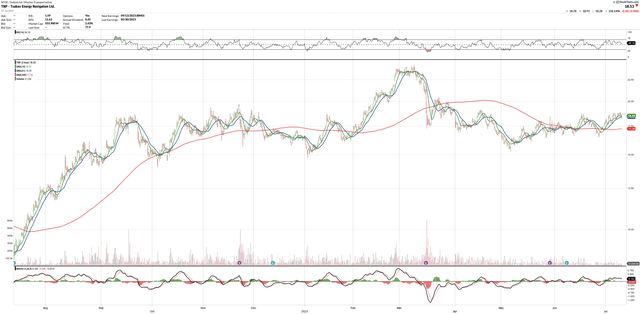

Stock Chart (Stock Charts)

1-year price performance chart from www.StockCharts.com

TEN’s stock price has increased 115% over the last twelve months. The company’s stock price hit an all-time high of $24.36 per share back in March. The price has stabilized in the $15 to $20 price channel since last September. The company’s financial performance is less dependent on the price of oil and more dependent on demand of oil transport and oil consumption. If the company’s stock price mirrors its financial performance, the uptrend should continue. In general, energy tanker stocks have been up over the last twelve months. One might compare Teekay Corp (TK), which has increased 159% over the last year and is currently trading at its all-time high.

Investment Strategy and Risk

Some catalysts are possible, which will rally TEN’s stock price. Strong earnings reports over the next few quarters will do the trick. If the company announces a third dividend, it will likely cause an uptrend. If the stock returns to its all-time high of $24, then a 30% gain may be realized. One might take a long-hold position to profit from the uptrend. There are also further possibilities, if one plays covered calls or a call/put strategy.

TEN’s financial situation is well fit for future performance. The risk in playing its stock comes from the trends and sentiment of the greater stock market. Although the indexes have entered bull territory, there is more volatility to come. Core inflation was seen to cool off for July, but more rate hikes have not been ruled out. I believe that the demand for oil will remain high until the winter season. The war in Ukraine does not have any end in sight. The market conditions for TEN should remain the same.

Conclusion

Energy tanker stocks are experiencing an uptrend because of disruptions due to the Ukrainian War. TEN has recently reported record revenue and increasing free cash flow. The company’s stock price has been on the uptrend for the last twelve months, increasing 115%. TEN has rewarded its investors with an increase in dividend and has hinted at a third payment in 2023. The company’s financial performance is strong and mirrors its stock price trend. I rate the company as a buy and recommend that investors take a long-hold position, while watching the company’s financial performance.