FreezeFrames

Liberty Energy (NYSE:LBRT) is one of those companies that is looking toward the future in the right manner. When everyone is only looking at electric choices, Liberty is out there with a combination of tech that can reduce emissions and improve efficiency. I think it’s obvious to everyone that a near-future of entirely electric everything is virtually impossible – yet so many companies keep pushing for it.

Liberty has some great industry leading pieces of technology in the pipeline that should position them very well, even in a climate of declining oil and gas production if energy prices happen to crater. We’ll go through that, and I’ll give you some personal insight into the company and what I saw when I was in frac.

Company Overview

Liberty Energy, Inc. is a leading oilfield services company in the upstream sector. The firm offers an incredibly innovative suite of completion services and technologies to onshore oil and natural gas exploration and production companies. Liberty focuses on offering safe, efficient, and high-quality hydraulic fracturing, engineering, and wireline services.

DigiFrac And DigiPrime Products

Investors should be incredibly excited about the future direction of Liberty Energy, even if just based on the technologies the company has created alone.

The digiFrac division has created the first ever frac pump with advanced AI technology built in. The AI monitors and adjusts automatically for the unique and dynamic challenges of any frac job.

The AI and remote control capabilities reduce onsite footprint and the product is a clean and incredibly efficient solution for pressure pumping operations. Additionally, the fleet is a fully electric frac system powered by the grid and/or onsite natural gas generators.

Not only has the company developed the first frac pump with AI, but Liberty Energy has also created the world’s first natural gas hybrid frac pump – powered by a Rolls Royce engine. This natural gas frac pump has fewer mechanical efficiency losses than a conventional electric fleet and 29% less fuel consumption than competing technologies.

This meets the performance demand that electric fleets don’t often deliver while still meeting the efficiency and emissions goals for producers. This forward thinking hybridization of technologies is one of the things that can propel Liberty forward.

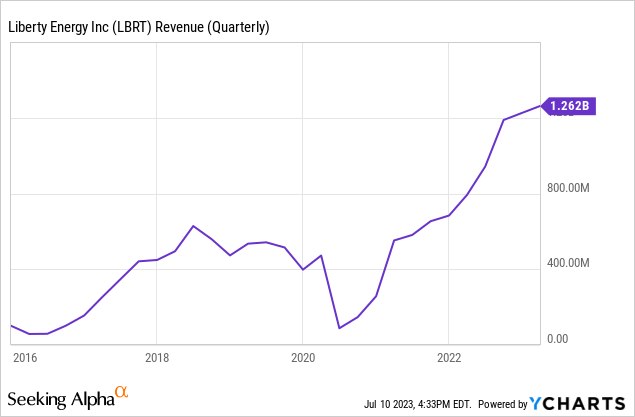

Revenue

I worked at Halliburton (HAL) until 2015. I was in frac, and did almost every job on a frac crew. I dragged hoses and pipe through the mud, all the way to running computers in the van with the customer. I remember when Liberty first came on the scene here in Colorado. They came out of the gate at higher payrates for the same positions at Halliburton and started poaching employees with a quickness.

One of the things I kept hearing from friends that had left to work at Liberty was how much better they were. Much less “corporate” feeling, better pay, better conditions. At Halliburton you were just a number: mine was 506344. Friends said it was much more personal at Liberty.

So looking at this revenue curve, I’m not surprised in the slightest. Whenever you hear about a company that just attracts employees because of that kind of working environment, typically that’s associated with an “up and to the right” revenue curve. Well that, and impeccable customer service.

Clearly they’ve been doing things right by attracting quality employees, and expanding their business across multiple basins. Now they’re developing industry leading tech like the digiFrac fleets.

Debt

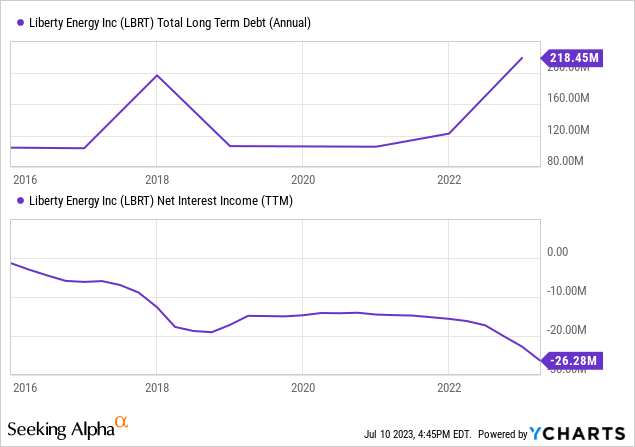

Debt? What debt?

Okay, they have a little. But very little. With only $218M in long term debt as of the last 10-Q and a paltry $26M in interest payments (giving them an interest coverage ratio of 27x vs. TTM EBIT), they have no problem servicing it and have plenty of runway to take more.

That can really benefit them in a few ways. Number one, if we see oil prices decline further and they get into another slow period then a decline in revenue won’t suffer a high overhead of debt payments. Number two, they’ve got plenty of runway to fund the construction of new advanced technology that performs better and more efficiently.

The flip side to the low debt is that they raised money in the equity markets by diluting the share float. You’ll see that next.

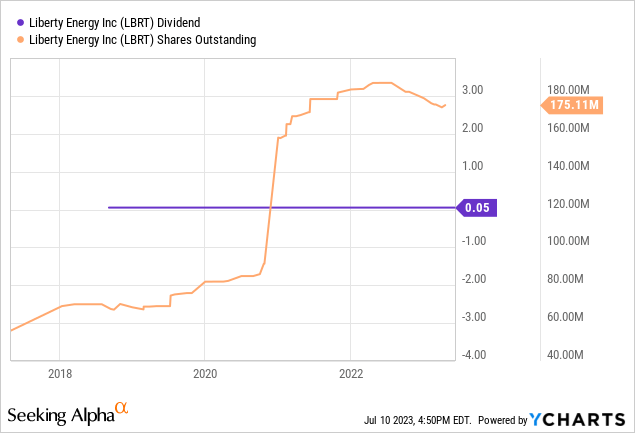

Return Of Value To Shareholders

Over the last few years, as they’ve found their footing as a publicly traded company, they’ve started to look to return some value to shareholders. As of their last conference call:

Since the reinstatement of our return of capital program in July of 2022, we have now returned $218 million to shareholders through cash dividends and the retirement of 7.1% of outstanding shares, while continuing to invest in long-term growth and expanding our competitive advantage. We now have $300 million remaining in our authorization and we are focused on the opportunistic execution of our buyback strategy.

The speed at which we execute on our buyback authorization will be driven by the dislocation in our stock price, relative to what we believe the intrinsic value of the stock to be. Three years on from the onset of the global pandemic and severe crash in energy markets, discipline is now widespread in the energy sector.

Personally I would rather see a higher dividend here instead of share buybacks. They’ve already diluted the float, just pay back your investors in cash. It could be however that they plan to increase dividends in the future and are reducing the float to lower that cost to the company.

Valuation

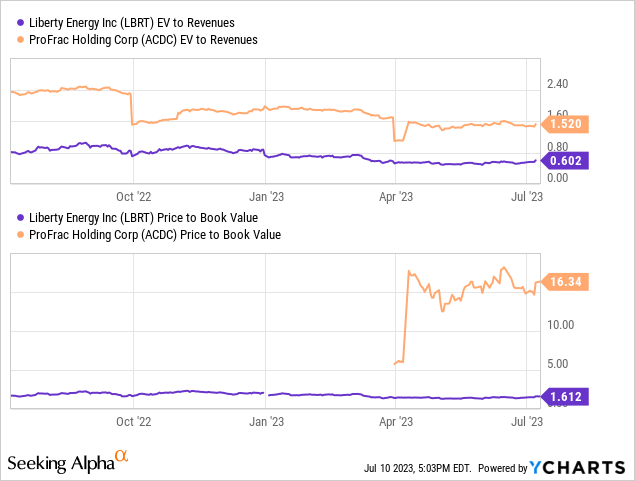

Recently I reviewed ProFrac (ACDC) so I’m somewhat familiar with their offerings. Like Liberty, they’ve been focusing on alternative technologies for their frac fleets. Unlike Liberty though, they’ve focused more strongly on electric fleets, whereas Liberty is also looking at natural gas.

Compared to ACDC, Liberty handedly beats it in both of these valuation metrics. And I believe the difference in valuation isn’t really warranted. Yes, ProFrac has the advantage of additional revenue streams from their proppant concerns, but I think Liberty holds the advantage in technology and market share.

Overall Liberty looks like a great buy compared to ProFrac, and in the oilfield services sector in general.

Latest Earnings Call Analysis

The latest earnings call was chalked full of positive financial reports and record year-over-year revenues, a great sign for investors. This comes even in the wake of declining drilling activity year-over-year, down 72 rigs in July of 2023 (according to the Baker Hughes Rig Count Report) from the same time last year.

The company went on to talk about how they see a multi-year upside cycle for the industry for companies that offer unique solutions. Overall, the company was extremely excited about its innovation and the future of the company.

This call was a few months ago at this point, and the next report is coming on July 20th. I’d suggest looking closely at their reports on the digiTech line.

Market Conditions

You should know there this a risk to the company’s performance associated with commodity price drops. If oil & natural gas prices bottom out for whatever reason (recession, geopolitics, supply/demand disruptions, climate change policy, etc.) there could be significant negative effects on the company.

But the good news is that the prospect of oil & gas prices bottoming out is slim to none. The reason for this is it appears OPEC+ continually attempts to prop up oil prices through surprise production cuts. For those not immersed in the oil & gas world, you probably haven’t noticed, but every time the price of oil starts to creep back down to the $72/barrel level OPEC+ seems to conveniently announce new production cuts.

Don’t forget that the Biden Administration announced that they want to refill the strategic petroleum reserve at the end of the year at the $65-$72/ barrel price level. It seems pretty obvious to me that OPEC+ (Saudi Arabia and Russia) will continue to try propping up oil prices if they start to fall to the $72/barrel level so that this pricing level does not happen and the U.S. will not have the energy security it desires.

You can check out my previous article on oil pricing thoughts here.

Final Analysis

The oil & gas industry has been moving toward maximizing well productivity and drilling efficiency for the last 5 or so years. The wild-west era of drilling is all but over and major exploration and production companies have focused on drilling and production efficiencies – and efficiency is the name of the game these days.

From their latest conference call:

North American frac activity predominantly just supports the maintenance of today’s oil and gas production levels. The days of breakneck oil and gas production growth are over. The large majority of contract activity is required to simply maintain today’s record high oil and gas production levels in the US and Canada.

Investors should note that the services offered by Liberty are considered mission-critical to the industry. Gone are the days of conventional vertical wells (when I first started fracing, these were all we did). Hydraulic fracturing and horizontal drilling are the standards in oil and gas production nowadays. Liberty is a leading innovator within the oilfield services sector and the investment in Digi technology should be a sound one for the company.

There is risk associated with the performance of the company as, at its core, the company is an oilfield services provider for the upstream sector. This means that in the event that oil and gas new drilling activity declines because of reasons like economic recession, oversupply, or weakened demand, service companies like Liberty will be one of the first types of companies to feel the impact. Reduced drilling activity means a reduced market and reduced profitability for the company.

That being said, overall I am bullish on the future of the company. Despite the risk of declining drilling activity, an administration change in the upcoming U.S. election could quickly turn that around and position Liberty for significant profitability in the coming years.

And even if that doesn’t happen, increasingly strict carbon emissions standards will likely still cause increased demand for Liberty Energy’s suite of services and technologies as the natural gas frac fleets significantly lower emissions compared to current fleets that typically run on diesel.

These increased standards and regulations will cause producers to continue becoming as efficient as possible to retain profit levels – and so once again even in the face of stringent regulation Liberty’s services and technologies could see an increase in demand, essentially offsetting losses from decreased drilling activity.

Conclusion

Overall, I like Liberty as an investment. I think they’re positioned well, and they’re investing in the right places for growth in tomorrow’s oil and gas industry. That stands in stark contrast to some of the bigger, older, companies out there in oilfield services. Liberty has been looking to the future with their technological R&D, and I like that a lot.

I’ve got to give this one a buy for a long-term investor, willing to hold on to this for 5 years or more.