yangphoto

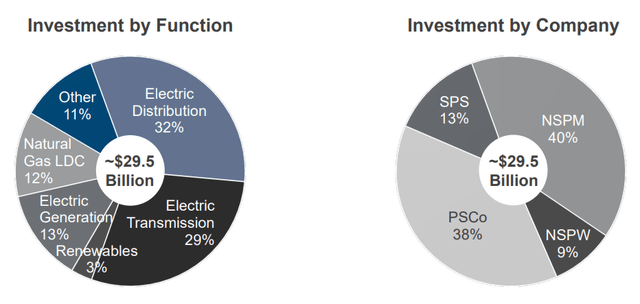

Xcel Energy Inc. (NASDAQ:XEL) is a Minneapolis, Minnesota-based electric utility and natural gas delivery firm with >3.7mn consumers across 8 states in the Midwest and Colorado, the Dakotas, Texas, and New Mexico. The firm currently maintains four major subsidiaries; Northern States Power-Minnesota, Northern States Power-Wisconsin, Public Service Company of Colorado, and Southwestern Public Service Co.

JP Morgan May’23 Conference Presentation

Through its activities, Xcel has seen Q1 revenues of $4.08bn- an 8.31% YoY increase- alongside a net income of $418.00mn- a 10.00% increase- and a free cash flow of $272.00mn, a 37.37% increase largely driven by increases in operational and financing cash flow.

Introduction

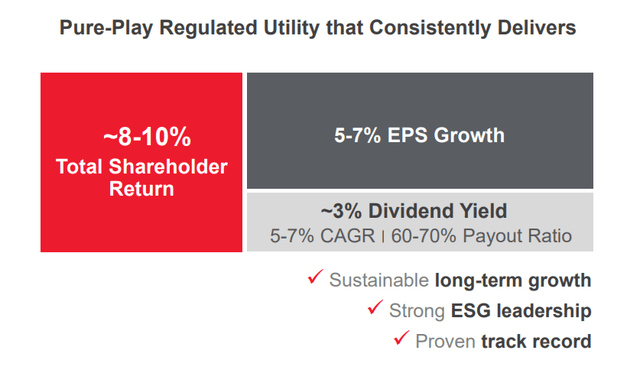

At the core of the Xcel philosophy remains highly conservative growth driven by residual investments, gradual EPS and dividend growth, all coupled with a secure shareholder return playbook. The latter outlook is grounded by Xcel’s sustainable growth characteristics, historic growth levels, and ESG inclusionary strategy, which will see a lower cost of capital.

JP Morgan May’23 Conference Presentation

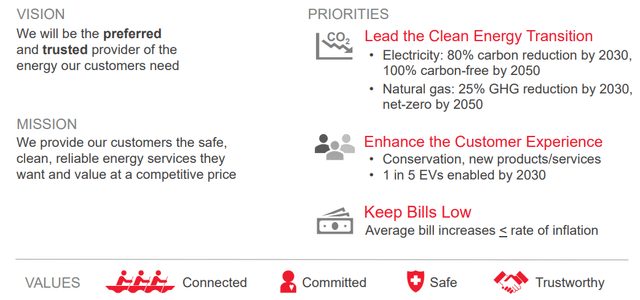

Xcel’s objectives are fundamentally undergirded by its macro strategy, prioritizing cost-effective transitions to clean energy, enhanced experiences in line with consumer habits, and affordable and accessible billing practices. In doing so, Xcel can secure piecemeal scale growth alongside margin growth through operational and power generation efficiencies.

JP Morgan May’23 Conference Presentation

The combined accretive effect of long-run capital investments in energy generation and infrastructure, alongside favourable macro tailwinds, a disciplined capital allocation strategy, and moderate undervaluation lead me to rate the stock a ‘buy’.

Valuation & Financials

General Overview

In the TTM period, Xcel’s stock- down 9.69%- has trailed both SPDR’s Select Utilities Fund (XLU)- down 6.18%- and the general market, as represented by the S&P500 (SPY)- up 15.15%.

Xcel (Dark Blue) vs Industry & Market (TradingView)

The utility industry at large has experienced poorer price action relative to the market, partially due to bonds providing superior risk-adjusted yields and partially due to the reduced need for utilities’ safe-haven status, with gradual reductions in core-inflation levels.

And while Xcel has largely followed XLU’s price action, it has, in recent months, trailed the utility industry, likely owing to unfavourable rate settlements and litigation concerns over the Marshall fires and subsequent price target cuts.

However, I believe Xcel’s cost-efficient capital model is well-positioned to navigate Midwestern rate standards and litigation concerns will not materially impact the firm’s bottom line in the long run.

Comparable Companies

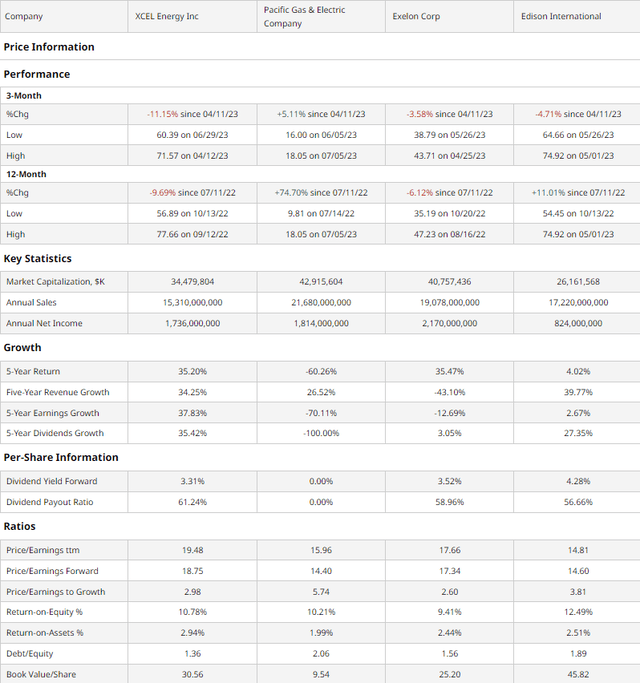

The utility industry remains inherently regional and consolidated with high capital costs for entry; Xcel, therefore, does not maintain any direct publicly listed competitors. As such, the firm remains most comparable to similarly sized regional utilities with adjacent operations. Such companies include the California-centric Pacific Gas & Energy (PCG), the Chicago-based nuclear-focused Exelon (EXC), and Southern California-servicer, Edison International (EIX).

barchart.com

As demonstrated above, Xcel has experienced the poorest annual and quarterly price action, likely driven by the firm’s recent downgrades due to the Minnesota and Wisconsin rate settlements. Despite these headwinds, Xcel remains undervalued on a multiples and growth basis.

For instance, Xcel maintains the second-lowest PEG ratio amongst peers, alongside the highest book value per share, manifesting the firm’s growth capabilities alongside its strong balance sheet.

Moreover, the company has experienced the second-best revenue growth in conjunction with best-in-class earnings and dividend growth. This comes on the back of peerless reinvestment capabilities, with the lowest debt/equity ratio, second-highest ROE, and highest ROA.

Valuation

According to my discounted cash flow model, at its base case, the net present value of Xcel is $68.40, meaning, at its current price of $63.12, the stock is undervalued by 8%.

My analysis, calculated over 5 years without perpetual growth built-in, assumes a discount rate of 9%, incorporating the increased cost of capital and overall leverage Xcel maintains while deducting for the firm’s low equity risk premium. Additionally, to be conservative, I estimated an average annual revenue growth rate of 4%, to account for slowed growth and compressed rates, less than the historic 5Y averaged revenue growth rate of 6.30%.

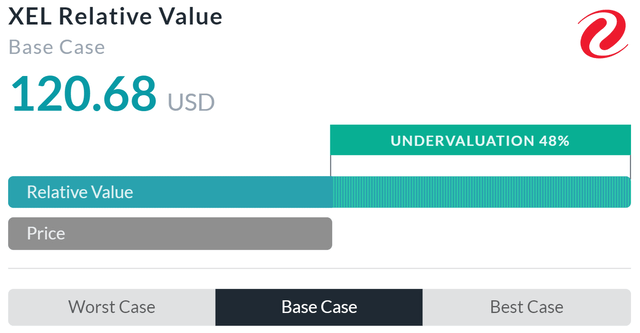

Alpha Spread

Alpha Spread’s multiples-based relative valuation more than supports my thesis on undervaluation, estimating the stock’s true value to be $120.68, a 48% undervaluation.

However, I believe Alpha Spread actually overrates Xcel, unable to account for the firm’s debt structure, recessionary pressures, and discount for dividends.

Therefore, although Alpha Spread provides insight into comparable multiples, my DCF remains a more accurate representation of Xcel’s fair value.

Disciplined Financial Management & Capital Deployment Planning Support Accretive Returns

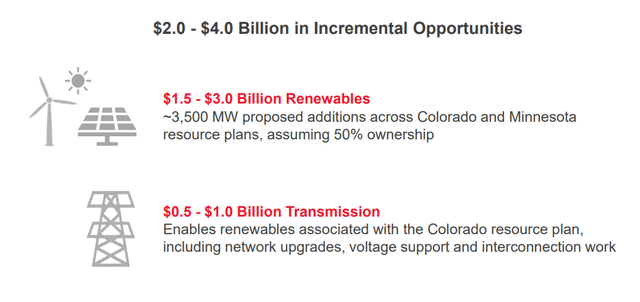

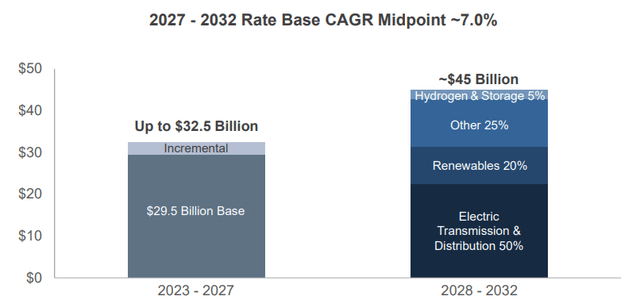

While Xcel remains a gradual growth-oriented firm, the key to preserving that growth, increasing scale, and reducing long-term rate increases is the firm’s multi-billion capital expenditure plan, which necessitates $1.5-$3bn investments in renewables energy- which sees lower opex than coal options- and $500mn-$1bn investments in electric transmissions, enabling more efficient energy movements. Through this, Xcel looks to increase its rate base at a CAGR of 6.5% through to 2027, with a 12% CAGR expected for Northern States Power-Wisconsin.

JP Morgan May’23 Conference Presentation

More so than that, by achieving a full coal exit by 2030 and an 80% carbon reduction in the same period, Xcel is looking towards ESG index inclusionary activities, lowering the cost of equity capital. On a more granular level, Xcel has developed its Minnesota and Colorado Resource Plans, which focus on expanding base load capacity and transmission capabilities, while promising 85% carbon reductions across the board.

JP Morgan May’23 Conference Presentation

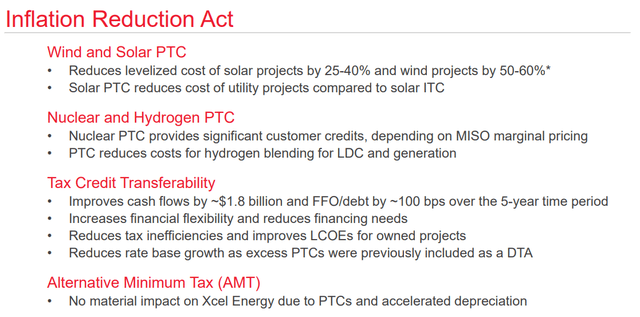

Xcel’s highly ambitious plans are reinforced by macro tailwinds, such as the Inflation Reduction Act, which will reduce overhead related to Xcel’s capital objectives while improving net cash flows. For instance, Xcel expects that the Inflation Reduction Act will reduce the levelized cost of renewable projects by 25-60%, and improve cash flows by ~$1.8bn.

JP Morgan May’23 Conference Presentation

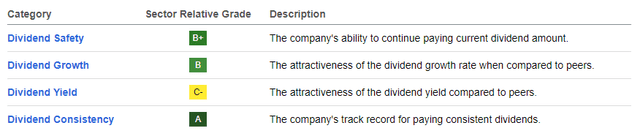

Through these measures, Xcel remains committed to gradual and consistent increases to its dividend, scoring highly on Seeking Alpha’s dividend report card when it comes to Dividend Consistency and Safety, as such being the ideal incrementalist income stock.

Seeking Alpha

Wall Street Consensus

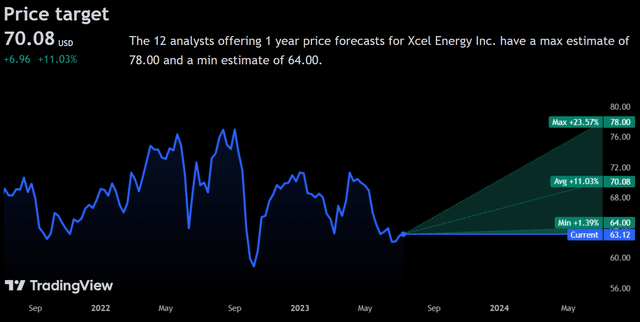

Analysts largely echo my positive view of the company, estimating an average 1Y price target of $70.08, signalling an 11.03% increase.

TradingView

Even at the minimum projected price target of $64.00, analysts expect a 1.39% YoY increase. Alongside Xcel’s 3.31% dividend, investors can expect to net even more.

Broadly, this positive outlook reflects Xcel’s operational resilience in the face of macro headwinds, its status as a safe haven security, and the firm’s general undervaluation.

Risks & Challenges

Input Cost Volatility May Compress Margins

Although, in order to insulate the firm from the said input cost volatility, the firm is spending extensively on renewable infrastructure, the firm nonetheless remains exposed to underlying volatility in natural gas and, to a lesser extent, coal prices. As such, rising commodity prices may lead to reduced profitability or demand, which may inhibit scale and reinvestment capabilities.

Regulatory Stress May Reduce Profitability & Scale Growth

Xcel operates across a wide range of regions in the US and across a multitude of utility verticals. While this supports the firm’s accretive scale growth, it also leads Xcel to be vulnerable to the regulatory stresses of each of these states and bureaucratic bodies. As such, as seen with the downward pressure of rate settlements across the Midwest, Xcel may see reduced profitability and rate base growth.

Conclusion

Looking forward, Xcel’s stability and accretive capital investments will lead to gradual scale and margin growth through operational efficiencies and rate base growth.