sefa ozel

Energy Income Performance

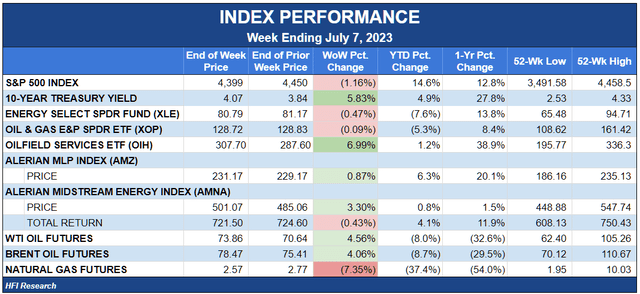

It was a challenging week for stock across the board. Strong economic reports boosted expectations for higher interest rates, sending treasury yields higher and stock prices lower. The S&P 500 (SP500) declined 1.2% after having rallied 16% from the beginning of the year. Various macro commentators have suspected the stock market rally was fueled by liquidity injections by the Fed, and the ugly price action on Thursday and Friday in response to higher interest rates appears to support that view.

HFI Research

The energy sector (XLE) failed to respond to WTI’s 4.1% gain, though its 0.5% drop outperformed the S&P 500. Natural gas prices plunged 7.4%, adding another headwind for energy stocks.

Among energy subsectors, oil and gas producers (XOP) were the worst performers, down 0.1%. Midstream fared better, up 0.9%, and oilfield services (OIH) surged 7.0% as offshore drilling contractors rocketed higher.

An interesting aspect of the week’s energy stock price action was the strong response to a tightening oil market. Our thesis has long been that the market was set to tighten in the second half of the year, which formally began on Monday. As the week progressed, the tightening was increasingly evident in various oil market data. Backwardation returned to both Brent and WTI and strengthened consistently throughout the week. Inventories declined. Saudi Arabia further increased the official selling prices of its oil. Pricing relationships shifted to incentivize oil exports from regions with excess inventory. And the list goes on.

By Thursday, the trend of a strengthening oil market was undeniable. Under normal circumstances, oil prices and oil stocks could be expected to respond positively. But this hasn’t been a normal year for oil and the energy sector, both of which have been held hostage to macro concerns.

On early Thursday, oil prices and oil stocks were pushed down early in the day after strong U.S. payroll data raised fears about higher interest rates. Prices fell even though the data were bullish for oil demand. This is the pattern oil investors have come to expect in 2023: irrespective of the latest fundamental data and the medium-term fundamental outlook, oil prices and energy equities decline when macro concerns rise to the fore. Not surprisingly, on Thursday morning, WTI dropped 2.2%, and the energy sector traded down 3.0%.

But then things got interesting. A bullish U.S. oil inventory report confirmed healthy demand and declining supply, sparking a turnaround in WTI. By the end of the trading day, oil prices had turned positive, shaking off the macroeconomic concerns that continued to spook the overall stock market.

The energy sector then followed through with a strong rally on Friday, ending the day up 2.2% while the broader stock indexes declined.

This price action is important because it is the first indication that fundamentals are beginning to crowd out the influence of macro concerns on oil prices. It suggests that bullish fundamentals can exert upward pressure on prices. For most of this year, a well-supplied market coupled with an overwhelmingly bearish financial community all but eliminated the impact of a bullish medium-term fundamental outlook on oil prices. Prices were locked in a trading range, responding with outsized declines to the slightest bearish macro signal while oftentimes ignoring bullish fundamental news.

This week’s price action indicates that oil prices will be subject to a new pricing regime in which fundamentals play a leading role. It is a refreshing change for investors like us who had prepared in advance for a bullish second half under the assumption other investors would come around to our view, but were continually frustrated by an oil market that was obsessed with the slightest sign of near-term macro negativity and was ignoring the bullish medium-term setup.

Assuming first, that fundamentals continue to tighten, and second, that tightening is reflected in oil prices, the second half bodes well for oil-weighted equities. Global inventories are likely to continue to decline, pushing oil prices higher. At the same time, oil futures positioning remains overly bearish. Speculators have already begun to abandon their short positions. Their return in force to the long side would add rocket fuel to a fundamentals-based rally.

With the market in the process of tightening, we believe the best investments in the second half will be those exposed to higher oil prices. After the week’s price action, we’re confident they will respond to strengthening oil fundamentals. We expect them to continue to do so over at least the next few months.

Energy Income News

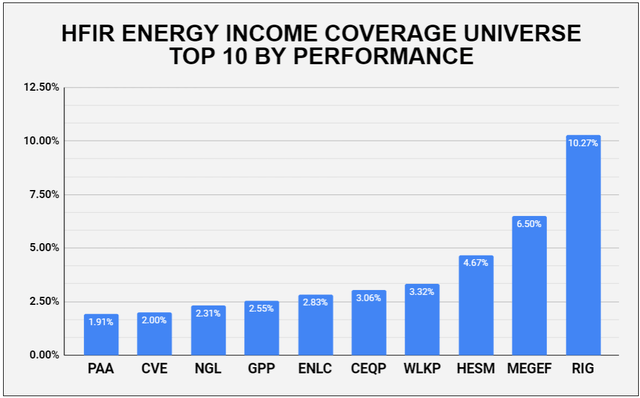

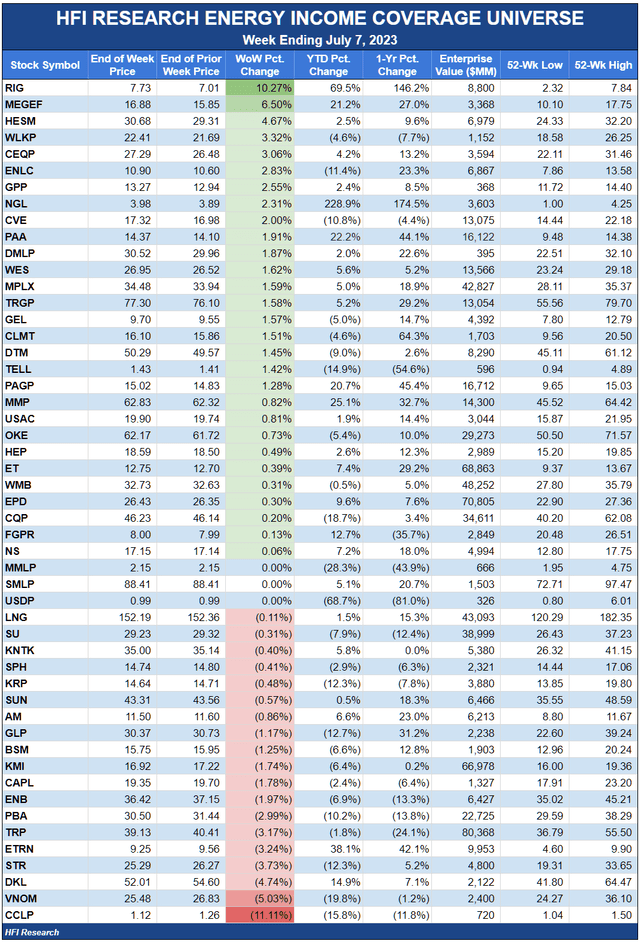

Equities with oil price exposure led the way higher. Transocean (RIG) led the way after its recent contract wins pointed to higher day rates and a tightening market for deepwater offshore rigs. We discussed the most recent development in this article published on Friday.

Besides offshore drillers, two of our favorite Canadian E&Ps registered among the top ten performers in our coverage universe. MEG Energy (OTCPK:MEGEF) increased 6.5%, and Cenovus Energy (CVE) was up 2.0%. Both made most of their weekly gains on Friday.

HFI Research

Oil-weighted gathering and processing operators Hess Midstream (HESM), Crestwood Equity Partners (CEQP), EnLink Midstream (ENLC), and Plains All American (PAA) were also among the leaders on no company-specific news. Their presence among this week’s top ten performers bodes well for oil-weighted midstream names going forward. We favor PAA and Western Midstream Partners (WES), though gassier names such as ENLC and Targa Resources (TRGP) should also do well due to their exposure to NGL prices. Our favorite oil-weighted midstreamer remains Genesis Energy (GEL), which we profiled in Friday’s article.

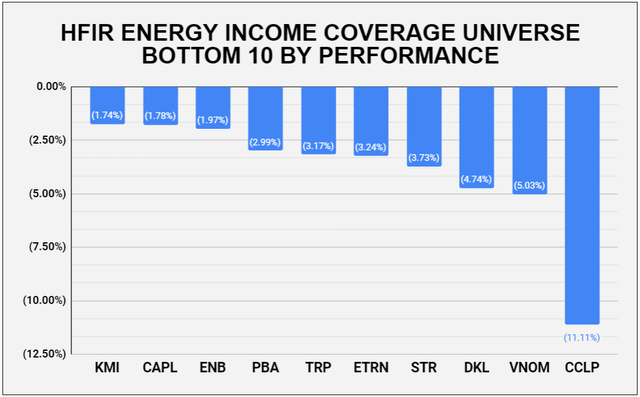

Among the week’s biggest losers, CSI Compressco (CCLP) led the way. CCLP is a natural gas compression services operator that has sold off in response to a downturn in domestic natural gas drilling activity. CCLP is highly leveraged, placing its equity at risk if the market for its services deteriorates significantly. We would avoid oilfield service operators exposed primarily to domestic production activity, which will remain subdued relative to recent years unless natural gas prices are sustained at very high levels.

HFI Research

The other stocks that came under pressure this week were weighed toward natural gas. Equitrans Midstream (ETRN) declined 3.2% after staging a fierce run higher after its Mountain Valley Pipeline was forced through by an act of Congress.

Canadian majors all traded lower. Enbridge (ENB) and Pembina (PBA) underperformed the wider midstream sector despite their exposure to Canadian oil activity. We recommend avoiding ENB until the market has a better understanding of the financial impact from the tolling reset on its Mainline system. PBA is our favorite of the three, as it has been since we began covering the names.

TC Energy (TRP) was the weakest of the group. The company is beset with operational difficulties and is in the process of selling assets to deleverage its balance sheet. Its latest setback came on Tuesday, when the Delaware Chancery Court ruled against it in a class action lawsuit relating to its acquisition of Columbia Pipeline Group in July 2016. While longer-term contrarian value investors might be tempted to buy TRP, its future remains too clouded by challenges to get us excited. We recommend avoiding the name until there is evidence that management can right the ship.

Interestingly, royalty trusts performed poorly during the week, despite their generally high oil price exposure. Viper Energy Partners (VNOM) and Sitio Royalties (STR) are high-quality royalty owners that may be a buy after this week’s price declines. They were down 5.0% and 3.7%, respectively. We’ll look into the situation further in the coming week.

Capital Markets Activity

None.

HFI Research

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.