lupmotion

The global energy transition is well and truly underway. As I highlighted to members of Beat Billions yesterday in an exclusive article discussing the outlook for the global energy sector, the energy sector is turning out to be a breeding ground for disruptive newcomers who would potentially change humanity in more ways than one. There will be winners and losers in this journey, and as investors, we should focus on differentiating winners from losers.

SolarEdge Technologies, Inc. (NASDAQ:SEDG) caught my attention recently when I started looking for opportunities in the renewable energy sector. SolarEdge seems to be well-positioned to capitalize on the favorable industry outlook for renewable energy. However, I am concerned about the lack of a margin of safety to invest in the company today at a time when margins are expected to come under pressure.

The Business

SolarEdge Technologies is an Israeli company specializing in smart energy solutions. With a focus on various sectors including residential, commercial, industrial, and transportation, SolarEdge offers innovative products such as solar inverters, power optimizers, energy storage batteries, and monitoring systems. The company’s mission is to optimize energy efficiency and drive the transition toward a cleaner energy future.

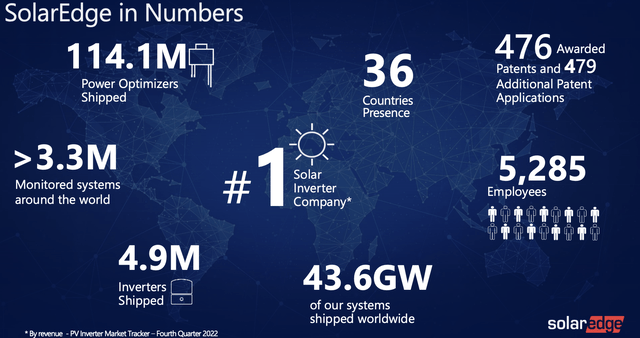

SolarEdge’s impressive track record is evident in its key performance indicators. The company has shipped over 114.1 million power optimizers and 4.9 million inverters worldwide, with a presence in 36 countries. The company’s commitment to innovation is reflected in the 476 awarded patents and 479 additional patent applications it has submitted. SolarEdge’s monitoring systems cover over 3.3 million systems worldwide, showcasing the scale of its operations.

Exhibit 1: Overview of the company

Investor presentation

In terms of financial performance, SolarEdge has consistently exceeded earnings estimates in recent quarters, which is one of the main reasons why I wanted to have a closer look at the company. According to Zacks, over the last two quarters, the company has surpassed estimates by an average of 62.61%. In the most recent quarter, SolarEdge reported earnings of $2.90 per share, surpassing the expected earnings of $1.98 per share by 46%. These exceptional earnings results highlight SolarEdge’s ability to deliver strong financial performance and position it as a key player in the global smart energy industry.

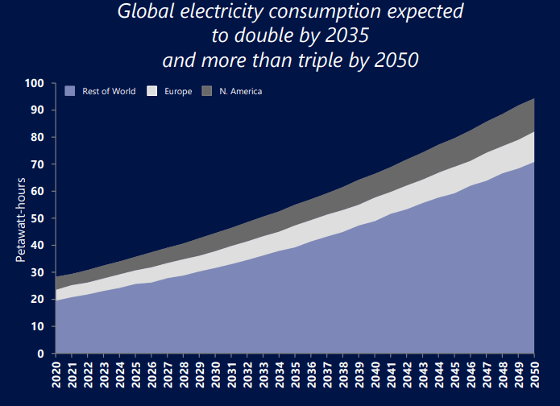

Clean Energy Transition In C&I Markets And EV Charging

The world is experiencing exponential growth in energy demand, and there is a global shift underway from centralized, fossil fuel-based energy to clean, distributed renewable energy sources. With the rapidly increasing worldwide demand for electricity, it is projected that global electricity consumption will double by 2035 and more than triple by 2050. This surge in energy demand is driven by multiple factors, including a projected population increase of 1.7 billion people (22%) from 2022 to 2050 and a significant rise in urbanization with 80% of the population expected to live in urban cities by 2050 compared to just 55% today.

Exhibit 2: Global electricity consumption projections

Investor presentation

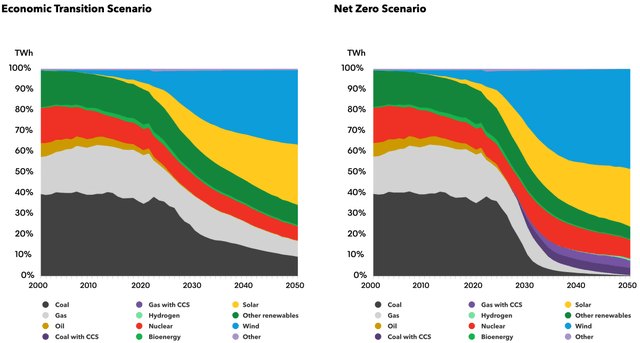

Renewable energy sources are set to become the dominant electricity source in the coming years. The installed electricity capacity mix in 2019 consisted of solar at 11%, wind at 8%, hydro at 15%, and fossil fuels accounting for 66%. However, the projected installed electricity capacity mix for 2050 indicates a substantial shift toward renewables, with solar expected to contribute 32%, wind at 52%, hydro at 8%, other renewables at 5%, and fossil fuels at a mere 3%. As illustrated below, both in the net zero scenario and the economic transition scenario, solar power is expected to account for a massive share of global electricity generation.

Exhibit 3: Electricity generation by technology, by scenario

BloombergNEF

Various stakeholders are driving the transition toward clean energy. Governments are implementing national-level initiatives to decarbonize, as demonstrated by global agreements such as the Glasgow and Paris Accords. Individuals are increasingly demanding electrification solutions, driven by a desire for energy independence and sustainability. Further, corporations across multiple industries are making decarbonization commitments driven by Environmental, Social, and Governance standards. Combined, these factors have created a business environment conducive to growth.

SolarEdge achieved remarkable growth in the commercial and industrial (C&I) market during the first quarter. The company shipped a record 2.1 gigawatts of inverters, representing an impressive 36% quarter-over-quarter growth and a stellar 108% year-over-year increase driven by ESG initiatives and the growing number of applications in the C&I sector. SolarEdge’s solutions offer advantages such as safety capabilities and cost efficiencies in the balance of the system, which positions the company well in meeting the increasing demand for its products. According to SolarEdge, the current demand exceeds its production capacity, which is an encouraging sign assuming the company will scale responsibly to meet this excess demand.

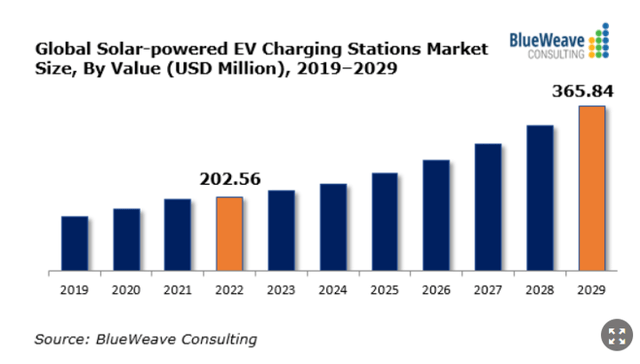

The company recently unveiled a new solar-attached EV management solution designed for the C&I segment expanding the portfolio of C&I-focused products and software, catering to sites with substantial EV quantities and a need for dynamic load management, such as apartment buildings, workplaces, and public charging locations. This launch aligns with the significant growth potential in the global solar-powered EV charging stations market. According to a recent study by BlueWeave Consulting, this market was valued at $202.56 million in 2022 and is expected to grow at a compounded annual growth rate of 6.84% through 2029, reaching a value of $365.84 million.

The rising demand for electric vehicles and the increasing need for sustainable energy solutions are driving the growth of the global solar-powered EV charging stations market. By leveraging advanced AI-based predictive algorithms, SolarEdge’s EV management solution optimizes the charging process by considering factors such as solar production, dynamic electricity prices, and tiered charging schedules. This seamless integration with SolarEdge’s energy management system enables efficient coordination and optimization of interactions between solar generation, battery storage, and large-scale EV charging.

Exhibit 4: Solar-powered EV charging stations market

BlueWeave consulting

In this evolving landscape, SolarEdge’s residential offering, SolarEdge Home, is positioned as a comprehensive solution for photovoltaic systems, energy storage, smart energy management, and electric vehicle charging. SolarEdge has already established residential leadership, with over 3 million residential sites across 125 countries and a network of more than 50,000 residential installers. This strong foundation positions SolarEdge for significant growth and success in the future, as the residential sector continues to play a crucial role in the clean energy transition.

Regional Growth

In the first quarter, SolarEdge recorded a strong performance in Europe and the Rest of the World region experiencing record revenues in several countries, including Germany, Austria, Switzerland, France, South Africa, and Australia. The non-U.S., non-Europe region demonstrated significant growth, with revenue increasing by 30% sequentially.

SolarEdge’s expansion into 24 countries across the Asia Pacific, Africa, and South America has positioned the company to capitalize on diverse growth opportunities. One notable market is South Africa, where SolarEdge is witnessing a significant surge in demand for solar products. This increased interest can be attributed to a rise in power outage frequency and duration, prompting consumers to seek solar solutions, including residential batteries, for energy resilience.

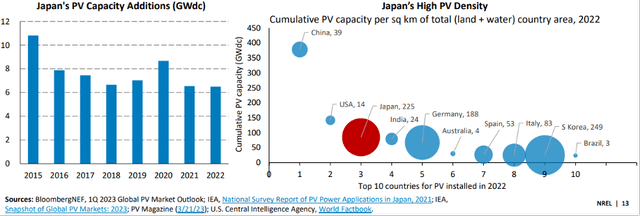

Another promising region for SolarEdge is Japan, where the regulatory environment for photovoltaic systems has been favorable. In 2022, Japan installed 6.5 GWdc of PV capacity, maintaining a steady level compared to the previous year. Cumulative capacity by the end of 2022 reached approximately 85 GWdc, reflecting the country’s ongoing commitment to renewable energy.

While Japan faces challenges such as limited available land and declining feed-in tariff rates, the government has set ambitious goals to double PV capacity by 2030. To achieve this target, Japan is exploring innovative strategies such as mandating PV installations on new buildings and implementing agrivoltaics, which combines agricultural activities with solar power generation. Government subsidies have played a crucial role in stimulating the growth of corporate power purchase agreements in Japan. In 2021, corporate PPAs for solar reached 91 MWdc, and this figure increased to 228 MWdc in 2022. These PPAs, mostly focused on PV projects, demonstrate the growing adoption of solar energy by businesses as part of their sustainability initiatives.

Exhibit 5: Japan PV capacity additions

BloombergNEF

In terms of specific regions, the European residential market remained robust for SolarEdge in Q1, driven by the ramp-up of three-phase residential inverters and the introduction of the new backup inverter and three-phase residential battery. The company expects this momentum to continue as it expands its capacity to meet the strong demand. However, U.S. solar revenues experienced a decrease due to weakness in the residential segment attributed to high interest rates and lower battery sales.

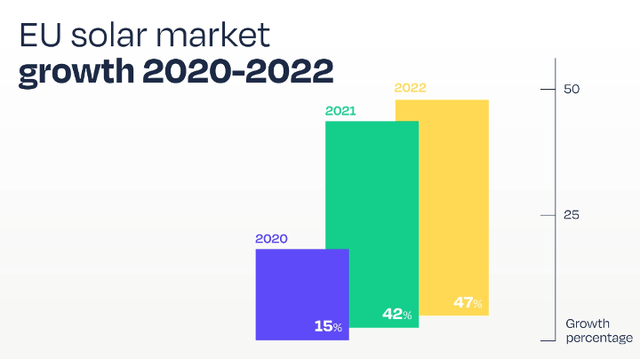

EU nations witnessed an extraordinary surge in solar power installations in 2022. The EU added a record-breaking 41.4 GW of solar power capacity, equivalent to powering 12.4 million European homes and replacing 102 LNG tankers. This represents a substantial 47% increase in annual EU solar power growth compared to 2021. The EU’s total solar power capacity rose by an impressive 25% in just one year, from 167.5 GW to 208.9 GW in 2022, highlighting the growing need to address energy security concerns.

Exhibit 6: EU solar market growth

Solar Power Europe

The outlook for solar power in Europe remains highly promising, with an average projection of an additional 53.6 GW of solar power in 2023. This trajectory suggests that the EU solar market is set to more than double within four years, reaching 484 GW by 2026. Ten EU countries are now adding at least 1 GW of solar power per year. Germany remains the largest solar market in Europe, with an addition of almost 8 GW in 2022, followed by Spain (7.5 GW), Poland (4.9 GW), the Netherlands (4.0 GW), and France (2.7 GW). In 2022, 26 out of the 27 EU member states witnessed higher solar deployments compared to the previous year. This significant milestone was driven by record-high energy prices and geopolitical tensions.

SolarEdge is well-positioned to capitalize on the remarkable growth in the European solar market, leveraging its expertise in residential solar solutions. With the increasing adoption of solar power and favorable market conditions, the company can further solidify its position as a key player in the European clean energy industry. In Q1, the company’s solar revenues from Europe reached a record $577.1 million, registering a 22% increase. Two countries in Europe surpassed $100 million each in revenue, and significant sequential growth was observed in Germany, Switzerland, Austria, and France.

Is SolarEdge Attractively Valued?

SolarEdge is a profitable company. This is an important consideration for any analyst building a valuation model for a growth company as many growth companies operate at a loss for many years before they become profitable, if at all. On the back of consistent double-digit growth in revenue (5 out of 6 fiscal years since 2017), SolarEdge has remained profitable despite a deterioration of profit margins. A closer look at margins is required to evaluate the long-term prospects for the company.

The margin pressures of the company stem from a couple of major reasons. First, over the last 5 years, SolarEdge’s sales mix has shifted in favor of commercial product categories, and this business segment is characterized by lower gross margins compared to the residential segment. Second, the solar energy industry is maturing and the solar value chain is being commoditized, thereby forcing industry players to compete on price. Price-based competition is likely to lead to an industry-wide decline in gross margins, and we are seeing this impact already. To combat the decline in margins, the company will resort to cost-reduction strategies and look to gain efficiencies within its supply chain. These measures proved to be helpful in Q1, where SolarEdge reported GAAP gross margins of 31.8% compared to 29.3% in the prior quarter.

Although this is an encouraging sign, I do not believe a meaningful expansion of gross margins is likely in the foreseeable future given that the company’s product mix is changing. For instance, SolarEdge plans to ship a higher number of batteries in the coming quarters, and this segment has historically experienced lower margins. For context, in Q1, residential inverter and optimizer margins exceeded 40% whereas battery margins hovered around 25%.

With profit margins expected to decline modestly, investors will have to look for a meaningful margin of safety before investing in SolarEdge although the company is well-positioned to capitalize on favorable macroeconomic trends. Little room for margin expansion is an early indication of a business sector that is not conducive to competitive advantages as well, which is another factor that needs to be accounted for.

At a TTM P/E ratio of 77, SolarEdge seems to be fairly valued from a historical P/E perspective given that the company has traded at an average P/E of 76 in the last 5 years. The forward P/E of 31, in my opinion, reflects the market expectations for a notable improvement in profitability on the back of strong revenue growth. There is no question about growth, but I am wary of SolarEdge’s prospects for net income growth. Even in the best case, I believe profits will grow at a decelerating pace in the next 5 years even on the back of an acceleration in revenue growth. SolarEdge, for now, does not seem to be trading cheaply for me to consider building a cash-flow-based valuation model.

Takeaway

SolarEdge Technologies has established itself as a leading player in the global smart energy industry, with a strong presence in multiple sectors and regions. The company’s financial performance has consistently exceeded expectations, with impressive earnings surprises in recent quarters. As the world experiences exponential growth in energy demand and transitions to clean, renewable energy sources, SolarEdge is well-positioned to grow. The company’s expansion into the C&I segment, along with its new solar-attached EV management solution, aligns with the growing demand for sustainable energy solutions in these sectors. Regionally, SolarEdge has seen remarkable success in Europe, where the residential market remains robust, and the EU has witnessed a record-breaking surge in solar power installations. Additionally, the company’s presence in other regions such as South Africa and Japan provides access to diverse growth opportunities.

Although I am not ready to jump on board SolarEdge Technologies, Inc. stock today, I believe the strong earnings revisions momentum will push the stock higher in the short run. I will revisit the company toward the end of the year to get a better understanding of how the changing product mix is impacting its margins and to re-evaluate the valuation of the company.