pandemin

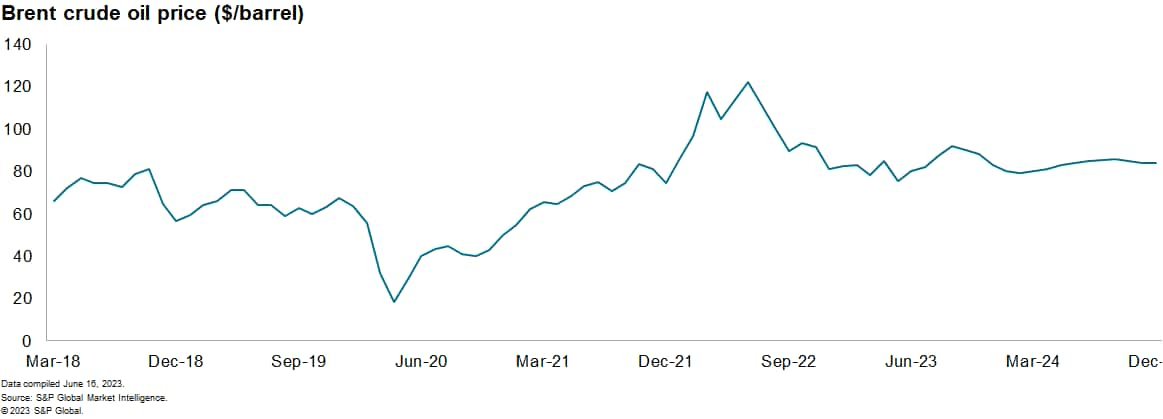

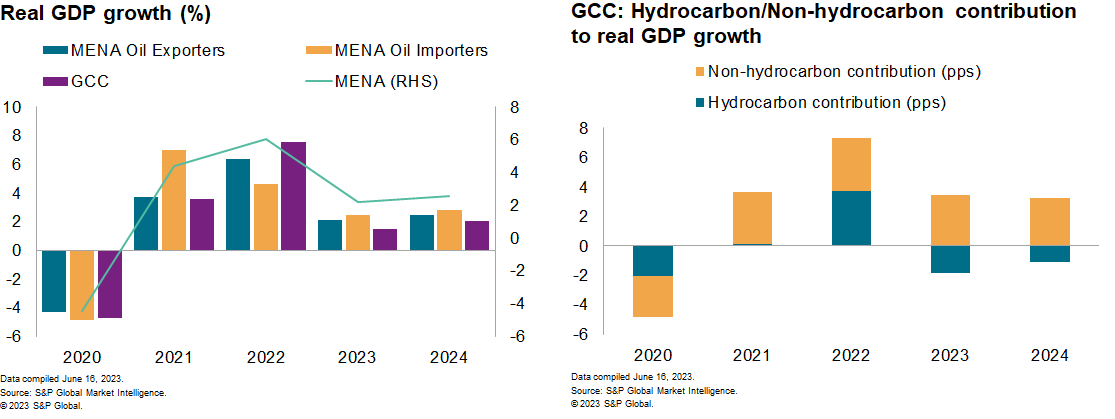

After a stellar performance driven by petrodollar inflows in 2022, the Gulf economy will feel the pinch of weaker global demand, higher borrowing rates, and lower oil output in line with OPEC+ decisions. S&P Global Market Intelligence forecasts real GDP growth in the Gulf Cooperation Council (GCC) to move from 7.5% in 2022 to 1.5% in 2023 before recovering slightly to 2.1% in 2024.

The slowdown is mostly attributed to less favorable performances at the level of the real hydrocarbon economy, which will slightly contract in the near term, mirroring lower oil output.

Although energy prices have moderated, governments will continue to benefit from sufficient petrodollars to press ahead with investment projects whenever needed. The vast amount of FX reserves accumulated since 2022 also reinforced their liquidity buffers and ability to spend to diversify their economies.

The real non-hydrocarbon economy continues to perform strongly, seeing uninterrupted growth as a full recovery from dissipating COVID-19 pandemic-related uncertainties comes into play.

Tourism activity has picked up quite significantly over the past year, with global travel resuming, countries opening up borders, and loosening health-related restrictions.

Hotel occupancy rates soared and transportation and other services sectors also performed robustly in the past few months. We expect 2023 to be another year of strong growth for the services economy, especially tourism and accommodation.

Construction activity growth should slow in the near term yet remain satisfactory as GCC governments continue to benefit from fairly high liquidity and pursue their respective economic diversification drives. The S&P Global Purchasing Managers’ Index (PMI)™ for Saudi Arabia, the United Arab Emirates, and Qatar, a gauge of non-oil economic activity, remained very much in expansionary territory in June.

What is noticeable is that real private consumption growth in the GCC is likely to reach 6.9% in 2023, higher than the estimate for 2022, before slowing down to a still strong level in 2024.

This is partly because we believe that elevated consumer price pressures somewhat eroded purchasing power and dented private consumption growth in 2022. With inflationary pressures gradually receding in the past few months, private consumption spending will gain further ground in 2023.

The acceleration of real private consumption growth is also attributed to higher consumer spending in Saudi Arabia due to evolving consumer patterns and recovering religious tourism.

Monetary policy and potential risks

Monetary policy tightening is likely to come to a halt after further rate hikes in the second half of 2023 in line with the US Federal Reserve, although easing is not expected before 2024, in our assessment.

Higher borrowing rates, coupled with lower global commodity prices on a year-over-year basis, improving global supply chain conditions, and weaker global demand are likely to allow for a gradual reduction of inflationary pressures around the Gulf in the near term. Average inflation in the GCC is forecast to decline to 2.9% in 2023 and 2.5% in 2024.

After largely following the US Federal Reserve in raising rates to combat surging inflationary pressures, GCC central banks are likely to hike rates further, in line with their US counterpart.

In any case, we believe that rate cuts are unlikely before 2024. GCC central banks will replicate US Fed moves (or lack of moves) in the near future due to their long-standing currency peg policies.

Although inflation will only trend down gradually, it is nowhere near the mid-to-high single digits registered in some advanced economies largely because of Gulf governments’ energy subsidy policies.

The region’s near-term outlook is clouded with downside tail risks. These mostly consist of a relapse of geopolitical confrontation points if political deal talks between Iran and the P5+1 collapse, a sustained and marked drop in global energy prices squeezing liquidity around the Gulf, and sticky inflation either in the US or domestically forcing central banks to tighten further, with adverse spillovers on growth momentum in the real economy.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.