BanksPhotos

Flotek industries’ (NYSE:FTK) stock is a buy for those wanting a sprinkle of excitement to their portfolio but it should be nothing more than that – unless one believes strongly in the broader energy commodities story. The company’s current financials seem fragile at best but it has turnaround potential under the right circumstances.

Introduction to Company

Flotek Industries is a Houston-based chemical and petroleum engineering company, primarily partnering with energy companies to optimise energy production economics. Through their business lines Energy Chemistry Technologies, Professional Chemistries, and Data Analytics, they offer products and services for both commercial, governmental, and personal use. These include disinfectants, sanitizers, and a range of energy-sector specific solutions.

Products & Segments

Business Segments & ProFrac Contract

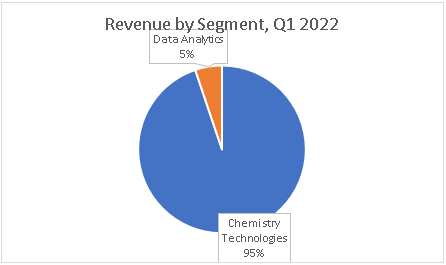

As one could imagine, customers served in this segment are both national and international oil- & gas companies, oilfield service groups, and supply chain management companies. As a percentage of total Q1 2023 revenue, it makes up 95%, being the largest segment of the company.

Made in Excel with data from Flotek Industries’ latest 10-Q

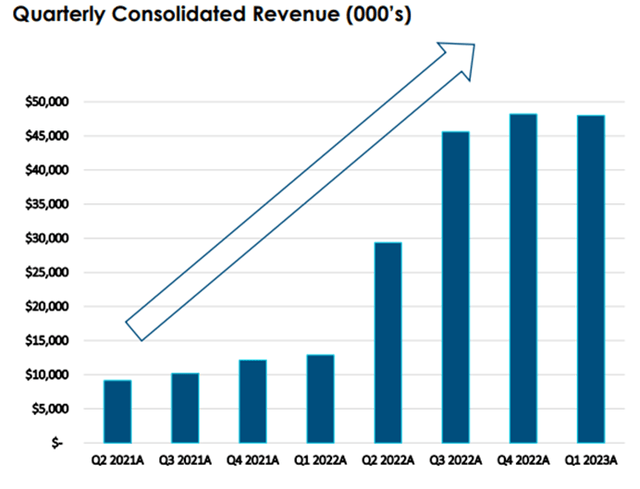

By partnering with customers, they tailor well-specific chemical products such as cements, oil recovery -enhancers, drilling fluid additives, and well stimulation additives. Compared to the Q1 2022 revenue of 11808 K USD, the segment has experienced sharp relative growth of 285% to the Q1 2023 figure of 45490 K USD.

This largely stems from their contract with their largest customer, ProFrac, with which Flotek Industries has entered into a long-term supply contract with, providing ProFrac access to all chemicals for their frac fleets for a minimum of 10 years. In exchange, ProFrac received 10 mm USD in convertible notes, meaning ProFrac owns more than 40%. The deal is projected to create recurring annual revenue for Flotek of more than 75 mm USD and might clear the way for a future takeover bid.

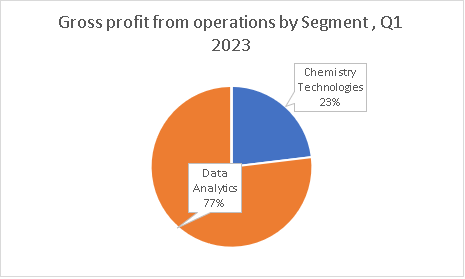

As a percentage of Gross profit, the segment makes up only 23% as compared to 95% of revenues, reflecting the asset light nature of data analytics as compared to chemical development, manufacturing, and selling. The Data analytics Segment helps diversify the company through more recurring subscription revenues as compared to the largely cyclical nature of drilling chemicals which often follows large swings in the general fossil fuel market picture.

Made in Excel with data from Flotek Industries’ latest 10-Q

Although the company reported quarterly Net Income of 21,343 K USD, it wouldn’t have been positive without the 26,095 K USD accounting item stemming from its ProFrac agreement called Gain in fair value of Contract Consideration Convertible Notes Payable, meaning its quarterly bottom line would have been -4,752 K USD without.

Although unprofitable adjusting in this way, the company is improving measured on raw revenue as one can infer from this chart:

Q1 2023 Flotek Industries Presentation

Oil & Gas Market Trends

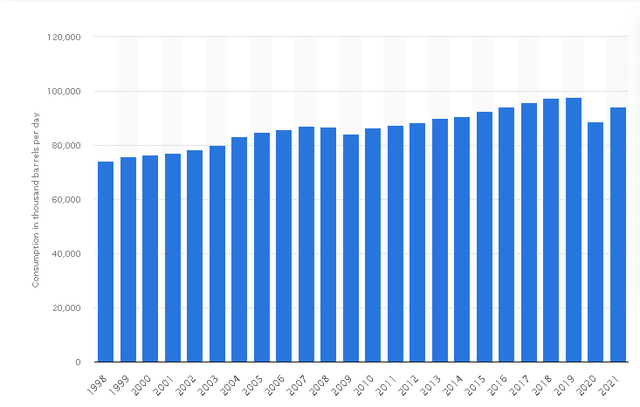

Much has already been written on the energy supply situation. But with the Russia-Ukraine war, energy security is returning as an ongoing concern in the western world. Muted energy prices through the last decade rendered energy production unviable and many domestic energy suppliers went out of business which, in Europe, meant increasingly relying on the less-secure energy sources Russia and renewable energy. All of this has resulted in a relatively inelastic energy supply while demand has mostly continued its slight upward trend of a couple percentage points a year.

Statista

Risks

Currently, Flotek Industries is largely dependent on ProFrac as its largest customer as it provides more than 50% of its revenue and also its financing. This is both a risk but simultaneously presents a merger arbitrage opportunity as the firms’ close partnership might suggest. A takeover would vertically integrate ProFrac’s supply chain, enabling smoother operations.

A recession would most likely further suppress Oil- and gas prices, making for an even tougher business climate for Flotek Industries through lower demand for their products as well as tougher financing options. Fortunately for Flotek, it has a somewhat normal debt-to-equity ratio of 0.95, meaning the firm might have room for taking on more debt although its operating cash flow-to-interest-expense ratio of 0.64 doesn’t suggest this. Based on the aforementioned debt-to-equity ratio, the company should look to add debt instead of share diluting in order to raise capital.

With its quick ratio of about 0.125, the company is indeed in a tough short-term liquidity position. One can calculate its cash burn rate of 0.23 using its cash burn, or, Q1 2023 Total Expenses of 53,668 K USD, and its current cash of 12,333 K USD, it suggests that the company will run out of its current cash in little less than 3 months. Assuming that the company will be able to collect its receivables as well, the cash burn rate changes to 1.14, indicating that the company has a little more than 1 year in runway. To me, the last scenario seems most probable since, their largest customer ProFrac, is in a relatively stable financial condition and will be able to pay its receivables to Flotek Industries.

A Valuation Perspective

Using book value per share, one can arrive at a per-share valuation of about 0.6 USD. With Flotek’s stockholders’ equity so volatile, it would be better to instead value the firm based on its future cash flows but these seem hard to find and/or estimate from publicly available materials.

Its current price/revenue ratio, using its current share price of 0.73 USD and its annualized Q1 2023 revenue, amounts to roughly 1.34 which is in the lower range of 1 to 2, suggesting room for a slightly higher price.

Valuation methods aside, it is most favourable to think of the stock in terms of a call option without an expiry date. The company has endured and flourished during earlier cycles of energy demand, for example, when the stock went from about 1.2 USD per share in 2010 to about 28 USD per share in 2014, making for a 2230% gain.

Using in a Kelly Criterion Calculator with a 1% winning probability, limiting the loss of negative outcome to 20% (which can be done through stop orders), one arrives at an optimal investment size of about 0.56% of one’s portfolio value.

Conclusion

Although enticing, very little, if anything, of one’s portfolio should be allocated to Flotek Industries’ stock unless one believes strongly in a structural energy bull market. The company is largely dependent on ProFrac for both its finances and its revenues, making its current profit appear fragile.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.