Vanit Janthra

Linde (NYSE:LIN) is the largest industrial gas company worldwide, and its primary products are atmospheric gases (oxygen, nitrogen, argon, and rare gases) and process gases (carbon dioxide, helium, hydrogen, electronic gases, specialty gases, and acetylene). The business was formed through the merger of Praxair and Linde AG in 2018.

Approximately two-thirds of Linde’s business consists of contractual fixed payments to resilient end-markets. I believe that their portfolio and cost pass-through model have provided significant downside protection during challenging economic times. Moreover, Linde is well-positioned in both the blue hydrogen and green hydrogen industries, which will experience growth driven by the global trend of decarbonization.

Growth Tailwinds

Hydrogen Growth Driven by Decarbonization: Hydrogen has long been recognized as a promising low-carbon transportation fuel. According to ResearchAndMarkets.com, the global hydrogen generation market is projected to reach $263 billion by 2027, indicating a compound annual growth rate of 10.5% from its current value of $160 billion. This suggests that there is a substantial growth potential in the hydrogen industry that is expected to continue for the next 20 years. Key players in this market include Siemens, Linde, Air Liquide (OTCPK:AIQUF), as well as smaller players like Air Products and Chemicals (APD).

Both the United States and Europe have been actively working to promote the use and development of hydrogen as a clean energy source through various legislation initiatives. For instance, the IRA has introduced a $3-per-kilogram subsidy for green hydrogen, and the EU has plans to produce and import a total of 20 million tons of hydrogen per year by 2030.

Linde is considered one of the leading companies in both the blue hydrogen and green hydrogen sectors. According to their management, they currently generate more than $2 billion in hydrogen sales, accounting for approximately 6% of their group sales, and they expect this business to quadruple over the next 10 years.

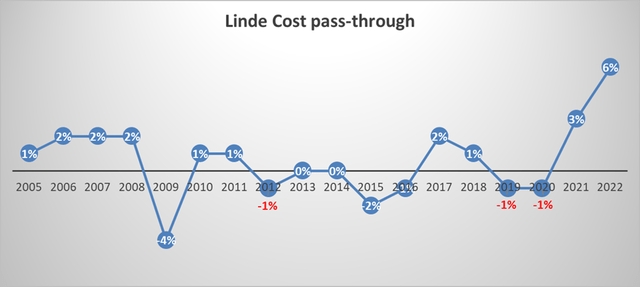

Recession and Inflation-Proof: Linde has implemented a strategy of passing through inflation to their customers through a surcharge. Their goal is to achieve a minimum additional price of 2% over inflation in different economic cycles. This price control is managed at a regional level, and they make weekly and/or daily price adjustments as needed to safeguard their margins. In essence, this approach allows them to potentially shield their profits from the impact of inflation.

For instance, in FY22, Linde achieved a 6% growth from cost pass-through, 9% growth from price/mix, and 1% growth from volume. These figures indicate the effectiveness of their pricing strategies in mitigating the effects of inflation and driving overall growth.

Linde 10K, Author’s Calculation

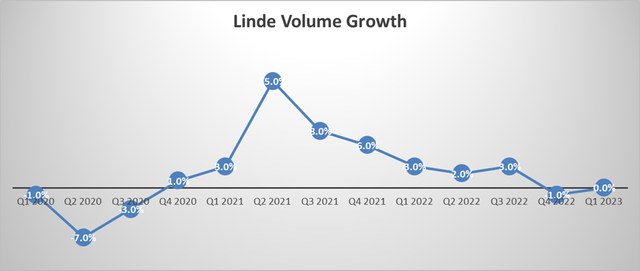

Around two-thirds of Linde’s business is safeguarded through contractual fixed payments from resilient end-markets, including food and beverage, healthcare, and electronics. This aspect of their portfolio offers significant downside protection during challenging periods, such as the early 2000s recession, the COVID-19 pandemic in 2020, and the high inflation experienced in 2022.

Furthermore, Linde benefits from strong cash generation and diligent price and cost management, which serve to support the business even when volumes contract. These factors contribute to the overall resilience of Linde’s operations and help navigate through difficult economic conditions.

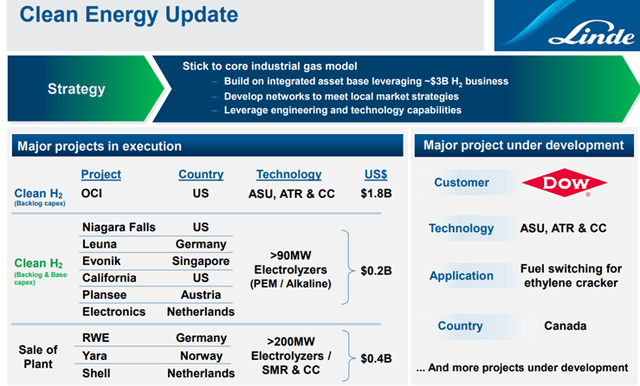

Clean-Energy Projects: Linde has achieved significant success in securing and advancing numerous clean-energy projects in recent years. Through these projects, Linde is assisting its customers in decarbonizing their operations and transitioning to more sustainable practices.

Looking ahead, the total opportunities in this space are projected to surpass $50 billion over the next decade. These opportunities, along with the backlog of projects that Linde has already secured, serve as a substantial cushion against future macro uncertainties. They provide a solid foundation for Linde’s future growth and stability in an evolving market focused on clean energy solutions.

Linde 2023 Capital Market Day

Solid Capital Allocation: Linde has been actively returning cash back to shareholders through dividends and share buybacks. Over the past four years, the company has returned $8.4 billion in dividends and $14.9 billion through stock repurchases. The total return of $23.3 billion accounts for approximately 13% of Linde’s current market capitalization. I believe that Linde’s capital allocation strategy is quite robust.

Key Risks

Weak Demand from On-Site Customers: Many on-site customers are adapting their operations to accommodate slower economic conditions. On-site customers make up approximately 26% of the group’s revenue. The contracts for on-site product supply are typically long-term agreements spanning 10-20 years, with minimum purchase obligations and provisions for price escalation. Consequently, while volume growth may be impacted, I believe that the challenges can be managed effectively due to the minimum purchase requirements and price provisions in place.

Sluggish EMEA Volume Growth: Considering the weak economy in Europe, it is not surprising to observe some softness in Linde’s EMEA volumes, particularly in the on-site business segments like chemicals and energy sectors. However, there has been a slight improvement in the on-site business for Linde. On the other hand, the Merchant and Packaged Gas markets have remained relatively stagnant, and this segment is more closely tied to overall industrial activities in Europe. I do not anticipate significant improvements in industrial activities in Europe in the near future.

In comparison to Air Liquide, Linde has a smaller European operation due to the divestment of most of its European businesses during the business combination in 2018. EMEA accounted for 25% of Linde’s group sales in FY22. Consequently, the weak industrial market in EMEA is expected to have some financial impact on Linde’s volume growth, which has already been reflected in their recent results.

Linde Quarterly Results, Author’s Calculation

Outlook and Valuation

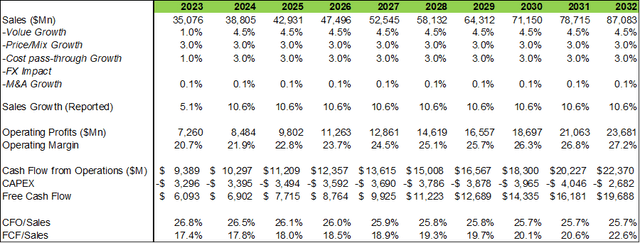

Linde boasts a commendable operating margin and maintains a solid balance sheet. While the volume growth may experience volatility in different economic cycles, the company’s price/mix growth and cost pass-through model enable them to achieve double-digit top-line growth, according to my estimates. Furthermore, with the anticipated growth in the hydrogen sector and a backlog of clear energy projects, Linde’s growth prospects appear to be recession-proof in nature.

Linde has provided guidance of 9%-13% EPS growth for FY23, which I believe is a prudent estimate.

In my DCF model, I assume a normalised 4.5% of volume growth, 3% price/mix growth and 3% inflation pass-through growth. I think their margin expansion will come primarily from the operating leverage, and the operating margin is forecasted to reach 27.2% in FY32.

Linde DCF Model- Author’s Calculation

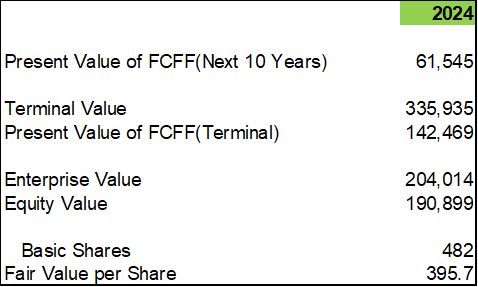

The free cash flow conversion is expected to reach 22.6% in FY32 in my model. Using 10% of WACC and 4% of terminal growth rate, the present values of FCFF over the next 10 years and terminal value are $61 billion and $142 billion, respectively. Adjusting cash and debt, the fair value is $395 per share in my model.

Linde DCF Model- Author’s Calculation

End Note

In my article on Alcon titled “The Steady Force Of ‘Boring‘,” I highlighted the inclusion of “boring” companies in my portfolio to provide significant downside protection during market downturns. These types of businesses have proven their ability to perform well across various economic conditions. Linde is undoubtedly one such company, as its business model has demonstrated exceptional resilience during challenging periods such as the early 2000s recession, the pandemic in 2020, and the high inflation experienced in 2022. Considering these factors and valuation, I firmly believe that Linde deserves a “Buy” rating.