ASphotowed

Eni S.p.A. (NYSE:E) is an Italian multinational energy company with a market capitalization of just under $50 billion. The company is one of the larger energy companies in Europe. The company’s share price remains lower as a result of weakness in the oil markets, but as we’ll see, the company has the ability to drive substantial shareholder returns.

Eni 1Q 2023 Results

Eni has continued to generate strong returns in the quarter.

Eni Investor Presentation

The company managed to continue to discover some additional crude oil resources in the quarter. Production was up >2% QoQ as the company continues to focus on its specialty areas. Overall, the company has moved towards its goals of cleaning up and improving its portfolio while generating strong returns.

For the quarter, the company earned $2.9 billion euros in net profit. The company’s free cash flow, or FCF, was $3.1 billion after $2.2 billion in capital spending, continued substantial capital spending in the portfolio. The company’s leverage ratio of 14% remains manageable and the company’s FCF yield remains more than 20%. That is a yield that enables strong shareholder returns.

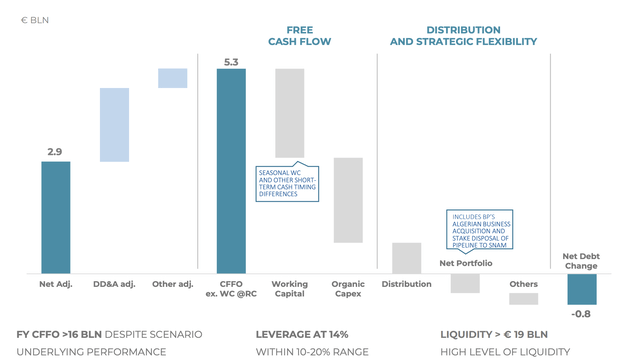

Eni 1Q 2023 Financial Strategy

The company’s financial strategy and strength is visible below.

Eni Investor Presentation

The company’s total CFFO was $5.3 billion. The company’s working capital was several $ billion with several billion in organic capex. The company’s 7% distributions remains a small part of its capital spending. The company’s debt at the end of the day was $0.8 billion, but with 14% leverage, the company doesn’t need to change that.

The company is planning to generate >$16 billion in CFFO despite weak underlying performance in the markets, which is impressive.

Eni 2023 Guidance

The company’s guidance shows how after a strong quarter it’ll continue shareholder returns.

Eni Investor Presentation

The company is targeting 1.65 million barrels / day in production. It plans to discover 700 million barrels, implying a 1.16x replacement ratio for its assets. The company expects $12 billion euros in earnings before interest and tax and more than $16 billion in CFFO. We expect that to be able to potentially increase if prices remain at the higher level they’ve been indicating.

Regardless, the company is targeting $9.2 billion euros on capex, resulting in $6.8 billion euros in FCF. That’s $7.5 billion in total FCF at lower prices. That’s a more than 15% FCF yield even with lower price indications. The company is continuing its 7% dividend yield with $2.4 billion USD in buybacks, enough to buyback 5% of its shares.

That’s sufficient for the company to generate double-digit shareholder returns.

Eni Potential

Eni’s potential is because of the lower valuation that’s being assigned to it by the market. The company is trading at a lower than $50 billion valuation despite a relatively low leverage ratio and 1.65 million barrels / day in annualized production. For perspective, Exxon Mobil Corporation (XOM) has 8x the valuation but less than 3x the production.

Eni is continuing to aggressively clean up its portfolio. At the same time, it’s continuing to improve its overall portfolio, and improve its overall discovered resources and production. The company has a tight operating region around where it excels in the Mediterranean and Africa primarily. Here the company has several growth projects.

The company is taking advantage of its valuation by working to drive substantial shareholder returns. The company’s dividend yield is almost 7%. At the same time, the company is planning to repurchase 5% of its shares this year. That combined level of shareholder returns is something that the company can comfortably afford this year.

The double-digit returns the company can provide, along with overall cash flow, and growth, in a tough market, make it a valuable investment.

Thesis Risk

The largest risk to our thesis is crude oil prices. Crude oil prices have recovered some recently and Brent prices are now almost $80 / barrel. That’s a level where Eni is profitable. However, there’s no guarantee that that profitability continues. A major drop in oil prices could hurt the company’s ability to drive future returns.

Conclusion

Eni continues to have a lower valuation than a number of its peers. However, the company is reorienting its portfolio and continues to have impressive production. Additionally, the company’s existing portfolio is very profitable, with the company’s FCF remaining strong. The company’s FCF guidance for the year is $7.5 billion, a strong double-digit yield.

Eni S.p.A. is focused on strong base shareholder returns. The company is expecting a 7% dividend along with 5% share buybacks for double-digit shareholder returns. That, combined with other returns, makes the company a valuable investment overall. Let us know your thoughts in the comments below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.