hamzehsh12/iStock via Getty Images

Is OPEC trying to add new members?

News emerged in the last few days that OPEC was courting new members, based on comments from the organization’s secretary-general Haitham Al Ghais (of Kuwait):

Speaking on the sidelines of the OPEC seminar in Vienna, Al Ghais said Azerbaijan, Malaysia, Brunei and Mexico have been consulted. All are already members of the Declaration of Co-operation — the framework that was formalized in December 2016 to bring together OPEC and 10 non-OPEC countries led by Russia — although Mexico has been exempt from adhering to the formal production targets since the middle of 2020…

His remarks build on earlier statements made by OPEC+ ministers that called for more oil producing countries to join them in a bid to gain a larger share of the global market.

This comes after Guyana, a rising offshore producer expected to hit 1 million bbl/d by 2028, rejected insinuations it may join the cartel. Deepwater exploration and development is expensive and Guyana would be unwise to risk repelling foreign capital from Exxon (XOM) and the likes by agreeing to production limits.

Will an expanded OPEC equate to less supply?

Maybe at the margin, but don’t expect anything earth-shattering. First, the approached countries would probably negotiate a generous quota as a pre-condition to join. Second, they aren’t that significant as producers to begin with.

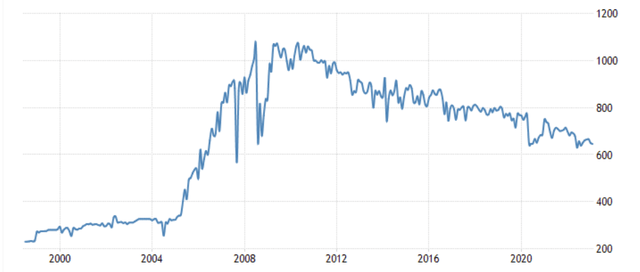

The newest OPEC member is Gabon, which re-joined the organization in 2016, after previously leaving in 1995. Here is Gabon’s production in bbl/d over the last 25 years:

tradingeconomics.com

Joining the cartel in 2016 hasn’t changed the long-term downtrend.

Azerbaijan

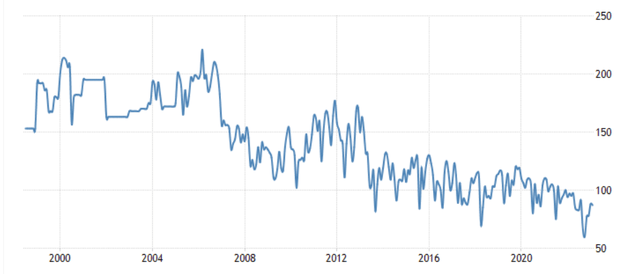

Azerbaijan is a more significant producer than Gabon, but the long-term trend is also down:

Tradingeconomics.com

If the country were to join OPEC, it may agree to a lower quota, but production would likely fall anyways.

Malaysia

Malaysia has been struggling to ramp up its production back to pre-pandemic levels:

Tradingeconomics.com

Brunei

Brunei is a tiny producer that has also been declining:

Tradingeconomics.com

Mexico

Mexico is the largest of the potential new members, but also in decline:

Tradingeconomics.com

I attribute the uptick in the last few years to Mexico’s 2013 energy reform that opened to country to foreign oil investment for the first time since the 1940s. Luckily for investors, this was carried out as a constitutional reform, which makes it harder for AMLO (Andres Manuel Lopez Obrador) to overturn. However, the President still has the discretion not to open new licensing rounds so the progress may fade.

Let’s not forget too that Mexico has an important relationship with the U.S. that runs across immigration, agriculture, supply chains and pretty much everything, including unfortunately drugs. The current U.S. administration with its above and beyond efforts to keep oil prices in check will likely not be happy with Mexico joining the cartel so this may dissuade AMLO, assuming he’s even considering it.

Watch Saudi Arabia and Russia

Adding Azerbaijan, Malaysia, Brunei or Mexico to OPEC may add some political benefits to the organization, perhaps greater legitimacy on the international stage, but the production significance will likely be negligible.

Ultimately, the two important heavyweights to watch are Saudi Arabia and Russia (as part of OPEC+).

Saudi Arabia just extended its voluntary July ‘lollipop cuts’ of 1 million bbl/d into August. Russia also seems to be playing ball:

Russia acknowledges the reduction of oil supplies to markets by 500,000 barrels daily in August through exports lowering and intends to take all the required action for this purpose, the Ministry of Energy told TASS.

Supplies will be lowered in addition to earlier assumed commitments on the voluntary production cut.

Based on Refinitiv, Russian seaborne exports were already tracking at 4.32 million bbl/d in June, down from 5.07 million bbl/d in May. As Energy Tidbits has speculated, this may coincide with the increase in Russian domestic demand as their refineries come out of seasonal maintenance.

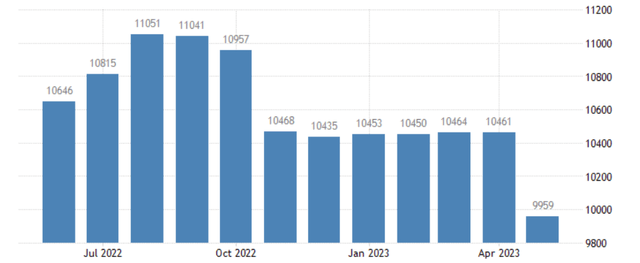

Saudi oil production tracks the cuts announcements so far:

Tradingeconomics.com

Historically, the summer is also Saudi’s domestic peak demand due to more power consumption for air conditioning. So it is easier for Saudi Arabia to commit to these cuts too.

Bottom line

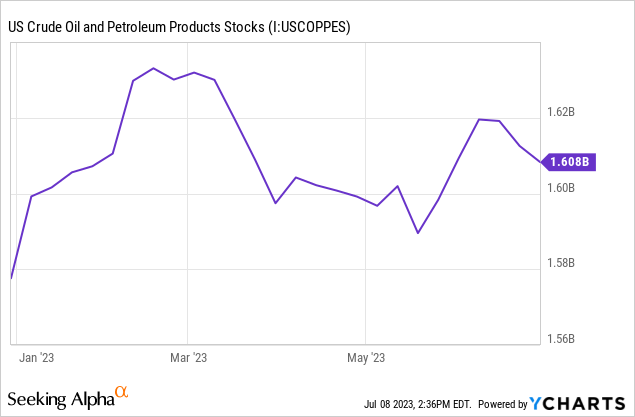

The OPEC expansion talk is mostly noise. The key point is if Saudi Arabia and Russia deliver on their promises. It is also important if the impact would be felt by the closely watched U.S. inventories, which are probably the most transparent and timely reported in the world.

After building for much of the first half of the year, it looks we may be finally starting to draw again:

For oil longs, the downside of the Saudi and Russian cuts may be that they increase spare capacity, which will keep a lid on prices from rising too high. However, as a market stabilizing measure they seem to work okay so far.

My base case is now $70-$80 oil for longer and I find that great for the offshore and services stocks where I currently try to focus.