onurdongel

Investment Thesis

Symbotic (NASDAQ:SYM) has been one of the best-performing companies this year, already up nearly 290% amid the booming enthusiasm around AI (artificial intelligence). The company has a sophisticated end-to-end automated warehouse system that is well-positioned to benefit from the rapid expansion of the logistics automation market. However, the valuation has gotten extremely elevated after the rally, which will likely weigh on its near-term upside potential.

YCharts

Why Symbotic?

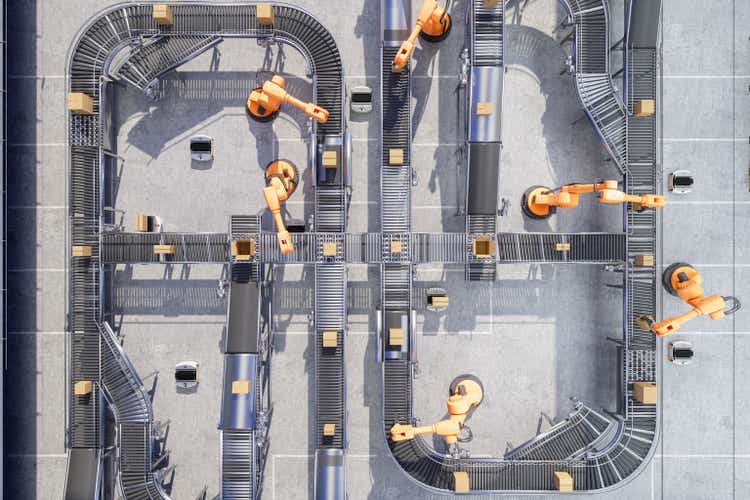

Symbotic is a Massachusetts-based technology company that specializes in supply chain automation. It provides an end-to-end automated warehouse system that comprises both hardware and software. The hardware includes vision-enabled autonomous robots (e.g. mobile robots and robotic arms) that induct, store and retrieve products within a specific structure. The software is responsible for routing, sequencing, planning, and orchestrating these robots to make them work cohesively together.

Symbotic’s system currently owns over 490 patents (existing and pending) and has multiple competitive advantages. For instance, its unique storage structure maximizes inventory density and capacity, which enables a 30% to 60% reduction in warehouse footprint. Its robots are also equipped with machine-learning capabilities, which allow them to improve and optimize their performance over time. The vision and sensing capability of its robots also increases the accuracy and reliability of their decision.

The system’s strong capabilities convert to great ROI (return on investment) for customers. According to a company, $50 million spent on the system can result in savings of $250 million across its lifetime (~25 years), with outbound efficiency improving by 5x to 9x. This helped the company land multiple blue-chip customers including Walmart (WMT), Target (TGT), and Albertsons (ACI). The company currently only serves US groceries and general merchandise companies, and a potential expansion into other verticals and locations should substantially increase its growth opportunities.

Symbotic

Huge Market Opportunity

Logistics automation presents a huge and fast-growing market opportunity. According to Precedence Research, its market size is forecasted to grow from $52.6 billion in 2021 to $162.5 billion in 2030, representing an excellent CAGR (compounded annual growth rate) of 13.2%. Symbotic is even more optimistic and expects its serviceable addressable market to potentially reach over $400 billion in the future. The market continues to expand rapidly due to the rise of the commerce industry, especially around e-commerce and omnichannel commerce (e.g. buy online pickup in-store).

The increasing retail channels vastly increase the complexity of companies’ logistic processes. While the system’s initial setup is expensive, there are multiple long-term benefits. Automation allows the company to increase operating efficiency, reduce headcount, and lower costs all at the same time. For instance, South Korean e-commerce giant Coupang (CPNG) has been leveraging automation robots in its fulfillment centers, which plays a key to its path to profitability. I believe logistics automation is an inevitable trend that will continue to be a priority investment area for retail companies.

Symbotic

Mixed Financials

Symbotic has been showing strong revenue growth but profitability continues to be a notable concern. The company reported revenue of $266.9 million in Q1, up 177% YoY (year-over-year) compared to $96.3 million. However, costs jumped 182% from $79.4 million to $224 million. Operating expenses also increased 114% from $46.9 million to $100.6 million. This resulted in the net loss widening 85.3% YoY from $(29.9) million to $(55.4) million, or (20%) of revenue.

Due to the company’s product nature, costs are extremely heavy at the start of the contract, as the company has to put everything in place. The annual software subscription and potential upsell afterward are generally where the profit comes from, as the incremental costs for these products are minimal. According to the company, its gross margin increases by 60% across the lifetime of the system. This poses a risk as profitability will be under pressure if the company cannot expand its relationship with existing customers or reach a large enough scale.

Customer concentration is another concern in my opinion, as the company currently relies heavily on only a handful of high-paying customers (predominantly Walmart and Albertsons). The expensive price tag of its products also pushes away many smaller potential customers, which reduces its addressable market and makes customer diversification much harder.

Expensive Valuation

After the 250% rise in share price this year, Symbotic’s valuation is now extremely expensive in my opinion. The company is currently trading at an EV/sales ratio of 25.6x, which is substantially higher than other warehouse automation companies including Zebra Technologies (ZBRA) and Berkshire Grey (BGRY). I am using EV/sales as the company is still not profitable yet.

As shown in the chart below, the two companies have an average EV/sales ratio of 3.8x, which represents a massive discount of 85% compared to Symbotic. The company’s revenue growth is much stronger, but most of the optimism is likely priced in already. I do not see much upside potential unless it can further accelerate its growth, which seems unlikely.

YCharts

Investor Takeaway

Symbotic is a great company trading at a bad price. The company has an advanced warehouse automation system that demonstrates strong competitive advantages and value propositions. It should also benefit meaningfully from the market’s rapid expansion, as the popularity of e-commerce and omnichannel commerce continues to grow. However, profitability and customer concentration are notable concerns. The valuation is also extremely expensive, which will likely limit its upside potential in the near term. The current risk-to-reward ratio does not look particularly attractive therefore I rate the company as a hold.