grandriver

A Quick Take On Rise Oil & Gas, Inc.

Rise Oil & Gas, Inc. (RISE) has filed to raise $11.5 million in an IPO of its common stock, according to an SEC S-1 registration statement.

The firm is operating as an independent oil & gas exploration and production company in the Texas Permian Basin.

RISE has no history of revenue generation and is thinly capitalized.

When we learn more IPO details from management, I’ll provide a final opinion.

Rise Overview

Austin, Texas-based Rise Oil & Gas, Inc. was founded to acquire oil & gas drilling rights in the Texas portion of the Permian Basin, with the intent of drilling one to two wells on its existing leasehold.

Management is headed by Chairman and CEO Kelly Hoffman, who has been with the firm since its inception in June 2021 and was previously CEO of Ring Energy (REI) and a co-founder, CEO and President of Arrow Operating Company, which was sold to Range Resources.

Rise has acquired a total of approximately 4,339 leasehold acres between multiple locations and seeks to ‘efficiently drill and develop our prospects, create proved reserves, achieve production, and generate operating cash flow.’

As of March 31, 2023, Rise has booked fair market value investment of $5.5 million from investors.

Rise’s Market & Competition

According to a 2022 market research report by GlobalData, the US Permian Basin crude oil and condensate production capacity is an estimated 5 million barrels per day and natural gas capacity is approximately 19.9 million cubic feet per day.

It is the largest oil-producing basin in the U.S. and is located in the region of West Texas and Southeast New Mexico.

In June 2019, the US Bureau of Land Management (BLM) estimated that the Permian Basin contained an estimated 46.3 billion barrels of undiscovered, technically recoverable oil and 281 trillion cubic feet of undiscovered, technically recoverable natural gas.

The Permian Basin is the largest tight oil play in the United States and one of the most active and economically important oil and gas plays in the world.

The company seeks to acquire assets ‘at a discount to market, increasing production and cash-flow through recompletion and re-entries, secondary recovery and lower risk infill drilling and development.’

Major competitive or other industry participants include:

-

Chevron

-

Exxon Mobil

-

Occidental Petroleum

-

ConocoPhillips

-

Pioneer Natural Resources

-

Chesapeake Energy

-

Devon Energy

-

EOG Resources

-

Endeavor Energy Resources

-

Marathon Oil

-

Coterra Energy

-

Continental Resources

-

Laredo Petroleum

-

TXO Energy Partners

Rise Oil & Gas, Inc. Financial Performance

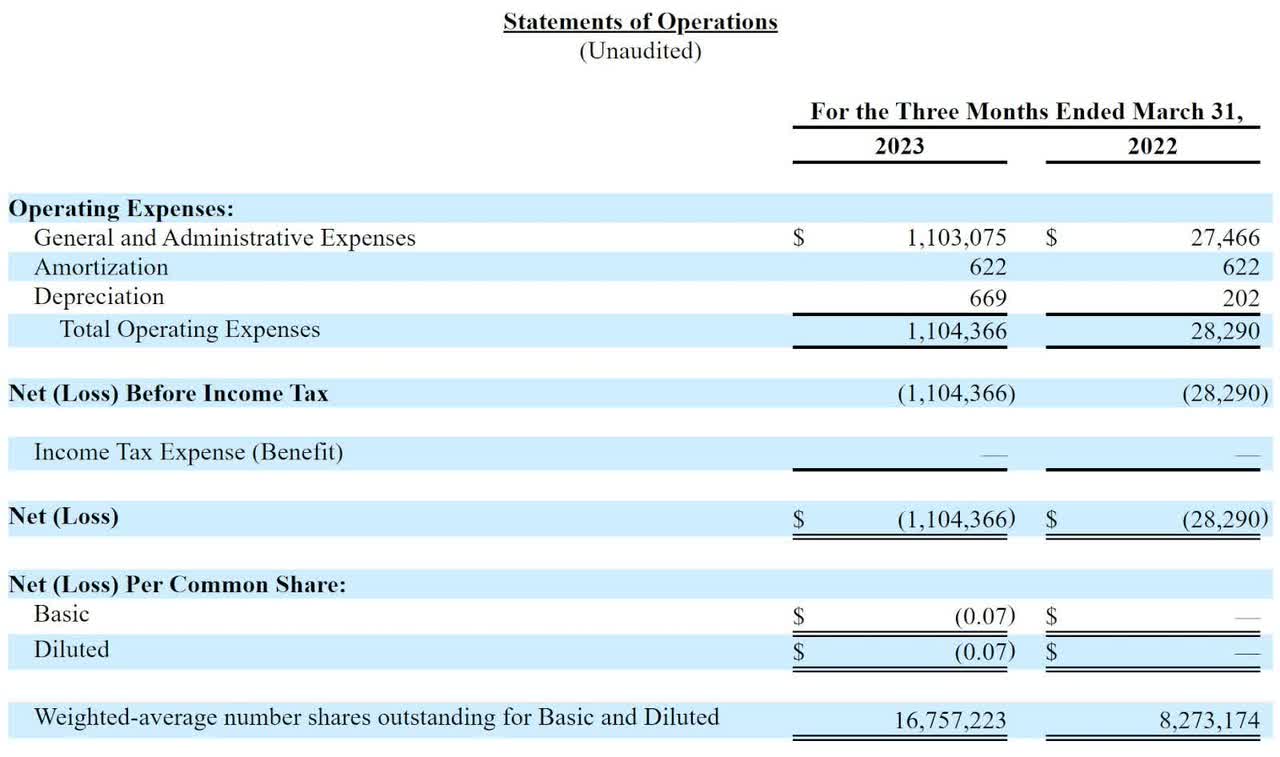

Below are relevant financial results derived from the firm’s registration statement:

Statement Of Operations (SEC)

As of March 31, 2023, Rise had $1.7 million in cash and $1.5 million in total liabilities.

Rise Oil & Gas, Inc. IPO Details

Rise intends to raise $11.5 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says the firm qualifies as an ’emerging growth company’ as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements; prospective shareholders would receive less information for the IPO and, in the future, as a publicly-held company within the requirements of the Act.

The company also claims to be a ‘smaller reporting company’, meaning it may be exempt from the more stringent financial reporting requirements before and after an IPO. For a non-exhaustive comparison of emerging company and smaller reporting company reporting and related requirements, view a summary here.

Management says it will use the net proceeds from the IPO as follows:

We intend to use the net proceeds from this offering to acquire new oil and natural gas leases, drill and complete new wells and for general corporate purposes.

(Source – SEC)

The firm’s equity compensation incentive plan provides for 500,000 shares of company stock for long-term incentive awards to management; this amounts to 3.64% of the 13,872,197 total shares issued and outstanding as of December 31, 2022.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management did not characterize the firm’s legal liability exposure, if any. It did state that its directors and executive officers have not been ‘involved in any legal proceedings as described in Item 401(f) of Regulation S-K in the past ten years.’

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary About Rise’s IPO

RISE is seeking U.S. public capital market investment to fund its operations and for acquiring additional leasehold interests.

The company’s financials have produced no revenue yet and significant operating and leasehold acquisition expenses.

The firm currently plans to pay no dividends and to retain future earnings, if any, for reinvestment into the firm’s growth and working capital requirements.

The market opportunity for oil and gas extraction in the Permian Basin is large and expected to continue producing significant amounts of natural gas and oil in the coming years.

ThinkEquity is the sole underwriter and the four IPOs led by the firm over the last 12-month period have generated an average return of negative (44.6%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Business risks to the company’s outlook as a public company include its tiny size and the need for significant capital to fund its operations and for acquisitions.

When we learn more about the IPO’s pricing and valuation assumptions, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.