kynny

Investment Thesis

Applied Optoelectronics, Inc. (NASDAQ:AAOI) has seen its share price soar 300% over the past 2 months.

And even though there are some interesting news bits that the company is embarking on of late, I don’t see this size of a move as being justified on anything more than animal spirits.

I recognize that the stock, even today, is priced at about 1x sales and this is not expensive. However, the business is volatile and burning through free cash flows, plus holds a balance sheet that leaves a lot to be desired.

All in all, I struggle to get bullish on this stock.

Why Applied Optoelectronics? Why Now?

Applied Optoelectronics manufactures advanced optical communications products. The business is in the process of selling a portion of its business to Yuhan Optoelectronic Technology (Shanghai) Co., Ltd. This asset sale will bring $150 million in proceeds. As part of the transaction, AAOI anticipates investing an amount equal to between 4% and 10% of the estimated proceeds from the transaction in exchange for a 10% equity in Yuhan. Simply put, this will tie up some of the capital from the sale.

This was announced last year, and the most recent earnings call leads one to believe that the transaction could close in Q4 2023 or early 2024.

To the best of my estimates, this sale gives up about 14% of AAOI’s business. Meaning that AAOI will be slightly smaller going forward beyond 2024.

Revenue Growth Rates Need to Improve

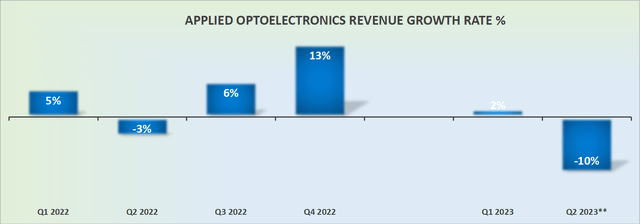

AAOI revenue growth rates

Moving on, what we see above is a business that prior to shedding its assets to Yuhan, AAOI’s revenues are far from stable.

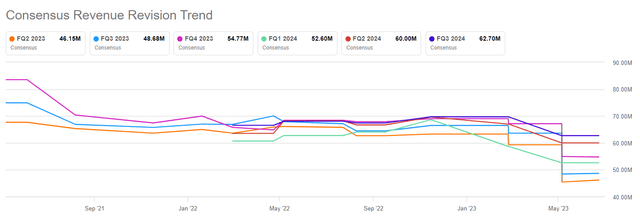

In fact, even before the sale goes through, analysts following the company had already been steadily revising downwards AAOI’s revenue consensus figures.

SA Premium

Finally, I recognize that in the past few weeks, AAOI has inked a deal with Microsoft (MSFT). And obviously, that’s a big win for the company. But the 8-K filing provides no insight into the revenue stream.

The 8-K only states that the initial contract is in place for 5 years. What I will put forth is that AAOI already had Microsoft as a significant customer. In fact, in 2022, approximately 18% of AAIO’s business was tied to Microsoft. So, I don’t see this new deal as being significantly larger than its prior tie-up with Microsoft.

AAOI Financial Position Leaves a Lot to be Desired

AAOI had $27 million of cash left on their books. This was offset by $70 million of debt. And then, on top of there are the convertible notes.

Let’s take these in turn. In the first instance, AAOI must repay $70 million worth of debt in the next twelve months, or sooner, that’s why the debt has been made current. This was something that surfaced during the Q&A section of the call, and this is what management said:

I think the transaction that we noted, the proceeds from that should be $150 million minus some amount of holdback, and that certainly gives us the ability to service that debt in the timeframe in which it’s going to come due.

Of course we’re also exploring other options in terms of other things that might be possible if that transaction gets pushed out or what have you. But certainly the cash from the transaction would be very instrumental to servicing that debt.

In other words, management is upfront with the fact that it’s selling its business, and a substantial portion of the proceeds is going to clean off its balance sheet. Meaning that there’s little excess capital to reinvest back into the business to improve its profit margins over time.

Then on top of that, AAOI’s convertible notes reach $80 million, and they are due by March of next year.

Essentially, AAOI’s business is not going to sink. But the business is far from thriving either.

The Bottom Line

Applied Optoelectronics has experienced a significant surge in its stock price, but I remain skeptical about the justification behind such a dramatic move.

While the stock may not be expensive based on its price-to-sales ratio, Applied Optoelectronics, Inc. faces volatility, negative free cash flows, and a less-than-desirable balance sheet.

The company is in the process of selling a portion of its business to Yuhan Optoelectronic Technology, which will provide proceeds of $150 million.

However, this transaction will tie up capital and make AAOI slightly smaller going forward.

Prior to the sale, AAOI’s revenue growth rates were unstable, and analysts had already been revising down their revenue expectations. The recent deal with Microsoft is a positive development, but its significance may not be significantly larger than their previous tie-up.

AAOI’s financial position is also concerning, with a limited cash balance, significant debt, and upcoming repayment obligations. While Applied Optoelectronics, Inc. may not be sinking, it is far from thriving.