onurdongel

Investment Thesis

Symbotic, ( SYM NASDAQ: ), has been among the top-performing companies in this year. The stock is up by nearly 290% due to the growing interest in AI (artificial Intelligence). The company’s end-to-end warehouse automation system is well positioned to take advantage of the rapid growth in the logistics automation market. The current valuation is still attractive and has plenty of upside potential, despite the recent rally.

YCharts

Why Use Symbotic?

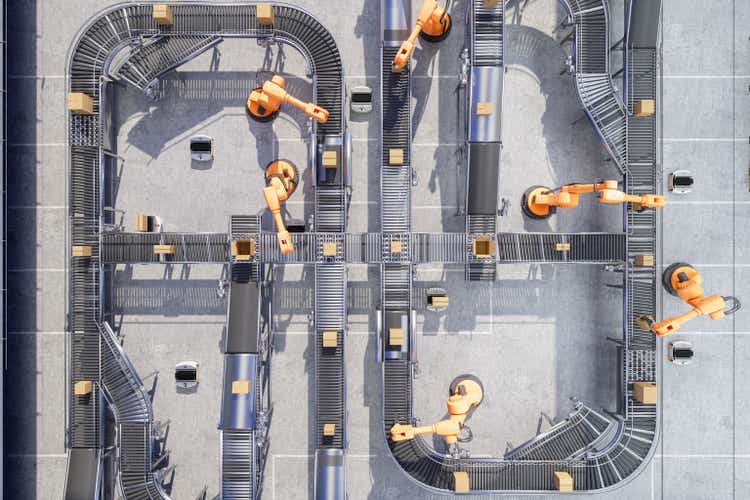

Symbotic, a technology company based in Massachusetts that specializes supply chain automation. The company offers a complete automated warehouse system, which includes both hardware and software. Hardware includes vision-enabled, autonomous robots. Mobile robots and robotic arm) are used to induct, store, and retrieve products from a structure. Software is responsible for routing these robots, sequencing them, planning and orchestrating their work.

Symbotic’s system has over 490 patents, both pending and existing. It also boasts multiple competitive advantages. Its unique storage structure, for example, maximizes inventory density, capacity and reduces warehouse footprint by 30% to 60%. The robots also have machine-learning abilities, which allows them to optimize and improve their performance with time. Its robots’ vision and sensing capabilities also increase the accuracy and reliability in their decisions.

Customers benefit from the system’s high ROI (return-on-investment). A company claims that $50 million invested in the system could result in $250 million savings over its lifetime (25 Years), and outbound efficiency can improve by 5x-9x. The company was able to secure multiple high-profile customers, including Walmart ( WMT), Target( TGT),and Albertsons ( ACI). The company only currently serves US grocery and general merchandise companies. A potential expansion into new verticals and geographical locations could significantly increase its growth.

Symbotic

Huge Market Opportunity

The logistics automation market is a large and rapidly growing opportunity. Precedence Research predicts that the market will grow from $52.6 Billion in 2021 to 162.5 Billion in 2030. This represents a CAGR of 13.2%. Symbotic, on the other hand, is more optimistic. It expects that its addressable serviceable market will reach $400 billion by 2030. Market growth is accelerating due to the growth of commerce, particularly around ecommerce and omnichannel (e.g. Buy online and pick up in store.

The complexity of logistical processes is increasing due to the increase in retail channels. The initial cost of the system is high, but there are many long-term advantages. Automation can help the company increase its operating efficiency while reducing costs. Coupang, a South Korean ecommerce giant ( CPNG ) uses automation robots in its fulfillment centres. This is a crucial factor for its profitability. Logistics automation will be an area of investment for retail companies that is likely to continue.

Symbotic

Value for Money

Symbotic is currently trading at an EV/sales ratio of 2.4x, which is cheap compared to other warehouse automation companies such as Zebra Technologies (a href=”https://seekingalpha.com/symbol/ZBRA” title=”Zebra Technologies Corporation”>ZBRA/a>) and Berkshire Grey (a href=”https://seekingalpha.com/symbol/BGRY” title=”Berkshire Grey, Inc.” As shown in the chart below, the company currently trades at a EV/sales of 2.4x. This is low compared to warehouse automation companies such as Zebra Technologies ( ZBRA), and Berkshire Grey( BGRY).

Both companies have a 3.8x average EV/sales, which is a premium of 58% over Symbotic. This huge valuation gap is unjustified, since the company’s 177% revenue growth in the last quarter was also higher than its peers.

YCharts

YCharts

Risques and concerns

I find that profitability is an important concern, since Symbotic has a net loss of (20%)%, which is far from breakeven. The costs of this product are high at the beginning of the contract because the company must set up everything. Profits will come from the annual software subscription, and any upsells that may follow. The incremental costs of these products are very low. The company claims that its gross margin will increase by 60% over the life of the system. The company faces a serious risk if they cannot grow their relationship with customers or achieve a sufficient scale.

Another minor risk is the concentration of customers, since the company relies heavily on a few high-paying clients (mostly Walmart). Its high price also scares off many smaller customers, making it difficult to diversify its customer base.

Investors Takeaway

Symbotic has a lot of potential, in my opinion. The company’s warehouse automation system has strong value propositions and competitive advantages. The market is expanding rapidly, and the company should benefit from this. Its current price seems to be discounted, given its growth and prospects. I think the company has more room to grow and rate it as a purchase.