DonNichols

Southwest Gas Holdings (NYSE:SWX) is a regulated natural gas utility that primarily serves the city of Las Vegas but also has operations stretching into Arizona and California. The utility sector in general has long been among the favorites for retirees and other conservative investors due to the overall financial stability of most companies in the sector as well as their relatively high dividend yields. As I have noted in the past, natural gas utilities have not been attracting nearly as much interest from investors as electric utilities due partly to a widespread perception that residential natural gas will soon be replaced by electricity for many purposes. That’s highly unlikely to be the case due to a variety of reasons, so this may be creating an opportunity for savvy investors in the market. Unfortunately, Southwest Gas does not appear to be particularly cheap right now due in part to its relatively low growth rate. The company does have an attractive 3.90% yield at the current price though, which should prove attractive to income-focused investors but it’s still well below the yield available in the money market. Let us investigate and see if this company could be a reasonable investment today.

About Southwest Gas Holdings

As stated in the introduction, Southwest Gas Holdings is a regulated natural gas utility that provides services to customers in Las Vegas. The company also provides services to customers in Phoenix as well as Tucson. The company is the largest utility supplier of natural gas in both Nevada and Arizona. This is not really a bad place to be as both of these states have been experiencing population growth in recent years.

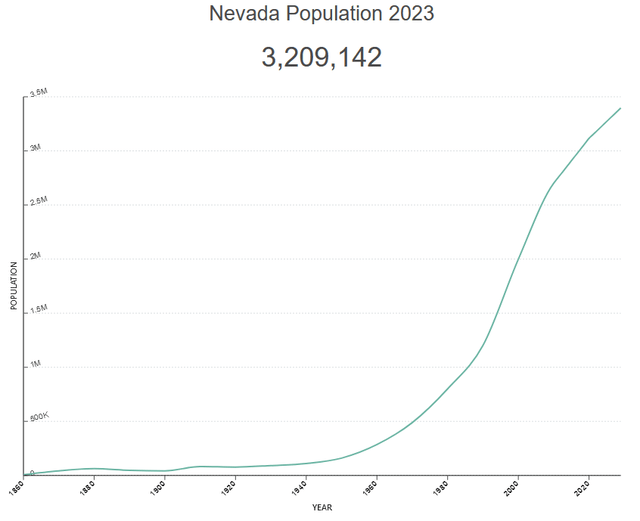

This chart shows Nevada’s population over time:

World Population Review

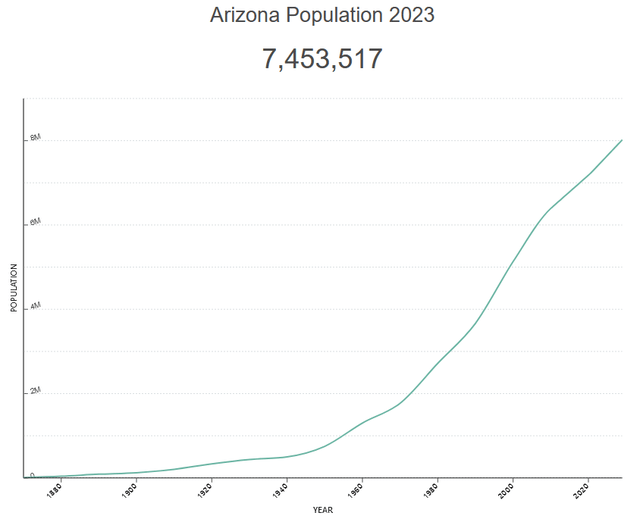

Here’s the same chart for Arizona:

World Population Review

As we can clearly see, both Arizona and Nevada have been growing their populations since 2020. This is much better than states such as California which have seen their populations decline over the same period. The reason for choosing 2020 as our point of comparison is because of the change in population demographics that occurred beginning in that year. As you may recall, during 2020 a large number of companies switched from office-based work to remote work in order to keep themselves operational during the pandemic. This allowed people to no longer have to live in a certain area just because that is where their jobs are located. We started to see people move to areas that they wanted to live in as a result.

The reason that this is important for our purposes here is that population growth in a utility’s service territory is one of the only ways that it’s able to grow its revenues. After all, as the company’s customer base grows, it will have more people paying their monthly bills and thus providing it with higher revenues. These higher revenues ultimately make their way down to bottom line profits. In the first quarter of 2023, Southwest Gas Holdings reported that it added 43,000 new customers in the trailing twelve-month period. The company has approximately two million customers so this is about a 2% year-over-year growth rate, which is not too bad for a utility.

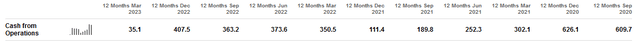

The fact that Southwest Gas has approximately two million customers makes it one of the largest natural gas utilities in the United States. However, as I have noted in the past, the size of a utility does not change the fact that it will possess certain inherent characteristics. Perhaps the most important of these is that Southwest Gas enjoys relatively stable cash flows over time. We can see this by looking at the company’s operating cash flows. Here they are during each of the past eleven trailing twelve-month periods:

Seeking Alpha

We do see a few variations, most notably the steep decline that occurred during the period that ended on March 31, 2023. That’s not particularly surprising though, and in fact many natural gas utilities saw their first quarter 2023 cash flows come in a lot weaker than normal. The biggest reason for this was the warm winter that allowed customers to consume less natural gas than normal to heat their homes. This is an unfortunate downside to natural gas utilities compared to electric ones. Southwest Gas Holdings is going to have more exposure to weather-related fluctuations than a comparable electric utility. However, the big thing that we don’t see is that the company’s cash flows did not come in a lot weaker than normal during 2020 despite the recession that accompanied the pandemic-related lockdowns. In fact, the company reported especially strong cash flows over most of 2020 even though Las Vegas suffered economic troubles during the period due to its heavy dependence on the tourism industry. This is an important thing for our purposes as investors.

The reason for this overall stability in any economic climate is that Southwest Gas provides a product that’s generally considered to be a necessity for our modern way of life. After all, many people have natural gas heating systems in their homes and so they need the natural gas utility to supply fuel to keep them warm during cold days. As such, most people will prioritize paying their utility bills ahead of making discretionary expenses during periods when money gets tight. This could include periods like today, as I discussed in a recent blog post. As such, a company like this should be able to weather a recession much better than something that’s more dependent on consumer spending. As the economy is widely expected to enter a recession during the second half of the year, the presence of a company like this could prove to be a much-needed safe harbor in our portfolios.

Growth Prospects

Naturally, as investors, we’re unlikely to be satisfied with mere stability. We like to see a company that we are invested in grow and prosper with the passage of time. Fortunately, Southwest Gas is well positioned to accomplish this. As was already discussed, the company operates in two states that are experiencing respectable population growth but this is only one of two ways that the company will deliver growth. The other is by increasing the size of its rate base.

The rate base is the value of a company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to increase the amount that it charges its customers in order to earn this specified rate of return. The usual way for a company like this to increase its rate base is by investing money into modernizing, upgrading, and possibly even expanding its utility-grade infrastructure. Southwest Gas is planning to do exactly this as the company recently revealed its plans to spend $2 billion on improving its infrastructure over the 2023 to 2025 period. I will admit that I would have preferred more visibility than this. Some of the company’s peers have presented capital investment plans extending through the end of 2027, which allows us as investors to make more accurate predictions as to where the company will be several years from now. This is naturally important for positions that you intend to hold for a long time. The fact that the company has not provided such an outlook is therefore disappointing.

With that said the company’s current planned capital spending program should allow it to grow its rate base at a 5% to 7% compound annual growth rate over the period. Curiously, it has not provided any guidance for earnings per share growth over the period but it will probably be in that same range unless Southwest Gas issues a significant amount of new equity to fund its capital spending. The company specifically states that it should be able to fund 65% to 70% of its capital program through the issuance of equity and the remainder through debt issuance, so unless that changes it should have earnings per share growth of 5% to 7%. This gives the company a 9% to 11% total return annually once we consider the current 3.90% dividend yield. That’s pretty good for a conservative utility company like this.

Financial Considerations

It’s always important to review the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That’s normally accomplished by issuing new debt and using the proceeds to repay the existing debt. As this new debt is going to have an interest rate that corresponds with the market rate at the time of issuance, this process can cause a company’s interest expenses to go up following the rollover in certain situations. As interest rates are currently at the highest levels that we have seen since 2007, this is a very real concern today. In addition to interest rate risk, we also have the fact that a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. While utilities such as Southwest Gas Holdings usually have remarkably stable cash flows, this is still a risk that we should not ignore as bankruptcies have occurred in the sector.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity will cover its debt obligations in the event of a liquidation of bankruptcy, which is arguably more important.

As of March 31, 2023, Southwest Gas Holdings had a net debt of $5.0049 billion compared to $3.4232 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.46 today. Here’s how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity |

| Southwest Gas Holdings | 1.46 |

| Atmos Energy (ATO) | 0.62 |

| NiSource Inc. (NI) | 1.43 |

| New Jersey Resources (NJR) | 1.55 |

| Northwest Natural Holdings (NWN) | 1.24 |

As we can see, Southwest Gas Holdings does generally have a higher level of leverage than many of its peers, but it’s also not too far out of line with the group. This is a sign that it’s probably not using too much leverage in its financial structure, which is good because that should indicate that the company is not taking on an excessive amount of risk through its financial structure. It’s worth noting too that management stated in the most recent conference call that the company is committed to reducing its debt, and the company’s net debt did drop by $999.9 million during the first three months of 2023 so it appears that the company’s management is actually backing up its statements with action. Thus, we probably do not need to worry too much about the company’s debt at the current level.

Dividend Analysis

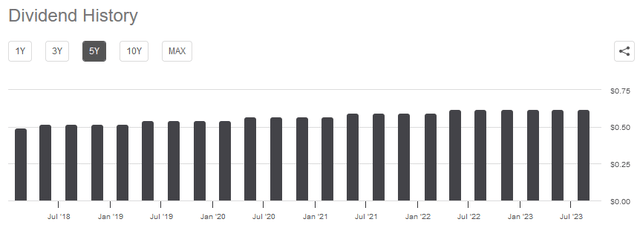

As stated earlier in this article, one of the biggest reasons why investors purchase shares of utility companies is that they normally have a higher yield than many other things in the market. This comes from the fact that these companies have fairly low growth rates, so they’re not usually able to benefit from a rapidly-rising valuation like a high-growth company can. As such, they pay out a large proportion of their cash flow to investors in order to provide a competitive return. Southwest Gas Holdings is certainly no exception to this as the company yields 3.90% at the current stock price, which is substantially higher than the 1.47% yield of the S&P 500 Index (SPY) today. Southwest Gas also has a history of raising its dividend over time, although it did not increase it this year:

Seeking Alpha

A rising dividend is generally something that’s very attractive during periods of inflation, such as today’s environment. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. As such, it can feel as though we’re getting progressively poorer and poorer with the passage of time. This can be a problem for those that are depending on their portfolios for income, such as most retirees. A regular dividend increase helps to offset this effect and maintains the purchasing power of the dividend over time.

With that said, it’s critical to ensure that the company can actually afford the dividend that it pays out. After all, we do not want to be the victims of a dividend cut since that would both reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. The free cash flow is the cash that was generated by a company’s ordinary operations that is left over after it pays all of its bills and makes any necessary capital expenditures. This is therefore the money that is available to reward the shareholders through debt reduction, stock buybacks, or dividends. During the twelve-month period that ended on March 31, 2023, Southwest Gas Holdings had a negative levered free cash flow of $838.8 million. That’s obviously not enough to pay any dividends, yet the company still paid out $166.2 million to its shareholders during the period. At first glance, this is likely to be concerning since the company is clearly failing to cover its dividends out of free cash flow.

However, it’s common for a utility to finance its capital expenditures through the issuance of debt and equity. This is due to the fact that it’s extremely expensive to construct and maintain utility-grade infrastructure over a wide geographic area and these assets take many years to pay for themselves. Thus, if the company had to finance everything solely out of free cash flow, it would never be able to provide a return to the shareholders. During the twelve-month period that ended on March 31, 2023, Southwest Gas Holdings reported an operating cash flow of $35.1 million. This also was nowhere near enough to cover the $166.2 million in dividends that the company paid out during the period. However, as we noted earlier, its operating cash flow was rather weak during the first three months of 2023. The company has historically had an operating cash flow of well above $166.2 million during any given twelve-month period, as shown in the chart earlier in this article. Thus, it should be able to maintain its dividends at the current level.

Valuation

It’s always critical that we do not overpay for any assets in our portfolio. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of Southwest Gas Holdings, we can value the company by looking at the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. However, there are very few companies that have such a low ratio in today’s market so the best way to use this ratio as a valuation tool is to compare Southwest Gas Holdings’ ratio against its peers to see which is most attractive on a relative basis.

According to Zacks Investment Research, Southwest Gas Holdings will grow its earnings per share at a 5.00% rate over the next three to five years. This is reasonable based on the company’s projected rate base growth, although it’s possible that it can do a bit more. We can certainly use this earnings estimate though as it works reasonably with management’s guidance. At this earnings growth rate, Southwest Gas Holdings has a price-to-earnings growth ratio of 3.84 at the current stock price. Here is how that compares to the company’s peers:

| Company | PEG Ratio |

| Southwest Gas Holdings | 3.84 |

| Atmos Energy | 2.58 |

| NiSource, Inc. | 2.45 |

| New Jersey Resources | 2.99 |

| Northwest Natural Holdings | 4.32 |

While not the most expensive of its peers, Southwest Gas certainly does not appear cheap compared to its peers. This is probably because the company has a lower growth rate than some of these other companies, but has a higher yield to compensate. Overall, it will probably deliver a reasonably comparable total return. However, more value-oriented investors will want to wait for a market correction before buying in.

Conclusion

In conclusion, Southwest Gas Holdings is a somewhat under-followed natural gas utility with some interesting growth prospects. In particular, its service territory has been growing as people leave California in favor of Arizona and Nevada, allowing the company to grow its customer base and revenues over time. The company also is working to improve its utility-grade network, which should also help drive growth. Unfortunately, all of these good things come at a cost and Southwest Gas Holdings is not especially cheap at its current price. It’s still positioned to deliver a reasonable total return though and should be resistant to any near-term economic turbulence.