TennesseePhotographer

Tractor Supply (NASDAQ:TSCO) has proven to be a solid performer throughout various economic cycles, but I’d prefer to be a buyer of the stock on a price dip.

Company Profile

TSCO describes itself as a rural lifestyle retailer. The company sells supplies to help meet the needs of recreational farmers, ranchers, and people that live a rural lifestyle. The company currently operates three concepts – Tractor Supply, Petsense by Tractor Supply, and Orscheln Farm and Home. It acquired Orscheln in October 2022 and plans to rebrand all its stores to Tractor Supply by the end of fiscal 2023.

At the end of Q1, it operated 2,353 stores, of which 2,164 were Tractor Supply or Orcheln Farm locations, and 189 were Petsense stores. Tractor Supply stores typically range from 15,000 to 20,000 square feet, while Petsense locations are small-box stores.

Approximately 50% of its sales come from the livestock & pet category, followed by seasonal at 21%, hardware & tools at 19%, apparel at 7%, and agricultural at 3%. Within livestock & pet, over 20% of sales are for companion animals, while just under 20% are for livestock & equine.

Company Presentation

Opportunities and Risks

In general, TSCO has a very steady business, estimating that about 85% of sales comes from more staple categories, while only about 15% is of a more discretionary nature. It’s one of the largest sellers of animal feed in the country, which obviously is a nice replenishment business. It estimates that 85% of its customers own animals, and the majority own multiple. As such, selling large 40–50 pounds of animal feed is one of its core strengths.

This has helped lead to steady results through economic cycles, with the company only comping negative one year in the past 30 years, and that was 2009 when it was less than -1%. For Q1 of this year, the company saw its same-stores rise 2.1%, with traffic down -0.7% but ticket up 2.8%.

With that strong core business in place, the company has been expanding the categories and services it offers to help drive growth. Given the number of its customers that own pets, adding pet services has been one natural extension.

It’s also adding Garden Centers as part of its Fusion remodel program. About 30% of its stores have been remodeled, and about 15% have a side lot garden center. With Fusion, the company is updating its layout to give more space to higher productivity categories, such as adding more space to pets and taking away space for apparel. It’s also been adding an aisle for power tools. Currently, the company is remodeling 200–300 stores a year, with all stores expected to be remodeled by either 2026 or 2027, including all the Orscheln stores it acquired last year.

Discussing the growing TAM of its market at recent Robert W Baird conference, CEO Harry Lawton said:

“TAM, total addressable market for our business, we estimate to be about $180 billion. In 2019, we estimated that to be around $110 billion. 1.5 years ago, we updated the TAM and had 2 growth drivers going from $110 million to $180 billion. The first growth driver was just market growth over the last 3 years in the context of COVID, but certainly in just kind of the generational changes and lifestyle changes that are happening out there. And the TAM went from $110 billion to $140 billion just with that core market growth.

The second thing is we’re entering a number of new categories in our business, and we’ve been doing that over the last 3 years, namely pet services and also live goods and specifically, we’ve been adding garden centers as an attachment to our stores to the tune of about 3,000, 4,000 square feet, like a small version of what you might see at a home improvement store, what you’d see at say, an hardware or something like that. And we attribute those pieces, the extra vet services, the live goods and the additional garden categories that we’ll be addressing, you made another $40 billion of TAM. So that walked us from $110 billion to $140 billion to $180 billion. And then as Peter said, this year, we’ll do roughly $15 billion on $180 billion. So we’re at 8-ish, 9-ish percent of our total market. So significant opportunity for us as we look ahead.”

Store expansion is another opportunity for TSCO. The company currently opens about 70-80 new stores a year, and believes it can support around 2,800 Tractor Supply locations. That gives it about another 8 years of store growth. With less than 200 Petsense locations, it also should have amble opportunity to build out that concept as well.

When looking at risks, while TSCO has certainly shown to be recession resistant, it may not be completely immune from a downturn. Given its store expansion and move into other categories over the years, this could be more tested in the future. In Q1, traffic was down, so there was at least some pushback.

As a retailer, things like labor inflation and freight are also things to be aware of. On the freight side, though, it has been doing a good job of building out distribution centers closer to stores, helping with freight costs.

Valuation

TSCO stock currently trades around 14.5x the 2023 consensus EBITDA of $1.96 billion and 13.4x the 2024 consensus of $2.12 billion.

It trades at a forward P/E of 20.8x the FY24 consensus of $10.48.

The company is projected to grow revenue 7% in 2023 to $15.2 billion and 6.5% in 2024 to $16.2 billion.

The company pays out a $1.03 quarterly dividend, which it’s increased every year for the past 13 years. Its current yield is around 1.9%.

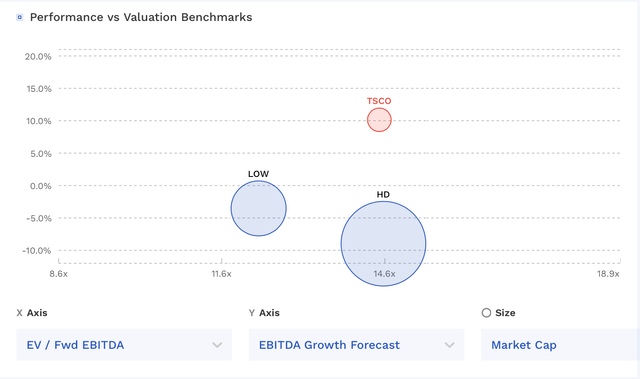

While it doesn’t have any great comps, the stock trades at a similar level to Home Depot (HD) and a bit of a premium to Lowe’s (LOW).

TSCO Valuation Vs Peers (FinBox)

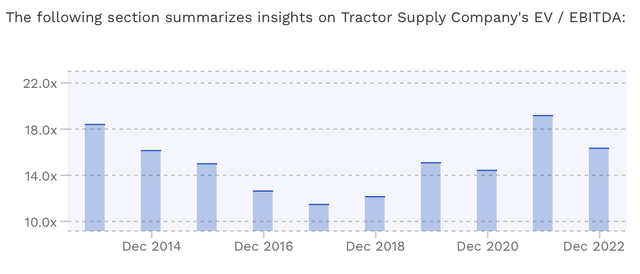

The stock has an average EV/EBITDA multiple of 15.1x over the past five years.

TSCO Historical Valuation (FinBox)

Conclusion

TSCO is a nice, steady business that has a proven track record of holding up in any economic environment, including during the financial crisis of 2008-9 and Covid. Meanwhile, it has some nice growth opportunities through its remodeling, category expansion, and store growth.

The stock isn’t cheap at current levels, although it is around the multiple it has historically traded at. The stock should be a solid performer, but I’d prefer to be a buyer on a dip when there is more upside potential. As such, I view it as a solid “Hold” and would prefer to be a buyer around $185, which would be under a 12x multiple on 2024 EBITDA.