richard johnson

Note:

I have covered Imperial Petroleum (NASDAQ:IMPP) (NASDAQ:IMPPP) previously, so investors should view this as an update to my earlier articles on the company.

Since its late-2021 spin-off from StealthGas (GASS), Imperial Petroleum’s strategy to pursue growth at the expense of common shareholders has resulted in outsized dilution.

Between January 2022 and March 2023, the company raised approximately $170 million in new capital, thus causing outstanding common shares to increase by more than 4,000%.

The company has used the funds to expand its fleet, with the majority of the vessels having been acquired from disclosed related parties associated with CEO Harry Vafias.

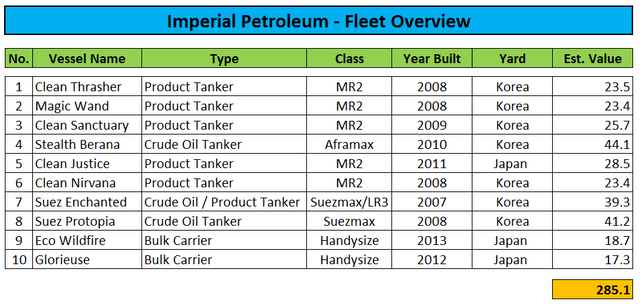

Following last week’s spin-off of two Handysize dry bulk carriers into a new Nasdaq-listed entity named C3is Inc. or “C3is” (CISS), Imperial Petroleum commands a fleet of ten vessels with an estimated value of approximately $285 million:

Regulatory Filings / MarineTraffic.com

The most recent related-party dealing looks particularly bad, in my opinion, with Imperial Petroleum overpaying by an estimated 15% for a pair of handysize dry bulk carriers and issuing $13.875 million in new Series C Cumulative Convertible Perpetual Preferred Stock as part of the purchase consideration:

The Series C Convertible Preferred Stock has a dividend rate of 5.00% per annum per $1,000 liquidation preference per share, which is payable in cash or additional shares of Series C Convertible Preferred Stock at the Company’s election, and is convertible, at the holder’s option, after the six-month anniversary of issuance into shares of the Company’s common stock at a conversion price equal to the lower of $0.50 and the ten-day volume weighted average price of the common stock.

Please note that the conversion option provides CEO Harry Vafias the chance to acquire a material part of the company going forward.

In recent months, the company has aggressively paid down debt “to utilize its excess cash amidst a positive market environment and shield its cash flow generation going forward against increasing finance costs“.

As a result, total outstanding debt has been reduced from approximately $70 million at the beginning of the year to zero as of today.

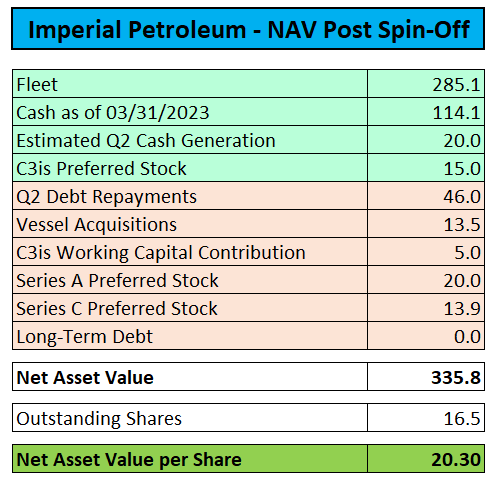

Last week, the company completed the spin-off of C3is. As a result, estimated net asset value (“NAV”) per common share has decreased slightly to $20.30:

Company Press Releases and Regulatory Filings

Imperial Petroleum’s stock- and warrantholders received one C3is share for every eight shares or warrants owned.

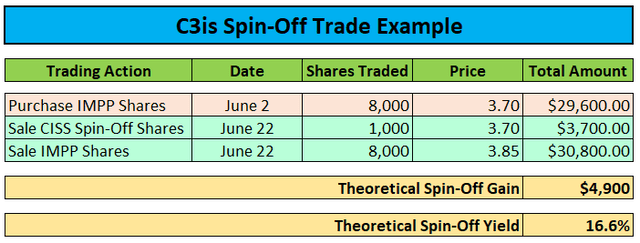

Dependent on timing, the spin-off would have provided for a promising trade. For example, purchasing 8,000 IMPP shares following the announcement of the spin-off date on June 2 would have resulted in an allocation of 1,000 C3is shares on June 22. Assuming a sale of both the IMPP and CISS shares at their respective closing prices on June 22 would have resulted in an almost $5,000 gain or approximately 16.6% within just three weeks:

Yahoo Finance / Author’s Assumptions

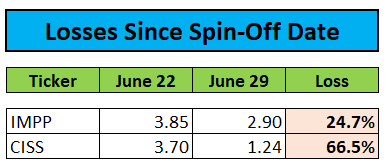

That said, keeping the shares would have been a terrible mistake, as both IMPP and CISS have sold-off quite heavily since the spin-off date:

Yahoo Finance

While I would mostly attribute the losses in Imperial Petroleum’s common shares to spin-off traders exiting positions, the massive sell-off in C3is’ common shares is almost certainly related to the company’s Form F-1 registration statement filed with the SEC on Monday:

Regulatory Filing

Very much as expected by me, C3is is wasting no time to raise funds for fleet expansion purposes, thus following the footsteps of parent Imperial Petroleum.

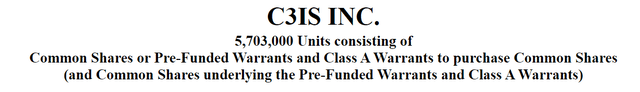

This prospectus relates to the issuance by us, on a best efforts basis, of up to 5,703,000 units (the “Units”), each consisting of one share of common stock, nominal value $0.01 per share (each, a “Common Share”), and one warrant to purchase one Common Share (each, a “Class A Warrant”), in each case at an assumed public offering price of $2.63 per Unit, equal to the closing price of our Common Shares on the Nasdaq Capital Market on June 23, 2023. Each Class A Warrant will be immediately exercisable for one Common Share at an assumed exercise price of $ per share (100% of the public offering price of each Unit sold in this offering) and expire five years after the issuance date.

As usual, controversial investment banking outfit Maxim Group LLC (FRHC) has been engaged as placement agent for the offering.

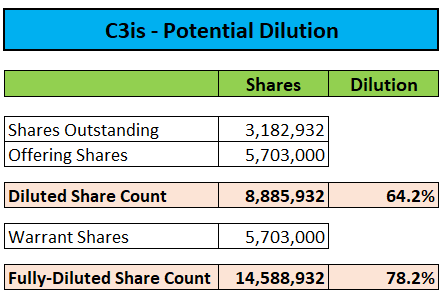

While the registration statement remains subject to changes and has yet to be declared effective by the SEC, the proposed offering has the potential to dilute existing shareholders by close to 80%:

Regulatory Filings

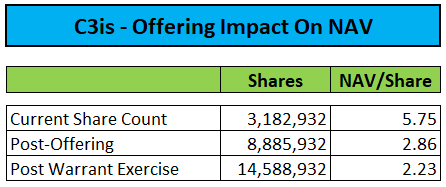

In addition, the company’s net asset value per share will be reduced very substantially:

Regulatory Filings

Usually, it takes a couple of weeks for the registration statement to become effective, so I would expect C3is’ shares to remain volatile in the near-term.

Bottom Line

Following last week’s completion of the C3is Inc. spin-off, both Imperial Petroleum’s and C3is’ common shares have sold off.

While I would mostly attribute the losses in Imperial Petroleum’s common shares to spin-off traders exiting positions, the massive sell-off in C3is’ common shares is almost certainly related to a registration statement for a proposed equity and warrant offering filed with the SEC on Monday.

While there appear to be no-near term catalysts for Imperial Petroleum’s common shares, I am reiterating my “Hold” rating based on management’s recent promise to abstain from additional common shareholder dilution for the time being.

Income-oriented investors should continue considering the company’s 8.75% Series A Preferred Shares (IMPPP) which currently offer a very safe double-digit yield.

At least when judging by Imperial Petroleum’s course of action since its spin-off from StealthGas eighteen months ago, C3is Inc.’s proposed equity and warrant offering might be just the prelude for additional capital raises down the road.

Given the very real risk of massive near-term dilution, investors should avoid C3is’ common shares or consider selling existing positions.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.