Naeblys

Investment Summary

Incredible revenue growth underpinned by strong and durable growth drivers is what makes Euronav NV (NYSE:EURN) a very interesting company right now. The company grew its top line by 197%, reflecting the growing demand in the industry as the large crude tanker freight markets remained in frequent use.

The hiked spot rates were a major cause for the growing revenues. The breakeven for EURN regarding their VLCC types is $23.415 and rates reached $51.400 in the last quarter, resulting in strong earnings growth. The future looks very promising as fixed prices remain above this for both the VLCC and Suezmax which should mean Q2 2023 will reflect a sequential growth. The management of EURN is anticipating distributing a $1.8 dividend in Q2 2023, a yield of around 12% with the current price, and that doesn’t include the Q1 guidance of $0.7 per share. The result is that EURN right now comes across as a very solid dividend play benefiting from decent future demand for crude tankers. I think at the current price, EURN is a solid buy that presents much more reward than risk.

High Spot Rates Are Persistent

One of the main reasons for the very successful quarter that EURN had to begin in 2023 is the higher spot rates they had compared to last year.

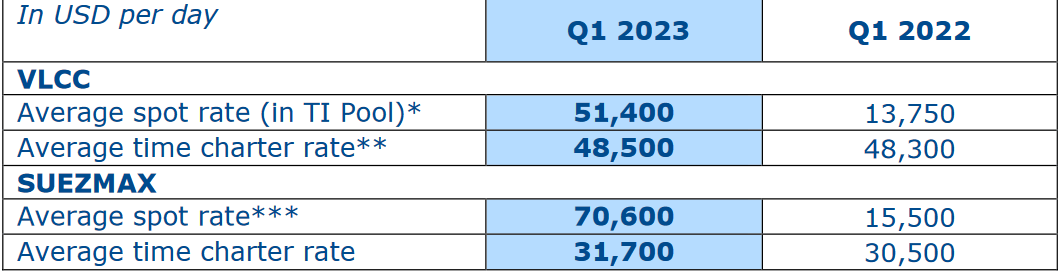

Spot Rates (Earnings Report)

The average time charter rate remains largely similar to Q1 2022 which indicates that performance was similar and nothing major changed here. But The interesting change is the average spot rates, which drastically increased, especially for the Suezmax, going from $15.500 in Q1 2022 to $70.600 in Q1 2023.

Looking deeper at the quarter, EURN noted that a sequential improvement in the rates was experienced in January – March. This is quite rare and this is only the third time this has happened since 1990 in both VLCC and Suezmax sectors. This further underlines the strength of the crude tanker market.

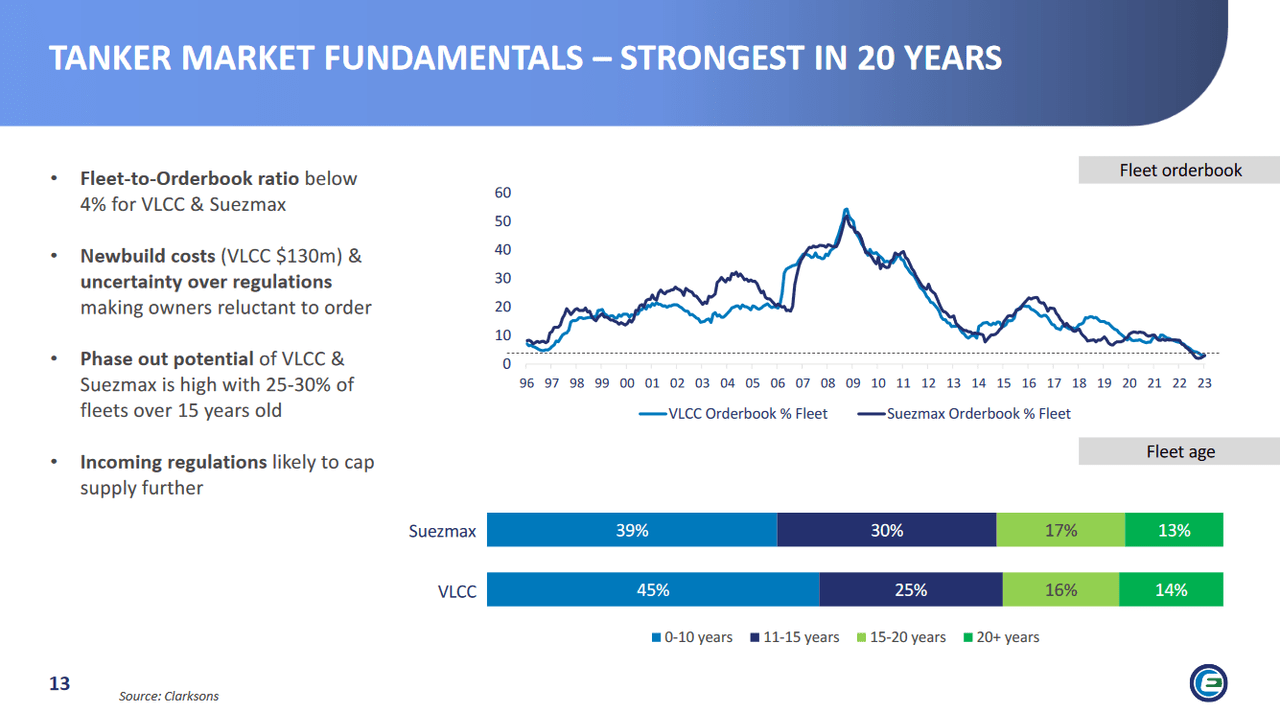

Market Fundamentals (Investor Presentation)

Some notable headwinds coming in the next few quarters are following the announcement that OPEC+ cutting supply as sources from the Middle East will be lower. This will force sourcing to be done from other regions, like Atlantic barrels, as demand from the Far East remains high. This will result in transportation about twice the distance but the positive ton-mile dynamic will be a key reason for some losses being offset. The demand for crude oil remains very high and this will result in EURN still having a market to serve. Some driving forces behind 2023 possibly ending up reaching a record 102m bpd in consumption are recovering air traffic and a Chinese market resurging. This could result in global crude consumption reaching pre-Covid 19 levels. I think this is very bullish for EURN as their 2019 spot rates were around $30.000 between the two sectors. Right now 2023 is looking to be far above that and with recovering crude demand I think we will see strong earnings reports from EURN.

Financials

As for the financial state of EURN, they have been very disciplined so far. The cash position has risen to over $200 million as the company aims to remain in a strong position to continue providing shareholders with value.

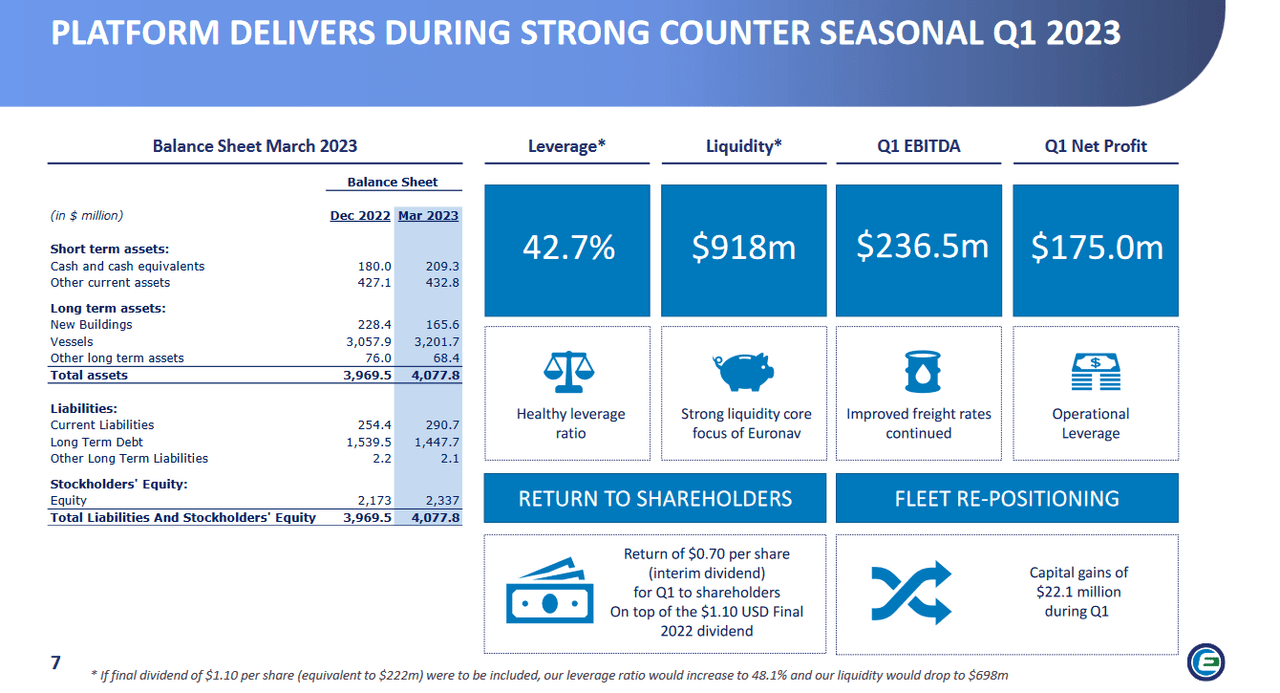

Balance Sheet (Investor Presentation)

With strong liquidity, I think EURN is in a position where it can continue making investments and building out its fleet further. The value of the vessels has grown by $200 million on a QoQ basis. I am looking especially at 2024 as it ordered two additional tankers expected to be delivered in Q3 2024. I think this would be a further growth accelerator for EURN.

In terms of debt, EURN has been proactive and paid down about 6.3% of the long-term debts on a QoQ basis. This has helped EURN reach a less leveraged position and the net debt/EBITDA ratio is right now at 2.29. Now, I think this is a little high even though it’s under my preferred threshold of 3. But I think there is ample reason to believe that the coming quarters will result in stronger EBITDA which will reduce this number and enable EURN to pay down debts more aggressively.

One of the worries I had with EURN previously was the lacking improvements in cash flows, but it seems that the times are changing and Q1 2023 resulted in $175 million generated in cash flows through operating activities, up largely from the negative result of Q1 2022. In terms of future performance for cash flows, I think the pertinent rates should be a reason to believe FCF will grow and result in increased dividends for the remaining part of 2023.

Risks

One of the main risks I see with EURN right now is the ongoing battle that is going on within the company. There are a lot of arguments and battles going on between major shareholders of EURN which could result in slowing investments and finally a lackluster growth performance. Right now there are two companies that each hold 25% of the stake in EURN. Those are Compagnie Maritime Belge (CMB) and Famatown. The pressure that CMB has put on management has resulted in the termination of the merger with Frontline (FRO) which was previously announced in 2022. EURN has been under scrutiny from the minority shareholder and in a recent shareholder meeting asked shareholders to accept the request to change 5 of the then current Supervisor Board with 5 of their directors. But the request was denied as CMB would have too much influence on the business and could essentially operate it from its minority position. I think ongoing struggles like this hurt the reputation of the company and I see it ultimately ending up with the share price trading at a lower multiple as outside investors view it as too risky.

Valuation & Wrap Up

Benefitting from growing crude demand seems very intriguing right now, especially if you can do it with a company like EURN that has a solid balance sheet and plans to distribute a very good dividend to investors. Often the case with companies in this sector is that the valuation will be quite low, I think a common reason being the nature of the industry. Fluctuations because commodities present risk, and therefore a lower valuation. With that said, I view the p/e under 7 right now for EURN to present a very solid entry point for the long term.

Looking at a similar company like Frontline plc, its valuation is lower than EURN at an FWD p/e of 5. But looking at the profit margins EURN has surpassed FRO and boasts better gross and net margins. As for the p/FCF with the two, they are largely similar at a multiple of around 3.7. Despite FRO having a much higher dividend yield, it seems to have resulted in a dilution of shares during the last few years. This makes EURN come out on top, as their outstanding shares have instead decreased.

Stock Price (Seeking Alpha)

The share price has tumbled in the first half of 2023 and is down around 6.5%. But I think this has resulted in the share price looking like a great entry point. The investment story with EURN is to essentially benefit from the strong spot rates as long as possible as it will directly translate to a very good dividend yield. Just looking at Q2 2023 it would put the yield at over 12% as the management aims to distribute $1.8 per share. I am rating EURN a buy as a result.