SHansche

A series of recent developments point to the limitations of the energy transition. From Sweden abandoning its goal of achieving 100% renewable energy to Siemens Energy (OTCPK:SMEGF) reporting problems with its onshore and offshore wind turbines, the reality is dawning on the public that wind and solar won’t be capable of replacing fossil fuels as planned.

However, the push toward electrification will continue. But with nuclear power at least five years away from scaling up, it will fall to natural gas to do the heavy lifting involved in generating the baseload power required to back up renewables and replace coal.

Cheniere Energy, Inc. (NYSE:LNG) remains our preferred way to play the increased adoption of natural gas throughout the world. Most regions lack a reliable domestic natural gas supply source and are forced to import LNG to meet their natural gas requirements.

Cheniere is an operating marvel that has won the confidence of some of the biggest global LNG buyers. It is also a cash flow machine with one of the best management teams in its industry. However, recent natural gas price weakness has led Cheniere shares to fall from their 2022 highs. The company’s stable business model, cash flow generation, growth prospects, and discounted stock price make it an attractive long-term opportunity at current prices.

Cheniere’s Superior Economic Model

Cheniere’s capex is aimed at projects that have a high probability of achieving attractive returns on capital over decades. Most oil and gas projects—from drilling wells to constructing pipelines—cannot ensure attractive economics several years after their completion. An oil well is dependent on unknowable and volatile future oil prices, while a pipeline’s profitability is ultimately subject to competition based on geographical commodity-price differences. These factors are at risk of reducing returns on capital over a period of years.

By contrast, Cheniere’s LNG operations generate attractive long-term returns from the get-go as the company signs multi-decade agreements that lock in a margin over their lives. Cheniere earns a fixed fee for LNG sales that must be paid by the customer even if the cargo is canceled, and a variable fee set at 115% of Henry Hub natural gas prices. The variable fee renders Cheniere subject to U.S. natural gas price changes, but it locks in a margin above the cost of natural gas feedstock. The company also earns variable lifting fees.

Cheniere’s requirement in these deals boils down to execution, and it has performed superbly on this score since it began exporting LNG cargos in 2016.

At the moment, approximately 95% of Cheniere’s volumes through the 2030s are subject to long-term contracts. For 2023, a full 98% of Cheniere’s Adjusted EBITDA was locked into long-term contracts at the end of the first quarter. These contracts limit the impact of spot cargo sales, giving management good visibility into the company’s near-term financial results.

While Cheniere’s financial results depend on sales volumes and Henry Hub prices, its stock fluctuates in response to a multitude of factors that don’t directly impact its results. These include European TTF natural gas prices and crude oil prices. These nonsensical stock fluctuations can be a source of opportunity for investors.

Shareholder-Friendly Capital Allocation

Cheniere management has a firm grasp of the company’s intrinsic value and growth prospects. It is therefore in a good position to identify attractive prices for share repurchases.

The company has been repurchasing shares in a big way throughout 2023. In the first quarter alone, Cheniere repurchased 3.1 million shares, representing 1.3% of total shares outstanding. It also paid down $896 million of debt and paid $99 million of dividends to shareholders.

As of the first quarter, Cheniere has reduced debt and improved its debt metrics to a point that the major credit rating agencies have awarded it with investment-grade ratings across its corporate structure. Having achieved investment-grade ratings, management now plans to alter its capital allocation plan. Whereas over the past few years it allocated free cash flow after dividends to debt reduction and share repurchases at a 4:1 ratio, it now plans to do so at a 1:1 ratio. In light of the dramatic discount from intrinsic value and management’s opportunistic approach to share repurchases, we expect the company to repurchase shares aggressively when they trade below $170 per share.

Cheniere will continue to pay down debt, eventually reducing its leverage ratio below 4.0-times, which is conservative for a company with high returns on capital and a stable operating model. Of course, additional debt paydown will add to shareholder value.

As for dividends, management plans to increase Cheniere’s annual payout by 10% per year, which is easily achievable with the dividend currently covered more than 20-times by free cash flow.

Growth is On the Way

Cheniere achieved unusually good results in 2022 as Henry Hub prices reached multi-year highs. It also completed construction of its Sabine Pass Train 6 early, and as a result, was able to sell LNG cargos on the spot market at record high prices tied to TTS. Lifting fees were also high, and the company was able to boost profits through sub-chartering LNG tankers.

With 98% of Adjusted EBITDA subject to long-term sales contracts, this year’s results provide a more appropriate baseline for estimating future EBITDA, free cash flow, and their respective growth prospects.

Cheniere’s LNG volumes will remain stable this year and next. In 2025, its Corpus Christie Stage 3, which is already contracted, is likely to enter commercial service. The additional volumes will boost Cheniere’s current 45 million tons per year of LNG capacity by 10 million tons per year, or 22.2%.

After Corpus Christie Stage 3, Cheniere plans to expand its Corpus Christi facility further by building two new midscale liquefaction trains that will add another 5 million tons per year of LNG production capacity. This expansion represents an additional 9.1% of volumetric growth.

In addition to these Corpus Christi projects, the Sabine Pass facility is also being expanded. While the Sabine Pass Expansion Project is in an early stage, contracting of new volumes has already begun. On June 21, Cheniere announced a 15-year agreement to sell 1.75 million tons per year to Equinor (EQNR). Half the contracted volumes will be sourced from the Sabine Pass Expansion. Then on June 26, the company announced a 20-year agreement to sell 1.8 million tons of LNG per year to ENN LNG. Similar to the Equinor deal, half the volumes will be sourced from the Sabine Pass Expansion. These volumes are likely to be produced in the 2027-2030 timeframe.

Altogether, the Sabine Pass Expansion Project will add 20 million tons per year of LNG production capacity, representing an additional 33% expansion over the 60 million tons per year being produced by the time the expansion enters service.

Cheniere can be expected to contract all volumes before expanded operations commence, locking in attractive margins and returns for shareholders. This ensures attractive returns on capital on Cheniere’s growth projects.

Valuation

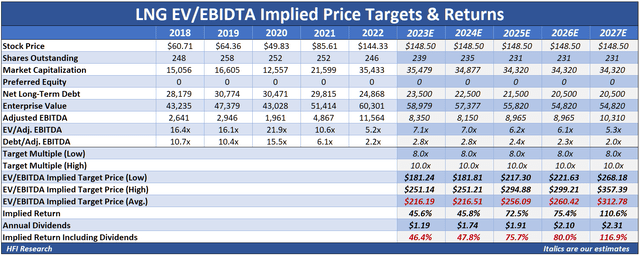

Management’s current guidance for 2023 Adjusted EBITDA is in the range of $8.2 to $8.7 billion. Our EV/EBITDA valuation assumes 2023 Adjusted EBITDA of $8.35 billion. Our valuation also assumes Cheniere repurchases $750 million of shares at progressively higher prices from 2023 through 2025 and that it pays down $1 billion of debt annually over the next three years. It uses a 9-times EBITDA multiple, which we believe is conservative in light of Cheniere’s high-quality business.

Our EV/EBITDA valuation uses 2023 as a baseline for Adjusted EBITDA and doesn’t take into consideration significant fluctuations in Henry Hub natural gas prices. If Henry Hub prices increase significantly above the mid-$2 per million btu range, we would expect EBITDA to be higher, and vice-versa. We believe mid-$2 per million Btu to be roughly the marginal cost of U.S. natural gas production. We therefore view it as a conservative baseline for price assumptions extending over the next five years.

Our valuation assumes Adjusted EBITDA falls in 2024 as the company won’t benefit from certain higher-priced contracts and higher lifting fees as in 2023. We then assume higher production volumes arrive in 2025 due to capacity expansions and that they boost Adjusted EBITDA by 10%. More production volumes arrive in 2027, increasing Adjusted EBITDA by an additional 10%. We expect further increases thereafter, though they’re not captured in our valuations.

Our EV/EBITDA valuation implies the shares are currently worth $216.19, representing 46.4% of total return upside from today’s price of $148.50. Over the next five years, the implied total return upside increases to 116.9%.

HFI Research

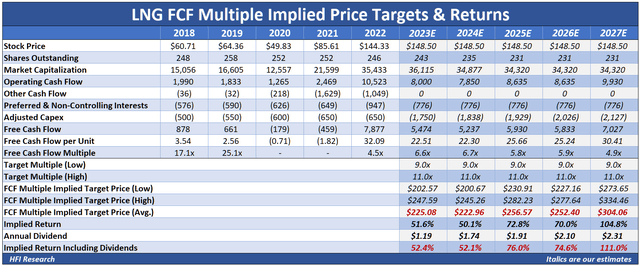

Our free cash flow multiple valuation uses similar assumptions and generates a similar estimate of intrinsic value. Currently, value stands at $225.08, 52.4% above today’s price. Implied total returns increase to 111.0% over the next five years.

HFI Research

Note that when the construction of new facilities tails off later this decade, free cash flow will receive up to an additional $1.5 billion boost from the absence of growth capex. At that point, we expect all free cash flow to be allocated to the benefit of shareholders.

Risks

One risk to our Cheniere Energy, Inc. valuation stems from the prospect that the U.S. government will impose a moratorium on LNG exports. However, we’ve seen over the last year that domestic natural gas producers are capable of responding rapidly to elevated prices, increasing production dramatically in a few months. We suspect that only if domestic producers act in a concerted manner to stabilize natural gas prices at high levels will calls for shutting off LNG exports be made. We don’t believe producers will behave this way due to the significant—and increasing—proportion of U.S. natural gas produced as a byproduct of oil production.

The more relevant risk for Cheniere shareholders comes from a major storm that damages infrastructure related to the company’s Sabine Pass facility in Louisiana or its Corpus Christi facility in Texas. A force majeure on Cheniere’s production would deliver a near-term blow to EBITDA and cash flow due to the loss of variable fees while also possibly denting the company’s sterling reputation for execution. Once repairs are completed, Cheniere would continue to perform on its contractual commitments.

This risk is large enough risk for investors to limit the size of a Cheniere Energy equity holding in an investment portfolio. An alternative spin on such a scenario would be that it could provide an attractive buying opportunity for long-term investors if Cheniere’s stock price were to plunge in response to a force majeure.

Conclusion

Cheniere Energy possesses a stable business model underpinned by long-term contracts that feature a take-or-pay component and lock in a margin. Its stability lends itself to long-term holding, as shareholders can rest assured that cash flows will remain relatively stable compared to the large swings of its stock price. Cheniere earns attractive returns on capital and generates massive amounts of free cash flow that is allocated well by management. In light of the significant upside we see in 2023, out to 2027, and beyond, we view Cheniere Energy, Inc. shares as a key holding for investors looking to benefit from the bullish long-term prospects for natural gas.