zhengzaishuru

Crude oil and oil product prices have declined after reaching over $130 per barrel in early 2020. However, the benchmark WTI and Brent Crude Oil futures have remained above the $60 per barrel level, which could be a solid floor for the energy commodity.

Rising interest rates have caused economies to slow while inflation remains elevated. The U.S. Federal Reserve and other central banks have tightened credit and remain committed to returning inflation to the 2% target level. However, geopolitical tensions distort commodity prices as war, sanctions, global supply chain challenges, and trading roadblocks create problems that are beyond the reach of central bank monetary policy initiatives.

Crude oil remains the energy commodity that powers the world. As the markets head into the second half of 2023, the potential for higher oil prices is greater than new lows as the international oil cartel is dominant in determining worldwide supplies. The U.S. oil companies with global interests benefit from stable to higher oil prices. Vanguard Energy Index Fund ETF Shares (NYSEARCA:VDE) owns a portfolio of the leading U.S. traditional energy companies, with a nearly 40% exposure to Exxon Mobil Corporation (XOM) and Chevron (CVX).

Crude oil prices have moved into the administration’s buy zone

As of the week ending on June 23, the U.S. Strategic Petroleum Reserve stood at 348.6 million barrels. The Department of Energy sold another 1.4 million barrels during the week. In November 2021, the SPR was at the 601.467-million-barrel level. The 42% decline to 348.6 million is unprecedented and has sent the reserves to the lowest level in four decades since July 1983.

The administration sold crude oil from the U.S. reserves after Russia invaded Ukraine. Russia is a leading oil producer, and the most influential non-member of OPEC, the international oil cartel. Since 2016, Russia has cooperated with OPEC on production quotas, with decisions a function of discussions and negotiations between Moscow, and Riyadh, Saudi Arabia.

In early 2022, the war in Ukraine caused oil prices to spike to over $130 per barrel, and the increasing inflationary results caused the U.S. administration to release and sell a significant percentage of its strategic petroleum reserves to put a lid on oil and oil product prices.

In October 2022, the Biden Administration said it would replace the SPR sales, stating:

“The President is announcing that the Administration intends to repurchase crude oil for the SPR when prices are at or below about $67-$72 per barrel, adding to global demand when prices are around that range.“

Even though prices have declined into and below the bottom end of the administration’s “buying” range, the Department of Energy has continued to sell petroleum from the SPR up to the week ending on June 16, 2023.

On June 29, the nearby NYMEX crude oil futures were at the bottom of the administration’s buying range.

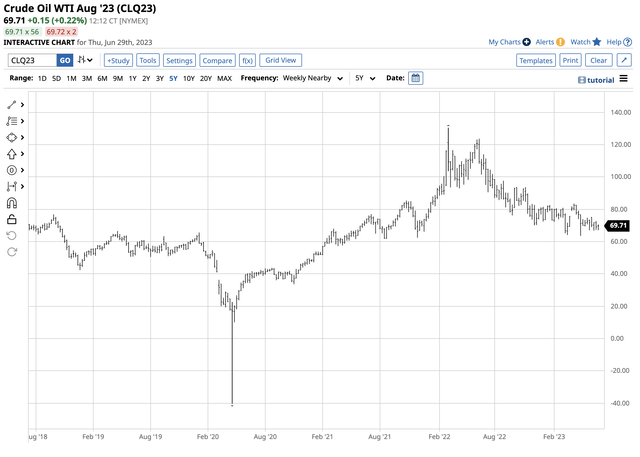

Five-Year Chart of U.S. NYMEX WTI Crude Oil Prices (Barchart)

The chart highlights that WTI crude oil for August delivery was at $69.71 per barrel on June 29, in the middle of the buying zone.

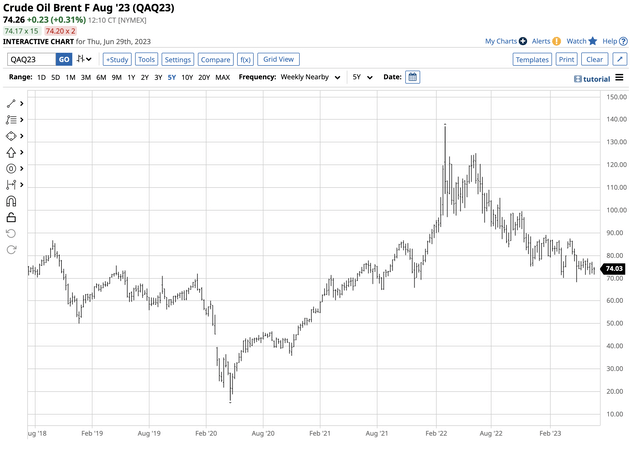

Five-Year Chart of ICE Brent Crude Oil Prices (Barchart)

Brent Crude Oil futures were above the top of the range at $74.26 per barrel. As of June 29, there have been no signs of buying from the Department of Energy even though prices have declined and the SPR is at a forty-year low. Moreover, the average sales price of $95 per barrel creates a windfall profit at the current price level.

On June 9, the Department of Energy reported it awarded supply contracts to five companies to deliver 3.1 million barrels of crude oil to the SPR in August. Still, the mid-June data continues to document sales.

Once the U.S. administration begins buying petroleum to replace the SPR, it could create a floor for oil prices.

Saudi Arabia and Russia need higher oil prices

While Russia is not an OPEC member, since 2016, the Russians have cooperated with the cartel’s production quotas, increasing its pricing power in the international petroleum market. Meanwhile, U.S. energy policy under the Biden administration supporting alternative and renewable fuels and inhibiting hydrocarbon production and consumption, has only strengthened Moscow and Riyadh’s position and influence in world oil prices.

The cartel cut output at the most recent biannual OPEC meeting, citing weak Chinese demand. Moreover, U.S. SPR sales have weighed on international prices over the past year, causing OPEC+ to reduce output to support prices.

Saudi Arabia requires a Brent Crude Oil price above the $80 per barrel to balance its annual budget. Russia needs higher oil prices to fund its ongoing war efforts in Ukraine and keep its economy afloat. Therefore, the cartel would rather sell less petroleum at $80 per barrel than at $40 per barrel, and when Chinese demand returns, a spike to higher levels will create a flood of revenues for the leading producing countries.

While rising U.S. shale production was a thorn in OPEC+’s side before 2020, in the current environment, the cartel is willing to wait until the U.S. SPR falls to a level where it begins buying instead of selling, which pushes prices higher. The current situation in the oil market is a game of chicken, and while the U.S. had a dominant position before 2020, the cartel now holds a stronger hand to push prices higher.

China will emerge from its economic malaise

While the U.S. and Europe address climate change by shifting energy policies, China and India remain significant consumers that will continue to burn fossil fuels.

China and India account for over one-third of the world’s eight billion people. As their economies improve, energy demand will increase, putting upward pressure on oil, gas, and coal prices. OPEC+ is biding its time and waiting for Chinese and Indian demand to come storming back, and the U.S. does not have the SPR resources to cap prices with sales. With the reserves at a forty-year low and the U.S. not buying at its target range, a sudden rise in oil prices will only increase the cartel’s pricing power and revenue flows.

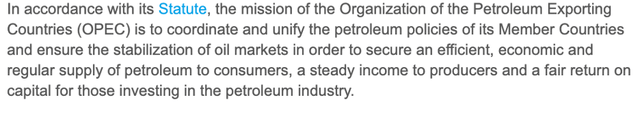

OPEC’s mission has not changed:

OPEC’s Mission Statement (OPEC)

Reading between the lines, “a steady income to producers and a fair return on capital for those investing in the petroleum industry” means the highest oil price possible.

At first, U.S. shale was a thorn in the cartel’s side, and the recent SPR sales were a less thorny nuisance. However, with U.S. reserves at the lowest level since 1983, and the intention to buy at $67 to $72 per barrel, it behooves OPEC+ to boost prices. Moreover, no love is lost between Washington D.C. and OPEC+ members today.

U.S. energy policy is not likely to change for at least two years

The U.S. Presidential season will kick into high gear over the coming months. While President Biden and former President Trump lead in their respective parties’ polls, Jeb Bush and Hillary Clinton led the year before the 2016 election, making the eventual outcome more than questionable. Meanwhile, U.S. energy policy will be at the center of the stage in the battle for the White House between Democrats and Republicans.

The Biden administration will control U.S. energy policy until January 2025, meaning addressing climate change through inhibiting fossil fuel production will continue. OPEC+ has at least a year and a half and possibly five-and-a-half years to control petroleum prices. Even if U.S. policy shifts back to the pre-2020 “drill-baby-drill” days, it will take longer to ramp up U.S. output.

VDE is a solid and flexible ETF

While the Biden administration continues to criticize the U.S. oil industry for oversized profits, the Republican majority in the House of Representatives is not likely to levy additional taxes on the leading companies. Since the pandemic-inspired 2020 low, the top U.S. oil and gas companies have been making money hand-over-fist, which is not likely to change. While the U.S. traditional energy sector has increased its investments in alternative and renewable energy production, crude oil, oil products, and gas will continue to provide the lion’s share of profits.

Moreover, with a potential floor above the $60 level, the top energy companies are positioned for significant revenue flows and profits, offering shareholders the “steady income to producers and a fair return on capital for those investing in the petroleum industry,” aligning them with OPEC+’s interests.

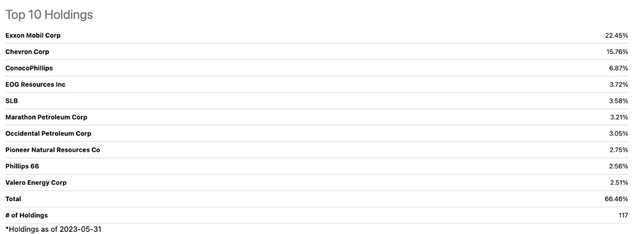

The top holdings of the Vanguard Energy Index Fund (VDE) include:

Top Holdings of the VDE ETF Product (Seeking Alpha)

At $111.71 on June 29, VDE had $7.25 billion in assets under management. The highly liquid ETF trades an average of nearly 7.5 million shares daily and charges a low 0.10% management fee. Meanwhile, the $4.59 dividend translates to an above-market 4.11% yield.

VDE is a smaller ETF than its competition, the Energy Select SPDR Fund (XLE), with $32.88 billion in assets. VDE’s smaller asset base allows for more flexibility in managing the fund.

Five-Year Chart of the VDE ETF Product (Barchart)

The chart shows VDE’s over 341% rise from the $30.03 March 2020 low to the $132.63 November 2022 high. At over $111 per share on June 29, VDE has declined from the high but remains closer to the peak and in a long-term bullish trend.

Crude oil continues to power the world. China and India are growing economies and do not subscribe to the U.S. and European climate change initiatives. Saudi Arabia and Russia will continue policies that support higher crude oil prices. Moreover, most U.S. cars require gasoline, which will take years, if not decades, to change.

Vanguard Energy Index Fund ETF Shares is a highly liquid ETF product with an attractive over 4% per year. At $111 per share, traditional energy fundamentals point to a limited downside and explosive upside potential. I am a buyer of VDE on any price weakness.